Wayne Michigan Notice of Adverse Action — Non-Employmen— - Due to Credit Report In Wayne, Michigan, individuals may come across a Notice of Adverse Action — Non-Employmen— - Due to Credit Report. This notice is a legal document that informs an individual about a negative action taken against them based on the information found in their credit report. The adverse action can affect various aspects of their life, such as loan applications, rental agreements, or even insurance policies. There are different types of Wayne Michigan Notice of Adverse Action — Non-Employmen— - Due to Credit Report that one may encounter: 1. Loan Denial: Financial institutions may deny a loan application if the individual's credit report reveals a poor credit history, high debts, or a low credit score. This type of adverse action can significantly impact an individual's ability to borrow money, purchase a home, or finance a vehicle. 2. Rental Rejection: Property owners or rental agencies may reject an individual's rental application if their credit report showcases a history of late payments, evictions, or outstanding debts. This adverse action can make it challenging for someone to secure suitable housing. 3. Insurance Premium Increase or Denial: Insurance companies may decide to increase an individual's insurance premiums or even deny coverage if their credit report indicates a high level of risk. This adverse action can affect various types of insurance, such as auto, home, or life insurance, making it more expensive or even unattainable for the individual. 4. Job Application Rejection: Employers in Wayne, Michigan may choose not to hire an applicant based on the information found in their credit report. While not all employers perform credit checks, some industries, such as financial institutions or government agencies, may consider an individual's credit history as part of their hiring process. Adverse action in employment can hinder job opportunities and hinder career growth. It's crucial for individuals residing in Wayne, Michigan, to be aware of their credit standing and monitor their credit reports regularly. By doing so, they can identify any potential issues and take appropriate measures to improve their creditworthiness. To ensure accuracy, individuals can obtain a free credit report once a year from each of the three major credit reporting agencies: Equifax, Experian, and TransUnion.

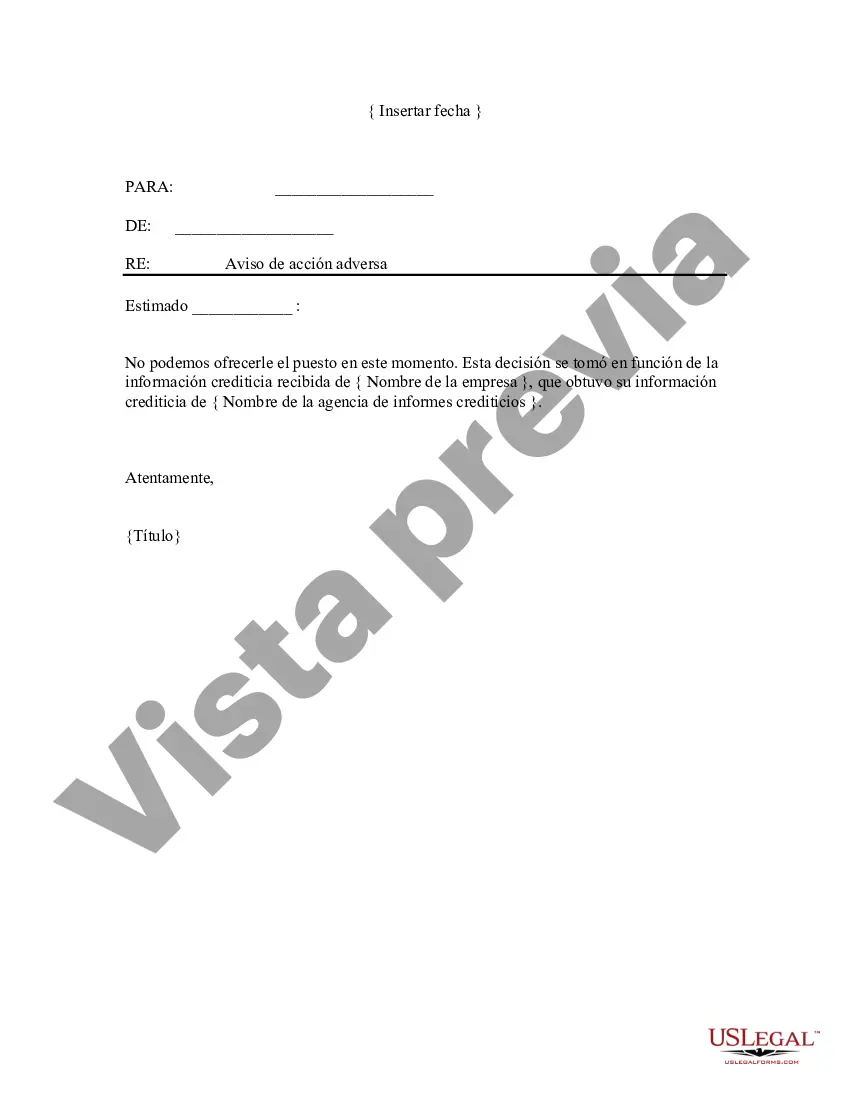

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Aviso de Acción Adversa - No Laboral - Debido a Reporte de Crédito - Notice of Adverse Action - Non-Employment - Due to Credit Report

Description

How to fill out Wayne Michigan Aviso De Acción Adversa - No Laboral - Debido A Reporte De Crédito?

Whether you intend to open your business, enter into an agreement, apply for your ID update, or resolve family-related legal issues, you must prepare specific paperwork corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business case. All files are collected by state and area of use, so opting for a copy like Wayne Notice of Adverse Action - Non-Employment - Due to Credit Report is quick and easy.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required form. If you are new to the service, it will take you a couple of additional steps to get the Wayne Notice of Adverse Action - Non-Employment - Due to Credit Report. Follow the guidelines below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Read the form description and check the Preview if there’s one on the page.

- Utilize the search tab providing your state above to locate another template.

- Click Buy Now to get the sample once you find the right one.

- Select the subscription plan that suits you most to proceed.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Wayne Notice of Adverse Action - Non-Employment - Due to Credit Report in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Forms provided by our library are multi-usable. Having an active subscription, you are able to access all of your earlier acquired paperwork at any time in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!