Maricopa, Arizona Separation Notice for 1099 Employees: A Comprehensive Guide When it comes to employment separation, both employers and employees in Maricopa, Arizona need to adhere to certain regulations and processes. One important document, specifically tailored for 1099 employees, is the Maricopa, Arizona Separation Notice. This notice serves as a legal acknowledgment of an employment termination for individuals working as independent contractors (1099 employees). This document is essential as it notifies the 1099 employee about their termination and outlines important information regarding their rights and responsibilities. Additionally, it helps employers maintain proper records and ensures compliance with state and federal labor laws. There are a few different types of Maricopa, Arizona Separation Notices for 1099 employees. Let's take a closer look at each of them: 1. Basic Separation Notice: This is the most common type of notice issued to 1099 employees in Maricopa, Arizona when their employment contract is terminated. It includes essential details such as the employee's name, employer's information, termination date, reason for separation, and information on final pay, including any outstanding compensation or benefits. 2. Separation Notice with Non-Disclosure Agreement (NDA): In some cases, employers may require 1099 employees to sign a non-disclosure agreement as part of their separation notice. This document ensures that the employee maintains confidentiality regarding certain trade secrets, proprietary information, or sensitive company data even after termination. 3. Separation Notice with Non-Compete Agreement (NCA): An NCA may accompany the separation notice if an employer wishes to restrict 1099 employees from engaging in certain competitive activities after the termination. It ensures that the employee does not work for or collaborate with competitors within a specified time frame and geographic area. 4. Separation Notice with Severance Agreement: In situations where an employer offers severance pay to a terminated 1099 employees, a separation notice accompanied by a severance agreement is used. This comprehensive document outlines the terms, conditions, and amount of severance pay, along with any additional benefits or arrangements. It's highly recommended for both employers and 1099 employees to keep copies of these separation notices for record-keeping purposes and potential legal requirements. In conclusion, the Maricopa, Arizona Separation Notice for 1099 employees is a crucial document to ensure proper acknowledgment and compliance in cases of employment termination. Offering various types to cater to different circumstances, it aims to protect the rights of both employers and employees while maintaining transparency and adherence to labor regulations.

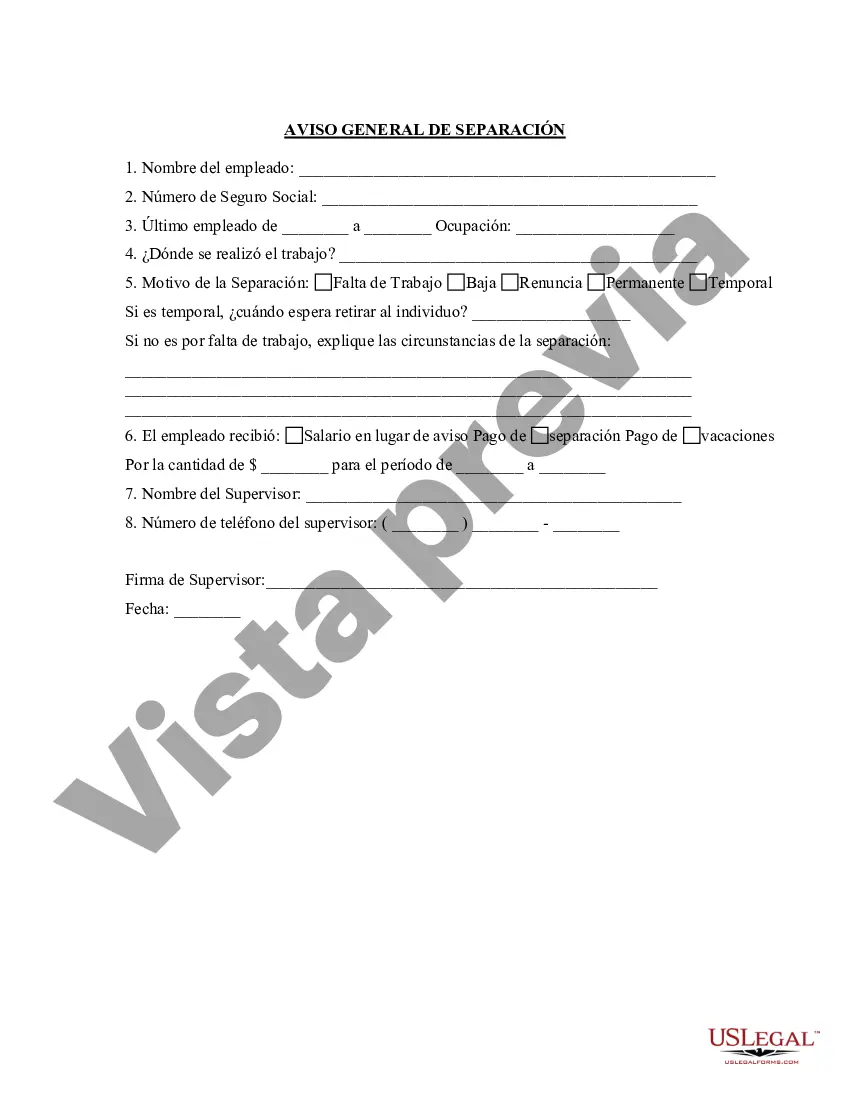

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Aviso de separación para el empleado 1099 - Separation Notice for 1099 Employee

Description

How to fill out Maricopa Arizona Aviso De Separación Para El Empleado 1099?

Laws and regulations in every area vary from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Maricopa Separation Notice for 1099 Employee, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Maricopa Separation Notice for 1099 Employee from the My Forms tab.

For new users, it's necessary to make several more steps to get the Maricopa Separation Notice for 1099 Employee:

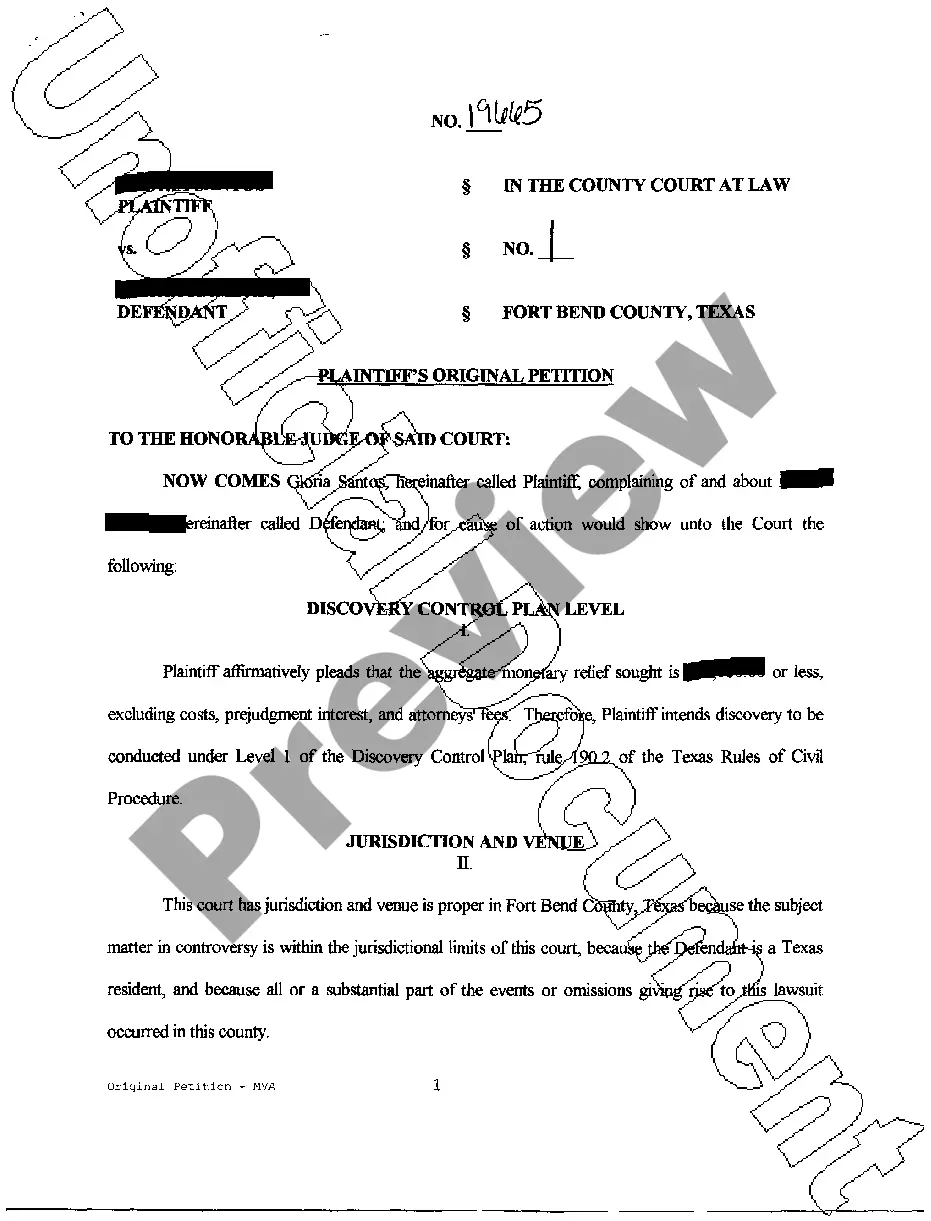

- Examine the page content to make sure you found the right sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Use the Buy Now button to get the template when you find the proper one.

- Opt for one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

La diferencia mas importante es que el 1099 se utiliza para trabajadores independientes o subcontratistas, y el W-2, para empleados. De acuerdo con el IRS, los contratistas independientes controlan el metodo de trabajo que emplean, mientras que los empleados no.

¿Como llenar formulario 1099-MISC en Mac? Descarga el formulario 1099-MISC del IRS de aqui. Instala PDF Expert en tu Mac y abre el formulario descargado. Introduce tus propios detalles en la informacion del Pagador y la informacion del Destinatario de tu formulario W-9 en el lado izquierdo del formulario.

Si paga a los contratistas independientes, puede tener que presentar el Formulario 1099-NEC, Remuneracion a personas que no son empleados (en ingles), para informar los pagos por los servicios prestados para su ocupacion o negocio.

Tipos comunes del formulario 1099 1099-MISC (en ingles) para trabajos como contratista o trabajador por cuenta propia (freelance), ganancias relacionadas con premios y apuestas, y otros. 1099-INT (en ingles) para intereses de cuentas bancarias. 1099-DIV (en ingles) para distribuciones de inversion y dividendos.

El Formulario W-9 del IRS (siglas en ingles de Servicio de Impuestos Internos) es comunmente utilizado por individuos que trabajan como trabajadores por cuenta propia o contratistas independientes.

Una cosa que podras notar en tus formularios 1099-NEC es que tus clientes no retienen impuesto sobre los ingresos de tus pagos como lo hacen para sus empleados. Sin embargo, esto no quiere decir que puedes esperar hasta que prepares tu declaracion de impuestos para pagar el 100% de tu responsabilidad tributaria.

Un formulario 1099-MISC, por ejemplo, generalmente se usa para informar los pagos realizados a trabajadores independientes (quienes pagan sus impuestos al empleo). Un formulario W-2, por otro lado, se usa para empleados (cuyos empleadores son quienes retienen impuestos sobre la nomina de sus ingresos).