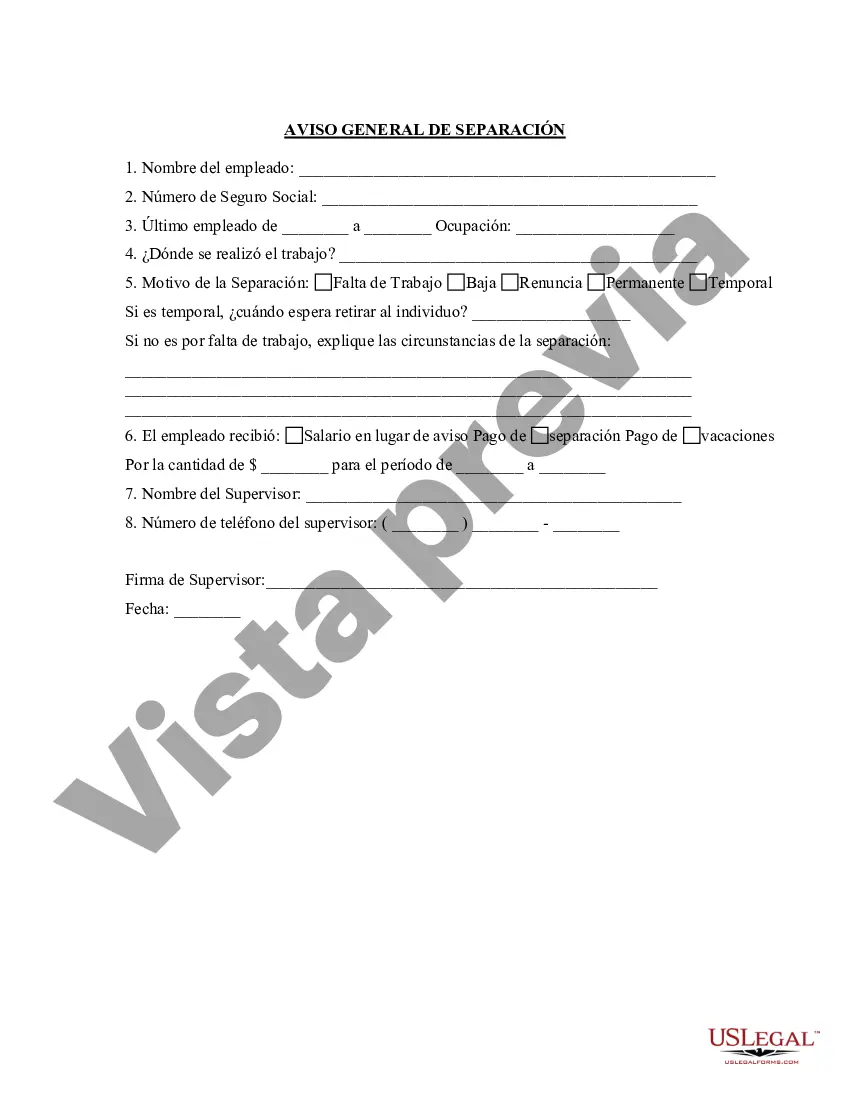

Miami-Dade Florida Separation Notice for 1099 Employees is a legal document that outlines the termination or separation of a 1099 employee's contract or work arrangement in Miami-Dade County, Florida. This notice serves as a formal record of the end of the working relationship between the employer and the 1099 employee. It is important to provide accurate and detailed information in the notice to ensure compliance with labor laws and to avoid any potential legal issues. The Miami-Dade Florida Separation Notice for 1099 Employees typically includes the following key information: 1. Employee Details: This section includes the full name, address, contact information, and any unique identification numbers or codes associated with the 1099 employee. It is crucial to accurately record these details to ensure the correct identification of the employee involved. 2. Employer Details: This section provides the details of the employer, including the company name, address, and contact information. It is important to ensure that the employer information is accurate and up-to-date. 3. Separation Date: The notice must clearly state the date on which the employment contract or working relationship between the employer and the 1099 employee will terminate. This ensures clarity regarding the effective end date of the working arrangement. 4. Reason for Separation: The notice should briefly mention the reason for the separation or termination. It is essential to provide a concise explanation, which might include the completion of a specific project, contract expiration, or any other valid reason for ending the employment arrangement. 5. Compensation: This section may outline any outstanding payments due to the 1099 employee, such as unpaid invoices or expense reimbursements. Additionally, it should include information regarding the final payment, if applicable, and provide instructions for the 1099 employee to address any concerns or discrepancies related to compensation. There may not be different types of Miami-Dade Florida Separation Notice for 1099 Employees, as the notice typically follows a standard format. However, employers may customize the content within the aforementioned sections to fit their specific requirements or add any additional information necessary to meet legal obligations. It is crucial for employers and 1099 employees in Miami-Dade County, Florida, to adhere to the guidelines set forth by the Fair Labor Standards Act (FLEA) and other relevant labor laws while drafting a separation notice. It is recommended to consult with a legal professional or human resources expert to ensure compliance with all applicable regulations and to minimize any potential legal risks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Aviso de separación para el empleado 1099 - Separation Notice for 1099 Employee

State:

Multi-State

County:

Miami-Dade

Control #:

US-412EM-2

Format:

Word

Instant download

Description

See form title.

Miami-Dade Florida Separation Notice for 1099 Employees is a legal document that outlines the termination or separation of a 1099 employee's contract or work arrangement in Miami-Dade County, Florida. This notice serves as a formal record of the end of the working relationship between the employer and the 1099 employee. It is important to provide accurate and detailed information in the notice to ensure compliance with labor laws and to avoid any potential legal issues. The Miami-Dade Florida Separation Notice for 1099 Employees typically includes the following key information: 1. Employee Details: This section includes the full name, address, contact information, and any unique identification numbers or codes associated with the 1099 employee. It is crucial to accurately record these details to ensure the correct identification of the employee involved. 2. Employer Details: This section provides the details of the employer, including the company name, address, and contact information. It is important to ensure that the employer information is accurate and up-to-date. 3. Separation Date: The notice must clearly state the date on which the employment contract or working relationship between the employer and the 1099 employee will terminate. This ensures clarity regarding the effective end date of the working arrangement. 4. Reason for Separation: The notice should briefly mention the reason for the separation or termination. It is essential to provide a concise explanation, which might include the completion of a specific project, contract expiration, or any other valid reason for ending the employment arrangement. 5. Compensation: This section may outline any outstanding payments due to the 1099 employee, such as unpaid invoices or expense reimbursements. Additionally, it should include information regarding the final payment, if applicable, and provide instructions for the 1099 employee to address any concerns or discrepancies related to compensation. There may not be different types of Miami-Dade Florida Separation Notice for 1099 Employees, as the notice typically follows a standard format. However, employers may customize the content within the aforementioned sections to fit their specific requirements or add any additional information necessary to meet legal obligations. It is crucial for employers and 1099 employees in Miami-Dade County, Florida, to adhere to the guidelines set forth by the Fair Labor Standards Act (FLEA) and other relevant labor laws while drafting a separation notice. It is recommended to consult with a legal professional or human resources expert to ensure compliance with all applicable regulations and to minimize any potential legal risks.