Hennepin Minnesota Employment Information Form is an important document that is used by employers in Hennepin County, Minnesota, to collect essential information from job applicants and employees. This form serves as a comprehensive record of an individual's personal and employment details and is crucial for various human resource processes, such as hiring, payroll, benefits administration, and tax reporting. Keywords: Hennepin Minnesota, employment information form, job application, employee record, human resource, personal details, employment details, job applicant, employee, hiring, payroll, benefits administration, tax reporting. There are several types of Hennepin Minnesota Employment Information Forms, including: 1. Job Application Form: This form is used by employers when seeking new employees. It captures general information about the applicant, such as their name, contact details, previous work experience, education, skills, and references. This form helps employers assess the qualifications and suitability of candidates for specific positions. 2. Employee Information Form: This form is filled out by newly hired employees to provide essential details to their employer. It collects information like the employee's full name, address, social security number, emergency contacts, tax withholding preferences, and other such necessary data that facilitates smooth onboarding and administrative processes. 3. Payroll Information Form: This form focuses primarily on gathering details related to an employee's compensation and payroll administration. It typically includes information about the employee's bank account for direct deposit, tax identification numbers, exemptions, deductions, and other payroll-related specifics. 4. Benefits Enrollment Form: This form is utilized when employees are enrolling in various benefits programs offered by the employer, such as health insurance, retirement plans, life insurance, and other employee benefits. It collects information relevant to the specific benefits being selected by the employee. This form helps employers keep track of employee benefit choices and ensure accurate benefits administration. 5. Tax Withholding Form: This form, often the W-4 form, is required by the Internal Revenue Service (IRS) to determine the correct amount of federal income tax to withhold from an employee's paycheck. It captures crucial information related to the employee's filing status, number of dependents, and any additional withholding preferences. Proper completion of this form ensures accurate tax withholding and prevents under or overpayment of taxes. Overall, Hennepin Minnesota Employment Information Forms play a central role in the employment lifecycle, from the initial job application to payroll and benefits management. By collecting relevant data, employers can make informed decisions, maintain accurate records, and comply with legal and regulatory requirements.

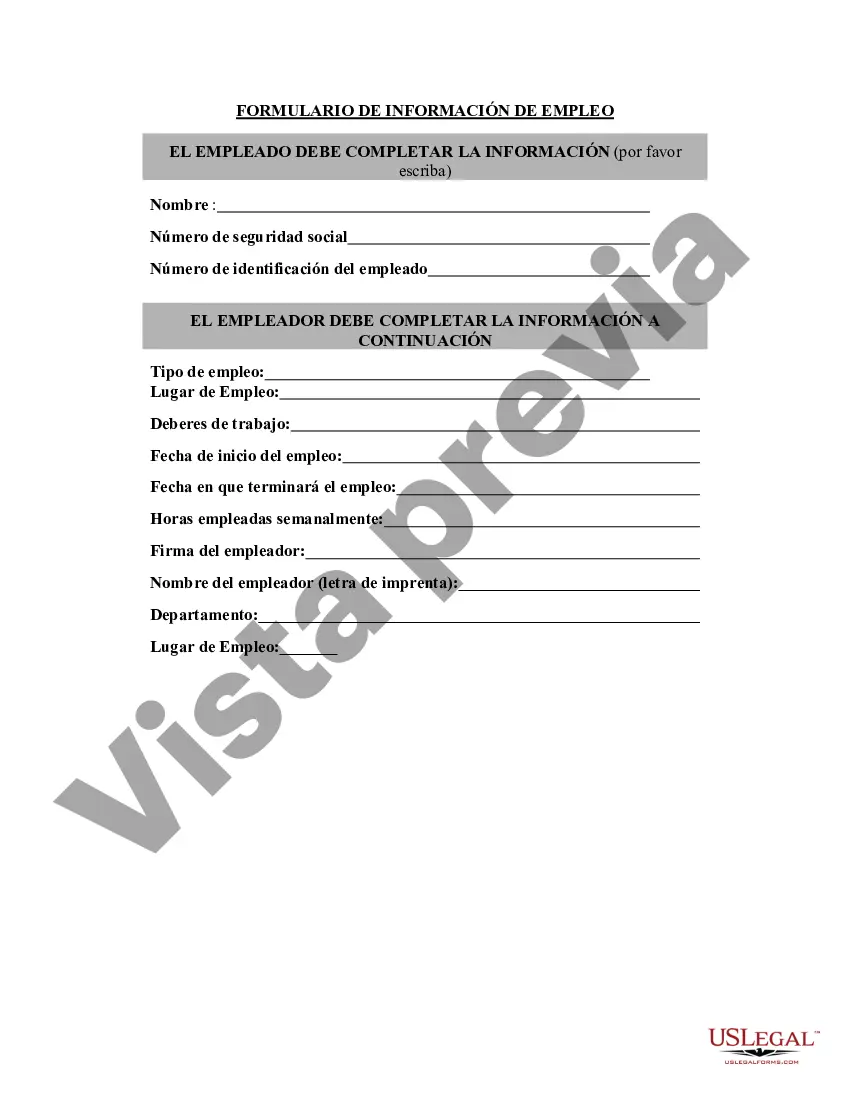

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Formulario de información de empleo - Employment Information Form

Description

How to fill out Hennepin Minnesota Formulario De Información De Empleo?

Laws and regulations in every area vary throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Hennepin Employment Information Form, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you pick a sample, it remains accessible in your profile for future use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Hennepin Employment Information Form from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Hennepin Employment Information Form:

- Analyze the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the template when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal reasons. Find them all in clicks and keep your documentation in order with the US Legal Forms!