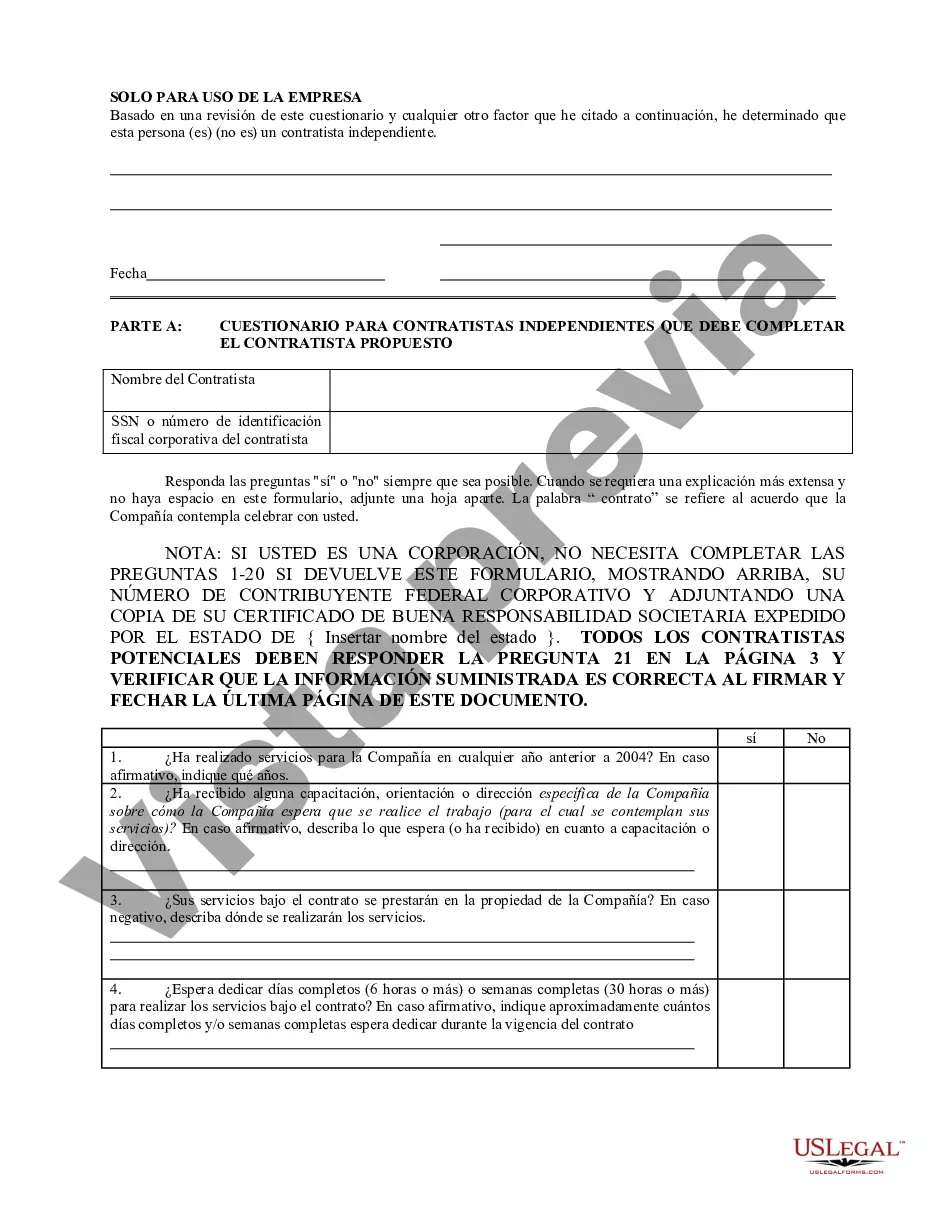

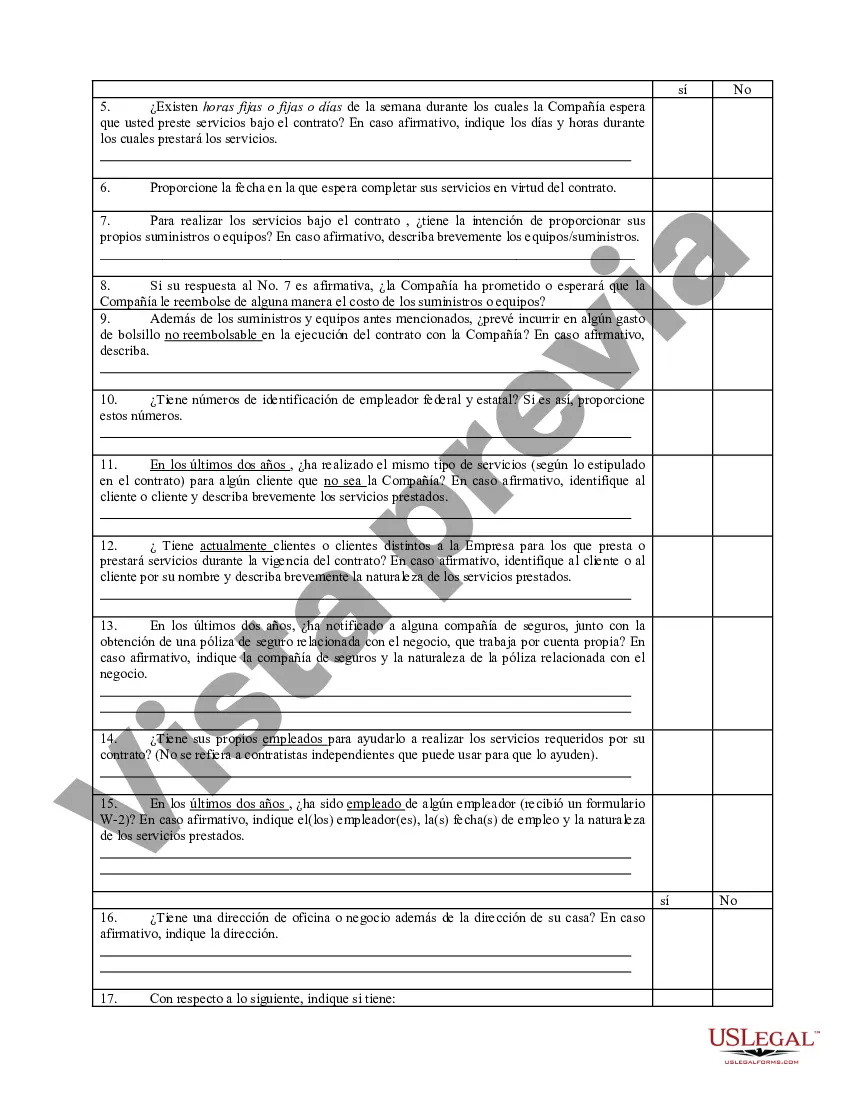

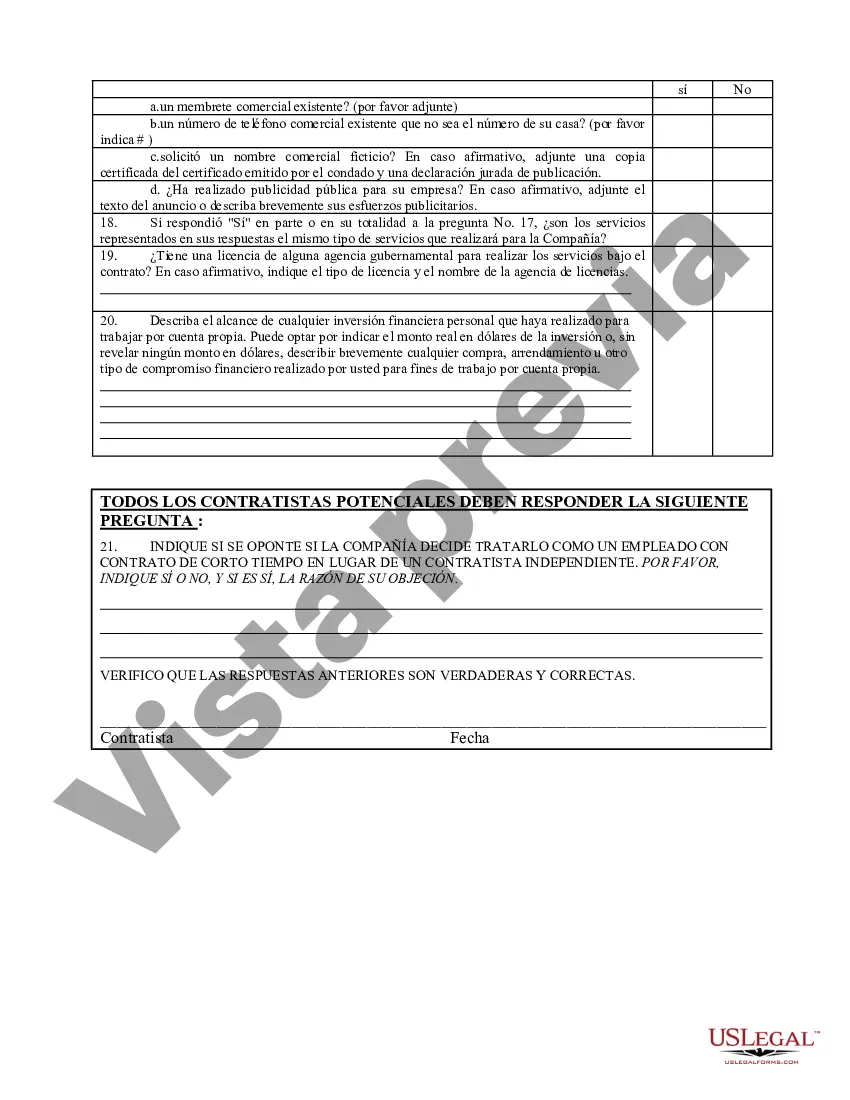

The Hennepin Minnesota Self-Employed Independent Contractor Questionnaire is a vital document designed to gather specific information about self-employed individuals working in Hennepin County, Minnesota. This comprehensive questionnaire aims to gather necessary details and ensure compliance with local regulations. The Hennepin Minnesota Self-Employed Independent Contractor Questionnaire gathers key information such as: 1. Personal Information: This section solicits personal details including name, contact information, social security number, date of birth, and address. 2. Business Information: Here, the questionnaire collects information related to the contractor's business, such as business name, address, phone number, and federal tax identification number (EIN). 3. Services Provided: This section requests a detailed description of the services the self-employed contractor offers. It aims to assess the contractor's field of expertise and the nature of their work. 4. Contracting Entity: This part seeks information about the entity or business the contractor is working for or contracting with, including name, address, and contact details. 5. Tax Compliance: The questionnaire explores tax compliance matters, asking contractors to confirm if they have filed all required tax returns, possess a valid Minnesota Tax ID number, and are in compliance with applicable tax laws. 6. Insurance Coverage: This section examines the contractor's insurance coverage status. Contractors are often required to carry specific types of insurance, such as liability insurance, and are asked to provide details on their coverage. 7. Licensing and Permits: Contractors are expected to possess appropriate licenses and permits for their line of work. This part requires contractors to provide information about their current licenses or permits. The Hennepin Minnesota Self-Employed Independent Contractor Questionnaire may also include supplementary sections depending on the specific requirements of the county or municipality. Some possible variations or additional questionnaires may include: 1. Hennepin County Contractor Safety Questionnaire: This questionnaire could focus on assessing safety protocols and compliance for contractors working in potentially hazardous environments. 2. Hennepin County Tax Withholding Questionnaire: This type of questionnaire would delve deeper into tax withholding requirements and compliance to ensure contractors are properly meeting their tax obligations. 3. Hennepin County Contractor Diversity Questionnaire: This questionnaire may focus on gathering information about the contractor's diversity status, such as minority-owned or woman-owned business certifications, in order to promote and encourage diversity in contracting. The Hennepin Minnesota Self-Employed Independent Contractor Questionnaire is a critical tool in ensuring that self-employed individuals in Hennepin County meet regulatory requirements, comply with tax laws, possess necessary licenses, and maintain appropriate insurance coverage.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Cuestionario para contratistas independientes que trabajan por cuenta propia - Self-Employed Independent Contractor Questionnaire

Description

How to fill out Hennepin Minnesota Cuestionario Para Contratistas Independientes Que Trabajan Por Cuenta Propia?

If you need to find a trustworthy legal form provider to obtain the Hennepin Self-Employed Independent Contractor Questionnaire, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can select from over 85,000 forms arranged by state/county and case.

- The self-explanatory interface, variety of learning materials, and dedicated support make it easy to locate and complete different documents.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply type to look for or browse Hennepin Self-Employed Independent Contractor Questionnaire, either by a keyword or by the state/county the form is intended for. After locating necessary form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Hennepin Self-Employed Independent Contractor Questionnaire template and take a look at the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription option. The template will be instantly ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive variety of legal forms makes these tasks less expensive and more reasonably priced. Create your first business, organize your advance care planning, create a real estate agreement, or execute the Hennepin Self-Employed Independent Contractor Questionnaire - all from the convenience of your sofa.

Join US Legal Forms now!