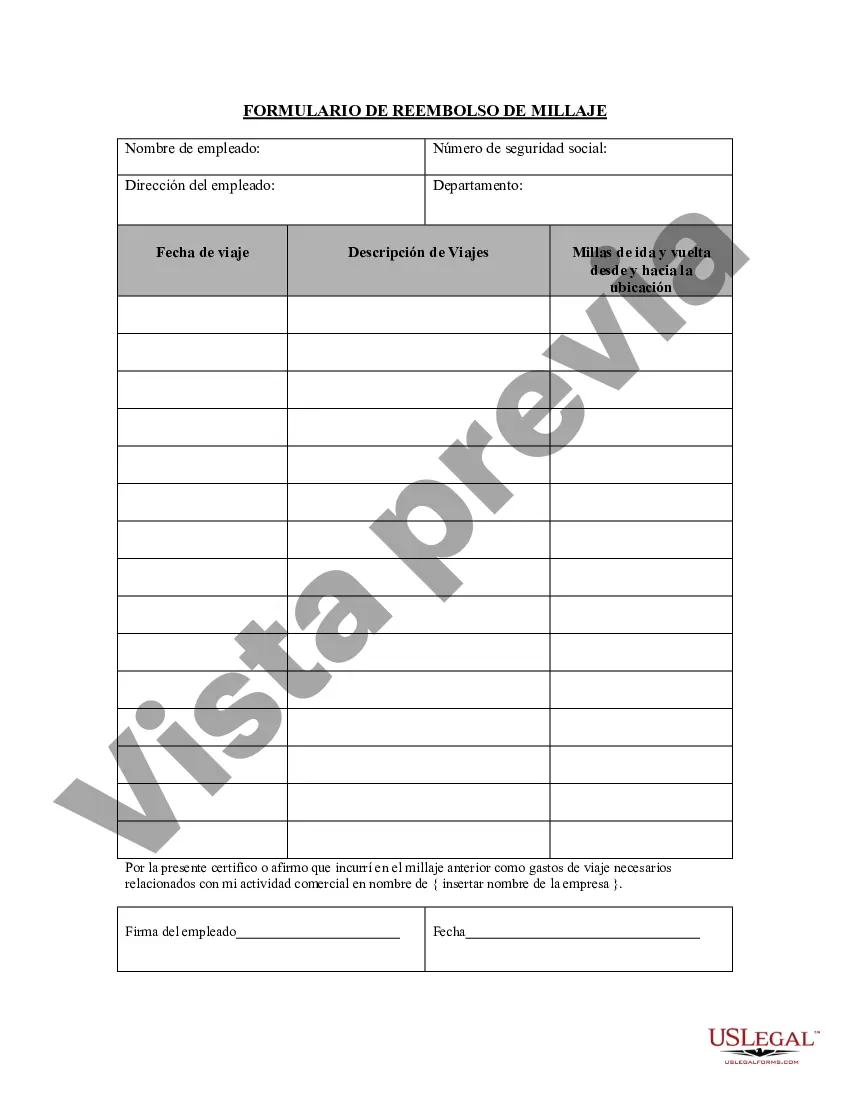

The San Diego California Mileage Reimbursement Form is a document that allows individuals or employees to request reimbursement for travel expenses incurred while using their personal vehicle for business purposes in the city of San Diego, California. This form is typically used by companies or organizations that have a mileage reimbursement policy in place. The form requires the requester to provide specific details such as their full name, employee ID, contact information, and the purpose of the trip. In addition, they must include the starting location and destination, along with the number of miles traveled. The requester must also indicate the date and time of departure and return, as well as any additional expenses associated with the trip, like parking fees or tolls. By providing accurate and detailed information, individuals can ensure a smooth reimbursement process. To expedite the reimbursement, it is often recommended attaching supporting documents, such as fuel receipts or invoices for additional expenses. There may be different types of San Diego California Mileage Reimbursement Forms based on the nature of the travel. For instance, there might be specific forms for regular employee travel, business development trips, client meetings, or conference attendance. Each form may have slight variations in terms of required information or specific sections tailored to the purpose of the trip. Mileage reimbursement is an essential aspect of managing business travel expenses and ensuring fair compensation for employees. By utilizing the San Diego California Mileage Reimbursement Form, organizations can effectively track and reimburse travel-related costs while maintaining accurate records for accounting and tax purposes. Keywords: San Diego California, mileage reimbursement, form, travel expenses, personal vehicle, business purposes, reimbursement policy, full name, employee ID, contact information, purpose of the trip, starting location, destination, miles traveled, date and time, additional expenses, supporting documents, fuel receipts, invoices, regular employee travel, business development trips, client meetings, conference attendance, business travel expenses, fair compensation, accounting, tax purposes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Formulario de reembolso de millaje - Mileage Reimbursement Form

Description

How to fill out Formulario De Reembolso De Millaje?

How long does it typically take for you to create a legal document? Since each state has its own laws and regulations for various life circumstances, finding a San Diego Mileage Reimbursement Form that meets all local standards can be overwhelming, and sourcing it from a qualified lawyer is frequently costly. Numerous online platforms provide the most common state-specific templates for download, yet utilizing the US Legal Forms collection is the most advantageous.

US Legal Forms stands as the most extensive online repository of templates, organized by states and areas of application. Beyond the San Diego Mileage Reimbursement Form, here you can acquire any particular document to manage your business or personal matters, adhering to your local standards. Experts validate all samples for their relevance, so you can be confident in preparing your documents accurately.

Using the service is incredibly straightforward. If you already possess an account on the platform and your subscription is active, you simply need to Log In, select the necessary form, and download it. You can access the file in your profile at any time afterwards. Conversely, if you are a newcomer to the platform, there will be additional steps before you obtain your San Diego Mileage Reimbursement Form.

Regardless of how many times you need to access the obtained document, you can find all the files you’ve ever saved in your profile by navigating to the My documents tab. Give it a try!

- Review the content of the page you’re viewing.

- Examine the description of the template or Preview it (if available).

- Look for another document using the related option in the navigation bar.

- Click Buy Now when you are confident in the selected file.

- Choose the subscription plan that best fits your needs.

- Register for an account on the platform or Log In to move to payment options.

- Complete payment through PayPal or with your credit card.

- Alter the file format if needed.

- Click Download to save the San Diego Mileage Reimbursement Form.

- Print the document or utilize any preferred online editor to fill it out digitally.

Form popularity

FAQ

Si recibe compensacion por accidentes en el trabajo o algun otro tipo de beneficios del gobierno por incapacidad y al mismo tiempo recibe los beneficios de SSDI, la cantidad total de estos beneficios, al presente, no puede exceder el 80 por ciento de las ganancias promedio que usted tenia antes de incapacitarse.

La compensacion para trabajadores se paga semanalmente o quincenalmente en funcion del salario semanal promedio del empleado lesionado. La Compensacion a los Trabajadores por una discapacidad total es equivalente a dos tercios del salario semanal promedio del empleado lesionado hasta un monto maximo de beneficio.

La compensacion del trabajador proporciona beneficios a los trabajadores que se lastiman en el trabajo o que tienen un malestar, una enfermedad, o una discapacidad causada o empeorada por condiciones en el lugar del trabajo. La mayoria de los patrones tienen que tener el seguro de la compensacion para los trabajadores.

Si usted sufre una lesion o enfermedad laboral y su empleador no esta asegurado, su empleador es responsable de pagar todas las cuentas relacionadas con su lesion o enfermedad.

Si usted tiene una lesion o enfermedad laboral, su empleador esta obligado por ley a pagarle los beneficios de compensacion de trabajadores.

Muchas personas que sufrieron lesiones en su lugar de trabajo optan por presentar un reclamo de compensacion para trabajadores. Aunque no existen cifras exactas, la firma de abogados Morris Bart estima que la mayoria de los empleados obtienen entre $2,000 y $40,000 dolares por su reclamo.

Este beneficio se paga a razon de 2/3 del salario semanal promedio, con algunas excepciones, durante 104 semanas.

En general, se tarda entre 4 y 8 semanas desde el momento en que se llega a un acuerdo para que tengas un cheque en la mano.

Descubrimos que la mayoria de los casos se resuelven en un plazo de 7 a 10 meses a partir de la fecha del incidente; pero el plazo en su caso podria ser mas corto o mas largo dependiendo de: los hechos y circunstancias del accidente; el tiempo que le toma completar el tratamiento medico; y el caracter de la compania o