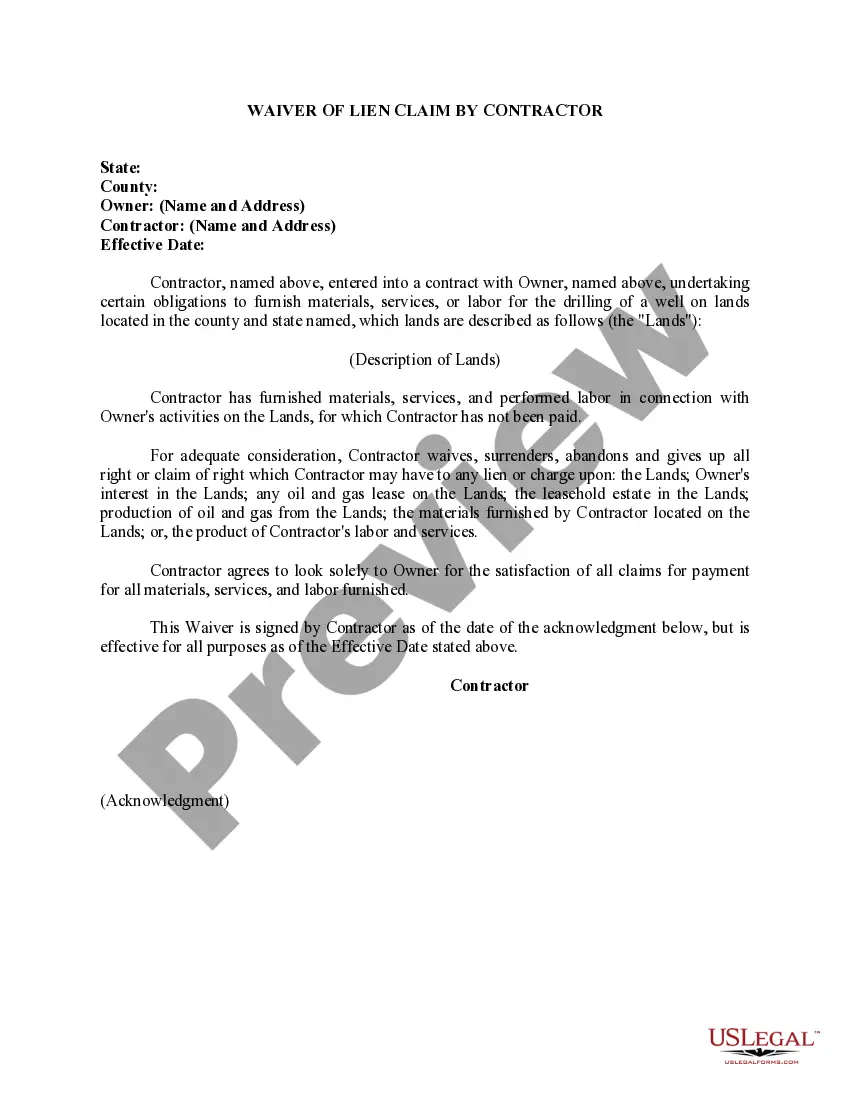

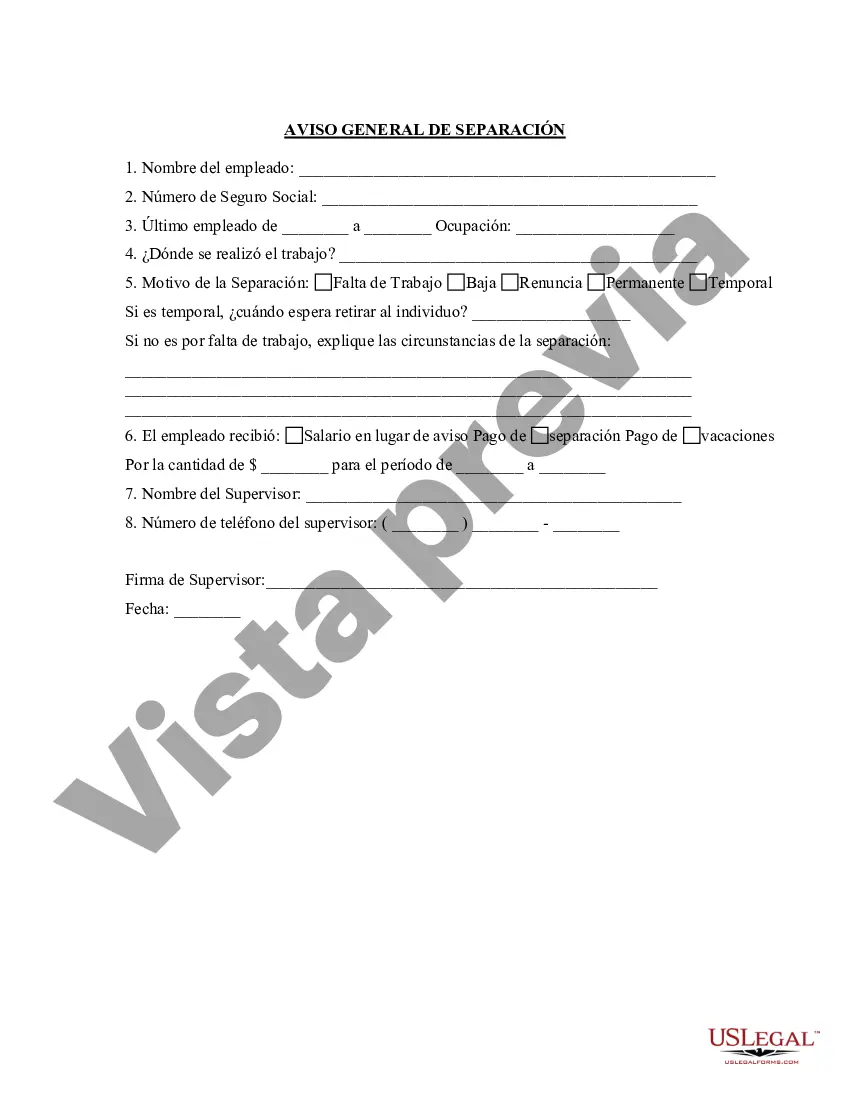

Santa Clara, California Separation Notice for 1099 Employees: A Comprehensive Overview In Santa Clara, California, a Separation Notice for 1099 Employees serves as an official document, detailing the termination of a working relationship between an employer and an independent contractor. This notice outlines the terms and conditions of separation and ensures compliance with state laws and regulations. The Santa Clara Separation Notice for 1099 Employees specifically caters to independent contractors, who are not classified as regular employees. Different versions of this notice may exist to accommodate various circumstances and legal classifications. Some notable types include: 1. Voluntary Separation Notice: This version is utilized when an independent contractor willingly terminates their working relationship with an employer in Santa Clara, California. It may be due to personal reasons, pursuing new opportunities, or any other valid reasons for voluntarily discontinuing the contractual agreement. 2. Involuntary Separation Notice: An employer issues this notice when they decide to terminate an independent contractor's services in Santa Clara, California. Reasons for involuntary separation may include unsatisfactory performance, budget cuts, and other business-related decisions. It is crucial for employers to comply with local labor laws to ensure a fair and lawful separation process. 3. Mutual Separation Notice: In certain situations, both parties involved in the independent contractor arrangement mutually agree to terminate the contractual relationship. This notice documents the consensus reached between the employer and the independent contractor, highlighting that the separation was mutually agreed upon and free of any disputes or conflicts. The Santa Clara Separation Notice for 1099 Employees typically includes various essential details, such as: 1. Identifying Information: This section identifies the employer and the independent contractor by providing their legal names, addresses, contact information, as well as any relevant identification or tracking numbers, such as Social Security or taxpayer identification numbers. 2. Effective Date: The separation notice specifies the date when the termination becomes effective, ensuring clarity about the timeline for ending the working relationship. 3. Reason for Separation: Employers must state the reason for the separation in compliance with Santa Clara, California, labor laws. While voluntary separations may not require a specific reason, involuntary separations should include a valid, lawful cause for termination. 4. Terms and Conditions: This section outlines any conditions associated with the separation, such as payment of outstanding invoices or fees, return of company property, and restrictions on future collaborations, if any. 5. Obligations and Rights: The notice reiterates the rights and obligations of both parties, emphasizing any legal responsibilities or restrictions that may persist after the separation. This may include confidentiality agreements, non-compete clauses, or any pending obligations to complete unfinished work. Employers and independent contractors in Santa Clara, California are advised to consult legal professionals or labor law experts to ensure compliance with local regulations while creating or processing a Separation Notice for 1099 Employees.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Aviso de separación para el empleado 1099 - Separation Notice for 1099 Employee

Description

How to fill out Santa Clara California Aviso De Separación Para El Empleado 1099?

Preparing legal paperwork can be cumbersome. In addition, if you decide to ask a legal professional to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Santa Clara Separation Notice for 1099 Employee, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is largest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the current version of the Santa Clara Separation Notice for 1099 Employee, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Santa Clara Separation Notice for 1099 Employee:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Santa Clara Separation Notice for 1099 Employee and download it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

El Formulario W-9 del IRS (siglas en ingles de Servicio de Impuestos Internos) es comunmente utilizado por individuos que trabajan como trabajadores por cuenta propia o contratistas independientes.

Tipos comunes del formulario 1099 1099-MISC (en ingles) para trabajos como contratista o trabajador por cuenta propia (freelance), ganancias relacionadas con premios y apuestas, y otros. 1099-INT (en ingles) para intereses de cuentas bancarias. 1099-DIV (en ingles) para distribuciones de inversion y dividendos.

Que hacer si no recibes todos tus formularios 1099 Incluso si no tienes todas las formas debidas, aun eres responsable de pagar los impuestos que debes. Si no recibiste una 1099, aun necesitas reportar el ingreso que recibiste para evitar una factura del IRS por los impuestos que debes.

¿Como llenar formulario 1099-MISC en Mac? Descarga el formulario 1099-MISC del IRS de aqui. Instala PDF Expert en tu Mac y abre el formulario descargado. Introduce tus propios detalles en la informacion del Pagador y la informacion del Destinatario de tu formulario W-9 en el lado izquierdo del formulario.

¿Como llenar formulario 1099-MISC en Mac? Descarga el formulario 1099-MISC del IRS de aqui. Instala PDF Expert en tu Mac y abre el formulario descargado. Introduce tus propios detalles en la informacion del Pagador y la informacion del Destinatario de tu formulario W-9 en el lado izquierdo del formulario.

Las empresas y agencias del Gobierno utilizan los formularios 1099 para reportar varios tipos de ingresos ademas de salarios, sueldos y propinas ante el Servicio de Impuestos Internos (IRS, sigla en ingles).

Una cosa que podras notar en tus formularios 1099-NEC es que tus clientes no retienen impuesto sobre los ingresos de tus pagos como lo hacen para sus empleados. Sin embargo, esto no quiere decir que puedes esperar hasta que prepares tu declaracion de impuestos para pagar el 100% de tu responsabilidad tributaria.

Si paga a los contratistas independientes, puede tener que presentar el Formulario 1099-NEC, Remuneracion a personas que no son empleados (en ingles), para informar los pagos por los servicios prestados para su ocupacion o negocio.