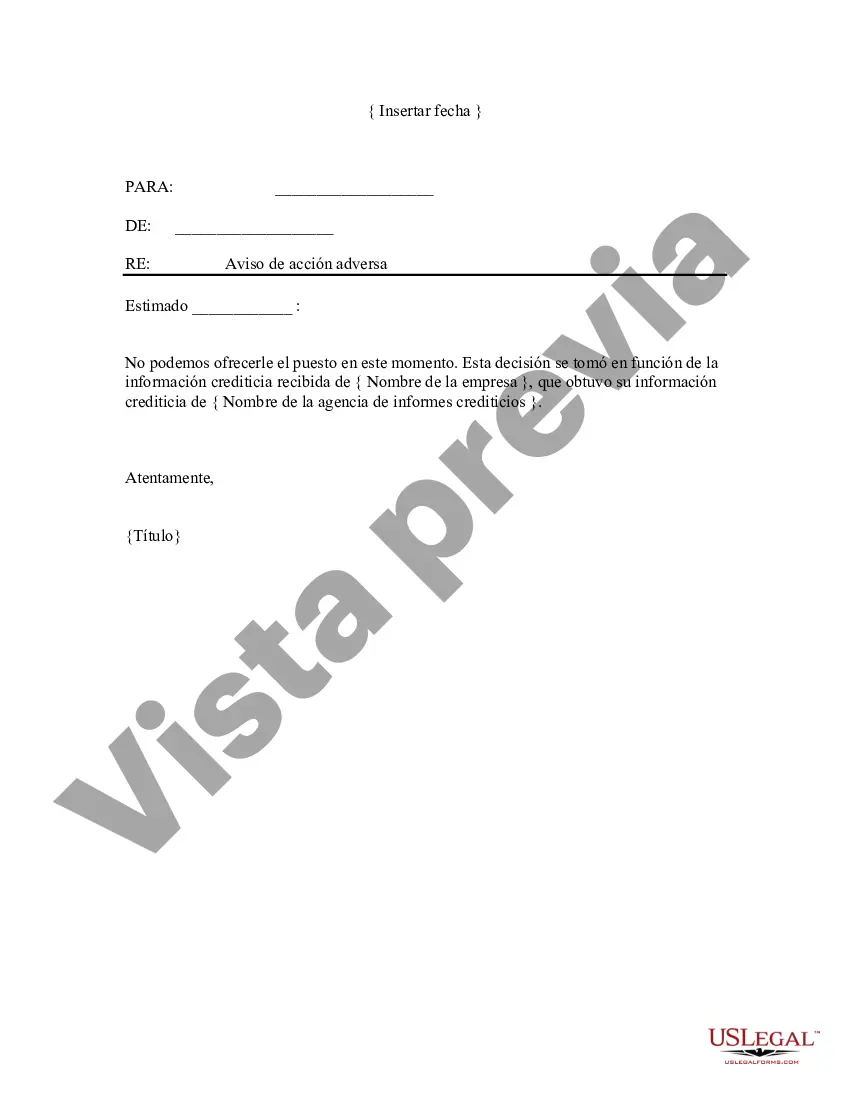

Philadelphia, Pennsylvania is a vibrant and historic city located in the northeastern United States. Known as the birthplace of America, Philadelphia is packed with rich history, diverse culture, and a thriving urban atmosphere. From famous landmarks like the Liberty Bell and Independence Hall to its renowned art institutions and culinary scene, there is always something to explore in this bustling city. When it comes to the Philadelphia Pennsylvania Notice of Adverse Action — Non-Employmen— - Due to Credit Report, there are various types that individuals may encounter. These notices are typically issued by businesses or organizations in response to negative information found in an individual's credit report. Such adverse action could result in denial of rental applications, loan applications, or even insurance coverage. 1. Rental Application Adverse Action: If an individual applies to rent a property in Philadelphia, the landlord may conduct a credit check. Depending on the information found in the credit report, the landlord may choose to deny the application or impose additional conditions such as a higher security deposit. 2. Loan Application Adverse Action: When applying for a loan in Philadelphia, lenders may pull an applicant's credit report. If the credit report reveals a low credit score, a history of missed payments, or excessive debt, the lender may decide to deny the loan application or offer less favorable terms. 3. Insurance Coverage Adverse Action: Insurance companies in Philadelphia also consider an individual's credit report when determining insurance rates or eligibility. A poor credit history could lead to higher premiums or denial of coverage for certain types of insurance, such as auto or home insurance. Receiving a Philadelphia Pennsylvania Notice of Adverse Action — Non-Employmen— - Due to Credit Report can be disheartening, but it's essential to understand the reasons behind the decision. By carefully reviewing your credit report and addressing any negative information, individuals can take steps towards improving their creditworthiness and increasing their chances of future success in various financial endeavors. To protect consumers' rights, the Fair Credit Reporting Act (FCRA) requires that individuals receive a written notice of adverse action if their credit report played a role in the decision. This notice should include detailed information about the decision, including the specific factors leading to the adverse action and contact details for the credit reporting agency used. In Philadelphia, individuals who receive a Notice of Adverse Action — Non-Employmen— - Due to Credit Report can seek assistance from local consumer advocacy groups, non-profit organizations, or credit counseling services. These resources can provide guidance on understanding and improving credit, as well as helping individuals navigate the adverse action process. In conclusion, Philadelphia is a vibrant city with a rich history and diverse culture. However, individuals may encounter various types of Philadelphia Pennsylvania Notice of Adverse Action — Non-Employmen— - Due to Credit Report depending on their financial activities. It's crucial to take steps to improve creditworthiness, seek assistance from local resources, and understand consumer rights to overcome any adverse action and pave the way towards a more secure financial future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Aviso de Acción Adversa - No Laboral - Debido a Reporte de Crédito - Notice of Adverse Action - Non-Employment - Due to Credit Report

Description

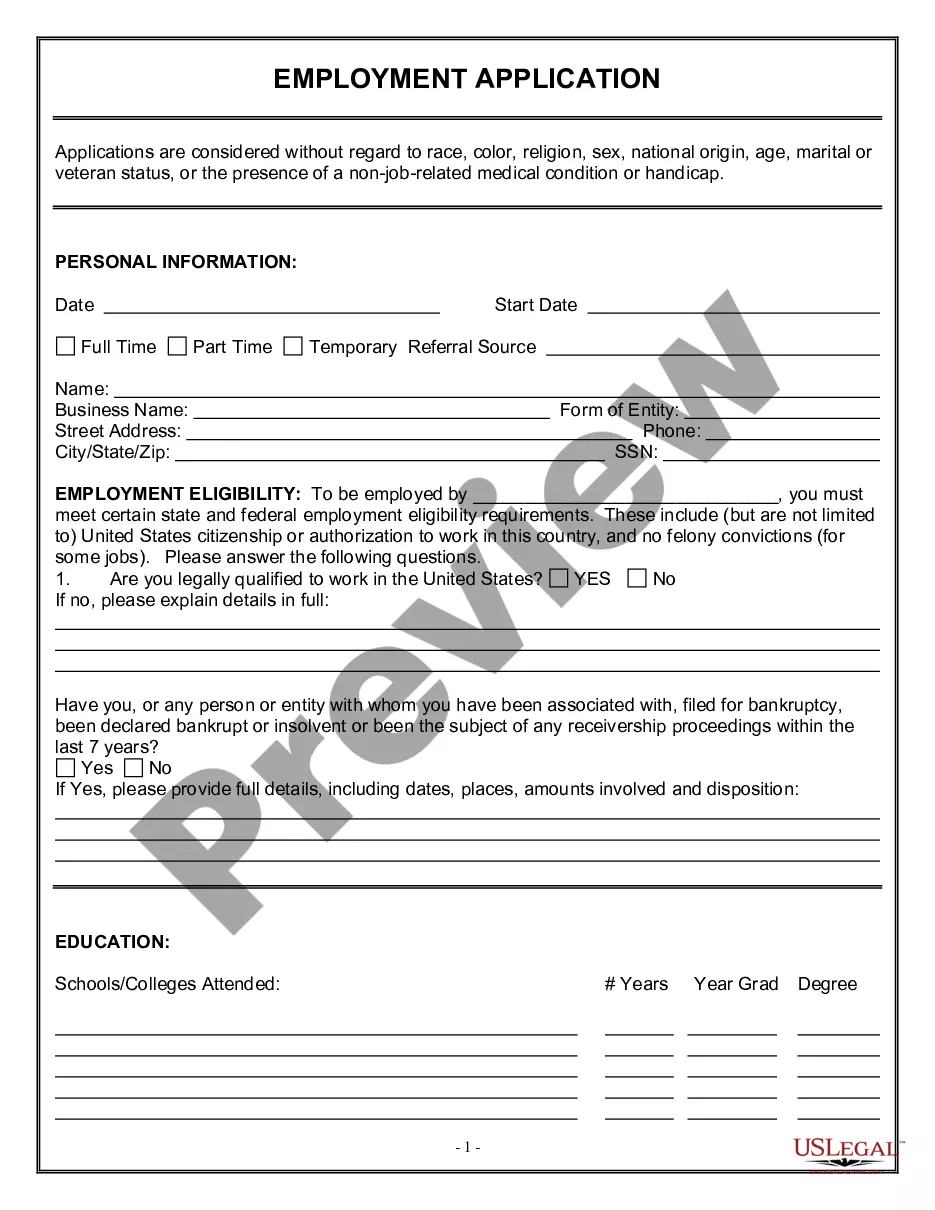

How to fill out Philadelphia Pennsylvania Aviso De Acción Adversa - No Laboral - Debido A Reporte De Crédito?

Are you looking to quickly draft a legally-binding Philadelphia Notice of Adverse Action - Non-Employment - Due to Credit Report or probably any other form to manage your personal or business affairs? You can go with two options: contact a professional to write a legal paper for you or draft it completely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you get neatly written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms provides a huge collection of more than 85,000 state-specific form templates, including Philadelphia Notice of Adverse Action - Non-Employment - Due to Credit Report and form packages. We offer templates for a myriad of life circumstances: from divorce paperwork to real estate document templates. We've been out there for over 25 years and got a spotless reputation among our customers. Here's how you can become one of them and get the necessary template without extra hassles.

- First and foremost, double-check if the Philadelphia Notice of Adverse Action - Non-Employment - Due to Credit Report is tailored to your state's or county's regulations.

- If the document includes a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the form isn’t what you were looking for by using the search box in the header.

- Select the plan that best fits your needs and proceed to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Philadelphia Notice of Adverse Action - Non-Employment - Due to Credit Report template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. Additionally, the documents we provide are reviewed by law professionals, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!