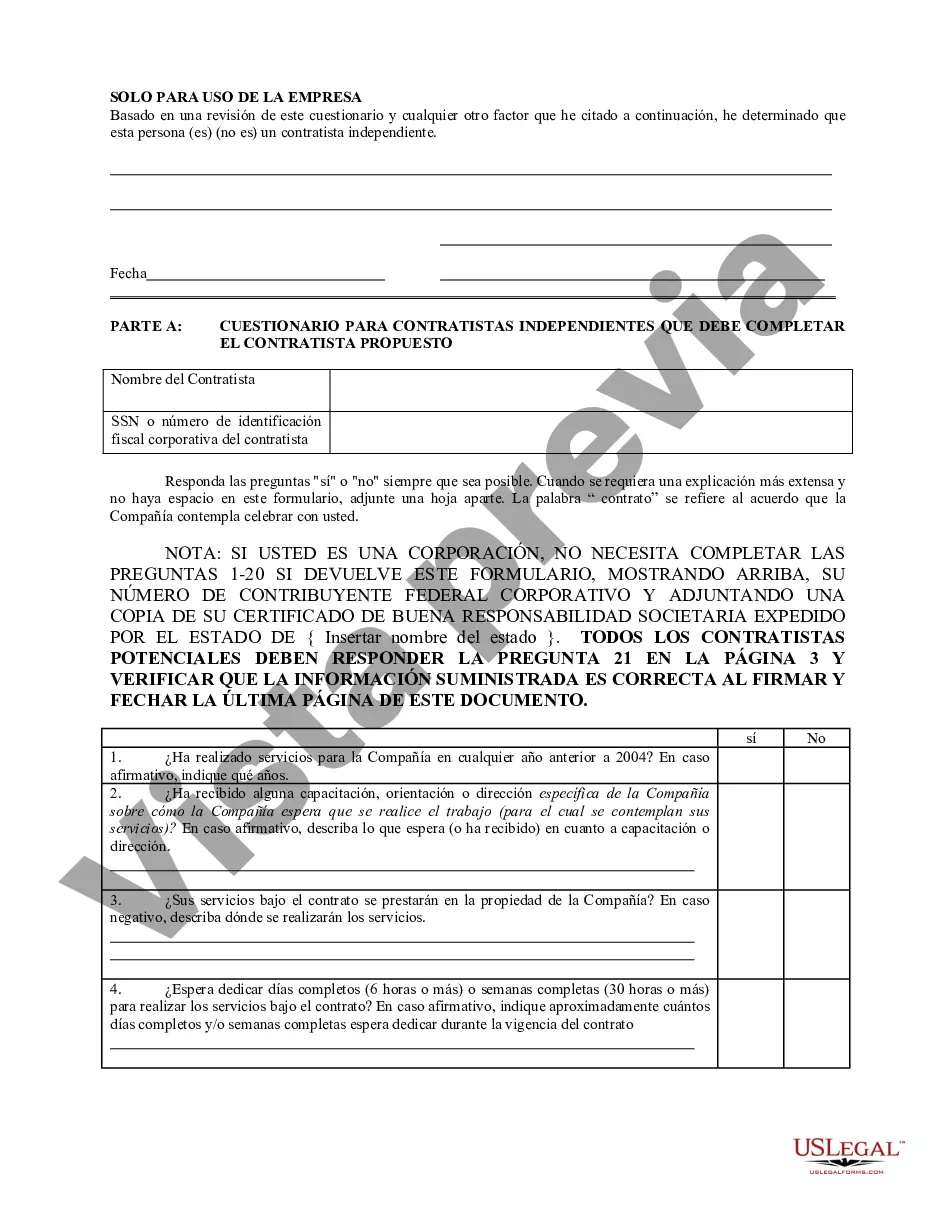

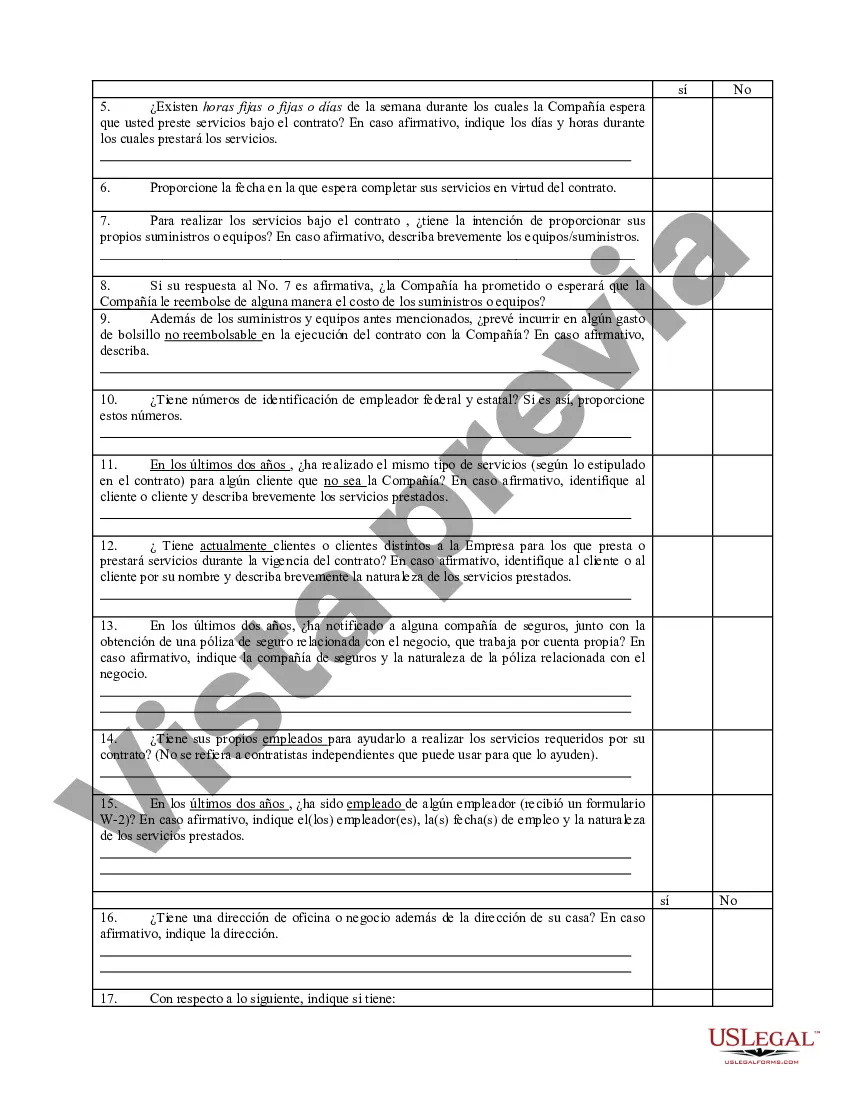

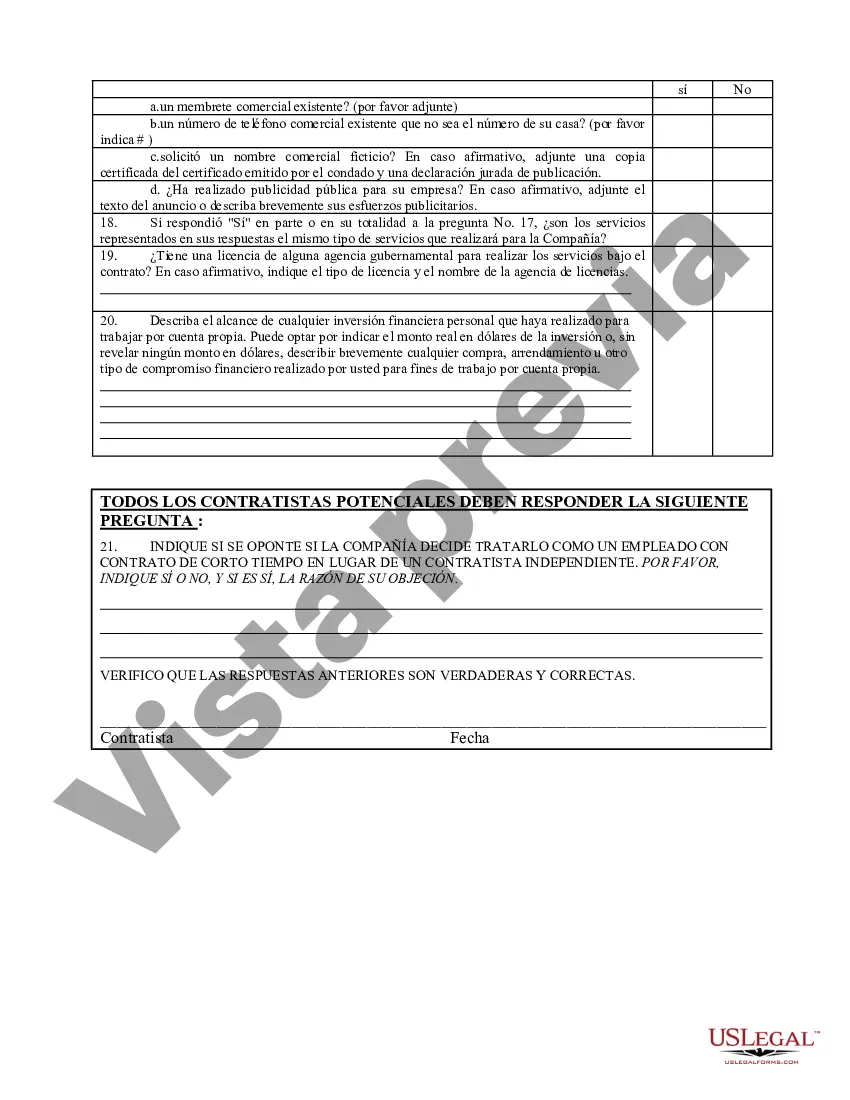

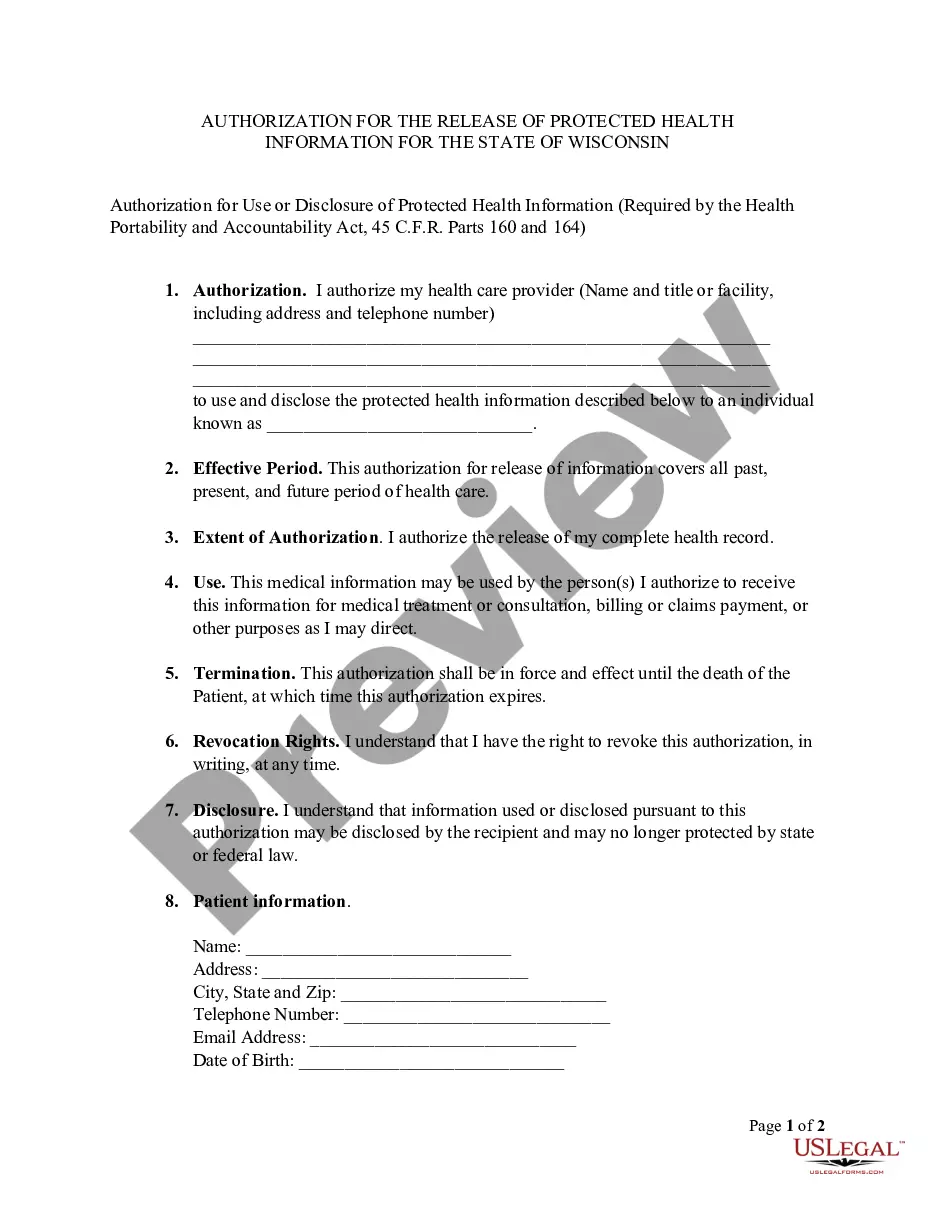

The Cuyahoga Ohio Self-Employed Independent Contractor Questionnaire is a comprehensive document that serves to gather important information about self-employed independent contractors operating in Cuyahoga County, Ohio. This questionnaire plays a crucial role in assessing the status and compliance of individuals working as independent contractors within the county. This questionnaire aims to delve into the various aspects of a self-employed independent contractor's business and work arrangements, ensuring adherence to legal requirements and determining their classification for tax and employment purposes. By gathering relevant information, this questionnaire assists authorities and organizations in evaluating the nature of a contractor's relationship with their clients, thereby determining their proper classification and eligibility for certain benefits and protections. Keywords: Cuyahoga County, Ohio, self-employed, independent contractor, questionnaire, compliance, tax classification, employment purposes, legal requirements, business arrangements, benefits, protections. Different types of Cuyahoga Ohio Self-Employed Independent Contractor Questionnaires may include: 1. Cuyahoga Ohio Self-Employed Independent Contractor Questionnaire for Tax Classification: This questionnaire specifically focuses on determining the appropriate tax classification for self-employed independent contractors in Cuyahoga County. It gathers information such as the contractor's business structure, client relationships, income sources, and other relevant tax-related details. 2. Cuyahoga Ohio Self-Employed Independent Contractor Questionnaire for Employment Verification: This questionnaire aims to verify a contractor's status and compliance with employment regulations. It may include inquiries about work contracts, payment arrangements, insurance coverage, work location, and other factors that determine the contractor's eligibility for certain employment-related benefits. 3. Cuyahoga Ohio Self-Employed Independent Contractor Questionnaire for Workers' Compensation: This specific questionnaire focuses on determining if a self-employed independent contractor qualifies for workers' compensation coverage. It may gather information about job hazards, safety protocols, equipment usage, contract details, and other factors that influence workers' compensation eligibility. Keywords: Cuyahoga County, Ohio, self-employed, independent contractor, questionnaire, tax classification, compliance, employment verification, work contracts, insurance coverage, work location, workers' compensation, eligibility, job hazards, safety protocols. Note: These examples are hypothetical and may not represent actual Cuyahoga Ohio Self-Employed Independent Contractor Questionnaire types. The specific questionnaires may vary depending on local regulations and the intentions of the issuing authorities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Cuestionario para contratistas independientes que trabajan por cuenta propia - Self-Employed Independent Contractor Questionnaire

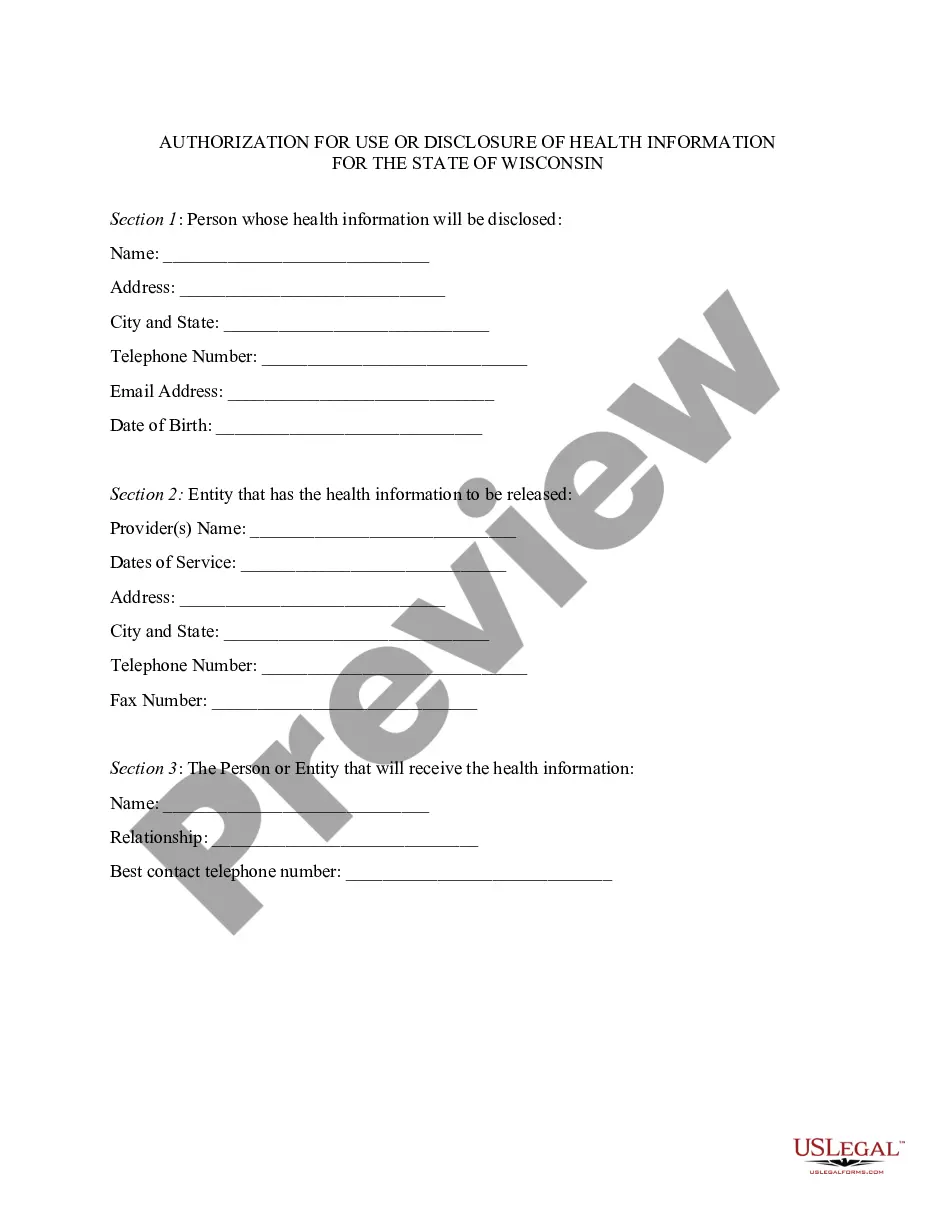

Description

How to fill out Cuyahoga Ohio Cuestionario Para Contratistas Independientes Que Trabajan Por Cuenta Propia?

If you need to find a trustworthy legal paperwork supplier to get the Cuyahoga Self-Employed Independent Contractor Questionnaire, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can search from more than 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of supporting resources, and dedicated support team make it simple to get and complete different paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of users since 1997.

You can simply type to look for or browse Cuyahoga Self-Employed Independent Contractor Questionnaire, either by a keyword or by the state/county the document is intended for. After locating required form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to start! Simply find the Cuyahoga Self-Employed Independent Contractor Questionnaire template and check the form's preview and short introductory information (if available). If you're confident about the template’s language, go ahead and hit Buy now. Create an account and choose a subscription option. The template will be instantly available for download once the payment is completed. Now you can complete the form.

Taking care of your law-related affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less pricey and more affordable. Set up your first company, organize your advance care planning, draft a real estate agreement, or execute the Cuyahoga Self-Employed Independent Contractor Questionnaire - all from the comfort of your home.

Sign up for US Legal Forms now!