Hillsborough Florida Notice of Adverse Action — Non-Employmen— - Due to Credit Report is a legal document issued by entities in Hillsborough County, Florida, notifying individuals of adverse actions taken against them based on their credit reports in non-employment situations. This notice serves to inform the individual of their right to request a free copy of their credit report and dispute any inaccuracies found within. This type of notice is typically sent by various organizations, such as financial institutions, landlords, or utility companies, when making decisions that negatively impact an individual's eligibility for credit, housing, or services due to information obtained from their credit report. Different types of Hillsborough Florida Notice of Adverse Action — Non-Employmen— - Due to Credit Report may include: 1. Loan Denials: Financial institutions, such as banks or credit unions, may issue this notice to individuals who have applied for loans, such as mortgages, personal loans, or car loans, but have been denied due to their credit history. 2. Rental Application Denials: Landlords or property management companies may send this notice to potential tenants who have been rejected for a rental property due to unsatisfactory credit reports. 3. Utility Service Denials: Utility companies, including electricity, gas, or water providers, may issue this notice to individuals who have been declined access to their services based on negative information found on their credit reports. 4. Insurance Coverage Denials: Insurance companies may send this notice to individuals who have been denied insurance coverage, such as for auto, home, or life insurance, due to negative credit history. 5. Credit Card Applications Rejections: Credit card issuers may issue this notice to individuals whose credit card applications have been denied based on their credit reports. Regardless of the specific type, a Hillsborough Florida Notice of Adverse Action — Non-Employmen— - Due to Credit Report must provide clear and concise information regarding the adverse action taken and inform the individual of their rights under the Fair Credit Reporting Act (FCRA). It must also include the contact information of the credit reporting agency used to obtain the credit report, allowing the individual to request a free copy of their report to review its accuracy and file a dispute if needed. It's crucial for individuals who receive such a notice to carefully read and understand its contents, as it can affect their ability to secure credit, housing, or services in the future. By being aware of their rights and taking appropriate steps to address any inaccuracies, individuals can work towards improving their creditworthiness and resolving any adverse actions taken against them.

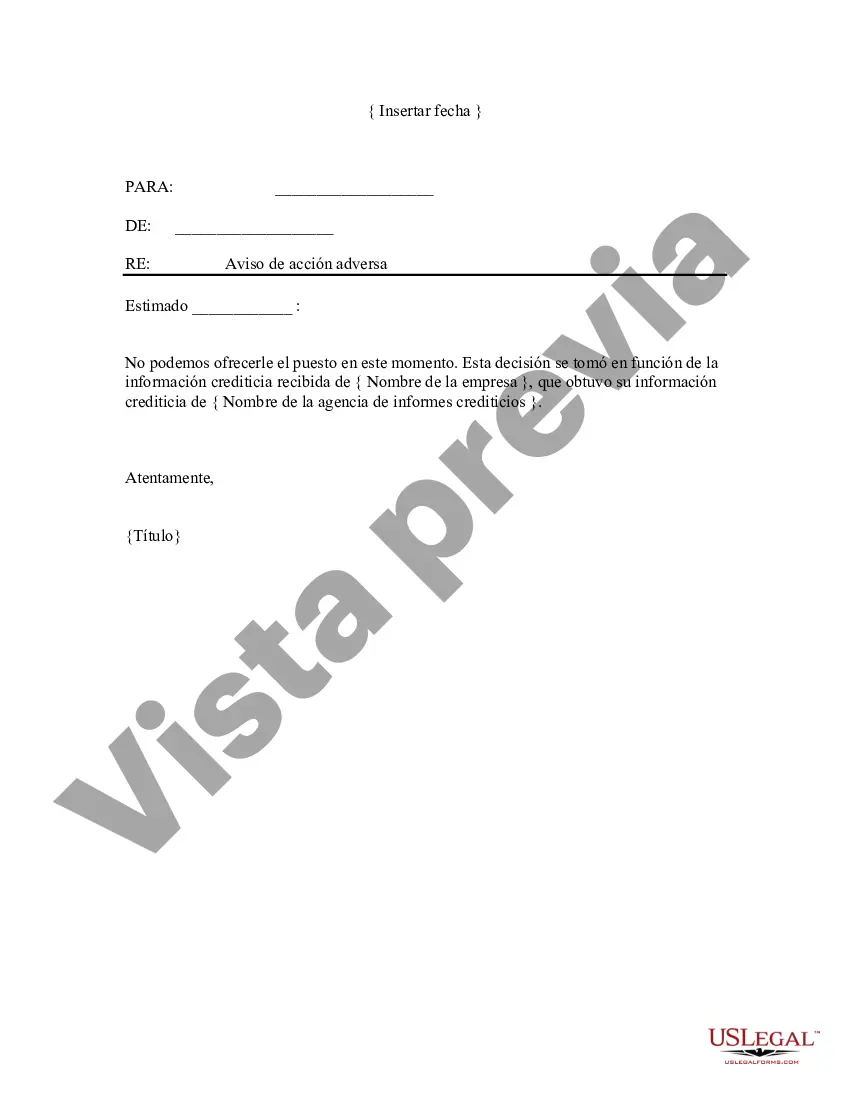

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Aviso de Acción Adversa - No Laboral - Debido a Reporte de Crédito - Notice of Adverse Action - Non-Employment - Due to Credit Report

Description

How to fill out Hillsborough Florida Aviso De Acción Adversa - No Laboral - Debido A Reporte De Crédito?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life scenarios require you prepare formal paperwork that differs throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Hillsborough Notice of Adverse Action - Non-Employment - Due to Credit Report.

Locating samples on the platform is remarkably straightforward. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Afterward, the Hillsborough Notice of Adverse Action - Non-Employment - Due to Credit Report will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Hillsborough Notice of Adverse Action - Non-Employment - Due to Credit Report:

- Ensure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document using the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Hillsborough Notice of Adverse Action - Non-Employment - Due to Credit Report on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!