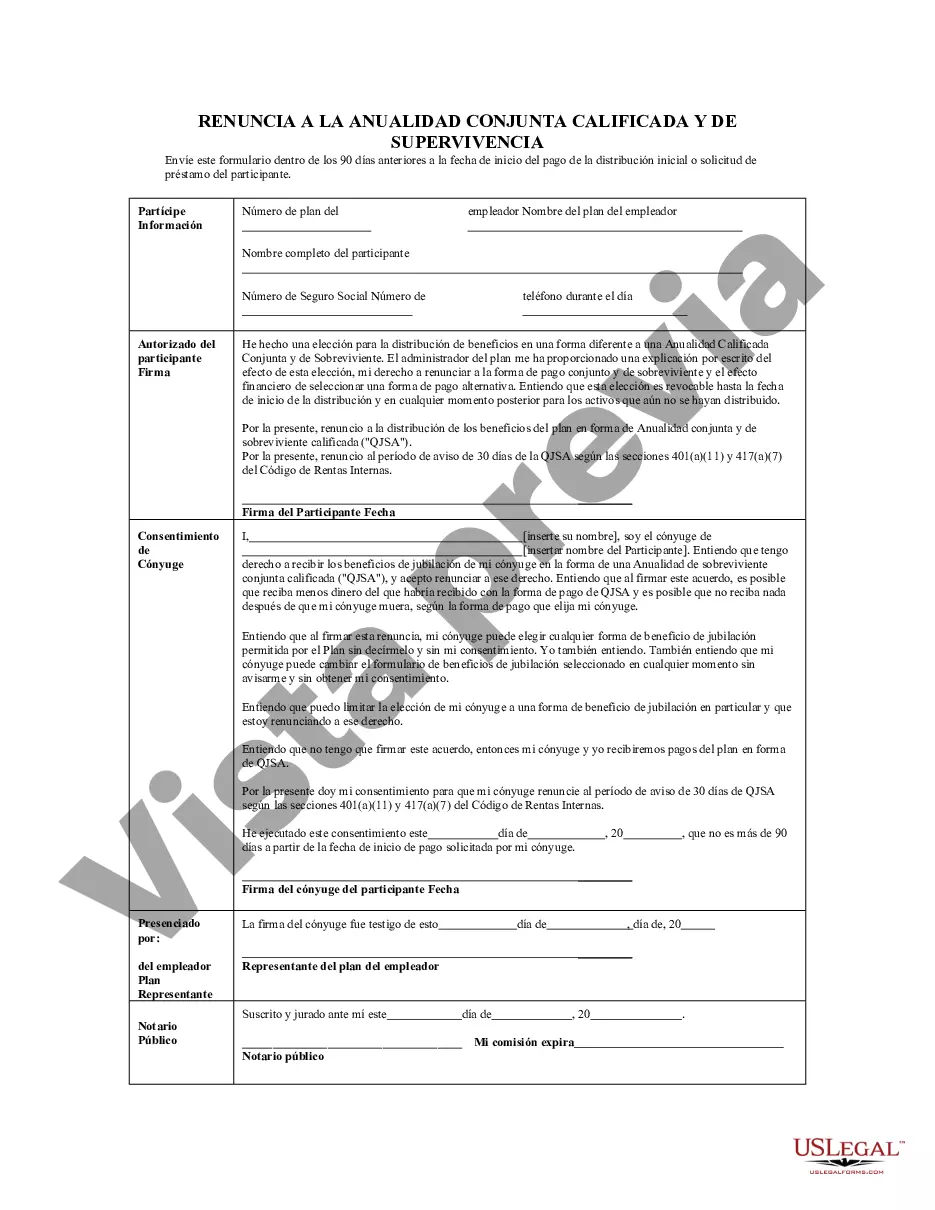

Allegheny County, Pennsylvania, is located in the western part of the state and includes the city of Pittsburgh. It is home to a diverse population, vibrant communities, and numerous attractions. The Waiver of Qualified Joint and Survivor Annuity (JSA) is a specific provision available for retirement plans, including pension plans. It allows plan participants to waive the JSA default option, which provides a lifelong annuity to the participant and their spouse after retirement. Instead, individuals can elect an alternative form of payment or designate a different beneficiary. There are different types of Allegheny Pennsylvania Waivers of Qualified Joint and Survivor Annuity JSASA available, each with its specific conditions and requirements. These may include: 1. Full Waiver of JSA: This type of waiver allows the plan participant to completely waive the default JSA option, removing the requirement to provide an annuity to their spouse or beneficiary after retirement. This gives the participant more flexibility in how they receive their retirement benefits. 2. Partial Waiver of JSA: With a partial waiver of JSA, the plan participant can elect to provide a reduced annuity payment to their spouse or beneficiary after retirement. This allows for a portion of the retirement benefits to be allocated to the designated individual, while still giving the participant some flexibility in managing their finances. 3. Alternative Payout Options: In addition to waiving the JSA, Allegheny Pennsylvania offers alternative payout options for retirement plan participants. These options may include lump-sum distributions, installment payments, or a combination of both. These alternatives provide individuals with greater control over their retirement funds, allowing them to make choices that align with their financial goals and priorities. It's important to note that the specific rules and regulations regarding the Waiver of Qualified Joint and Survivor Annuity JSASA may vary depending on the retirement plan and its associated governing laws. Individuals should consult their plan documents, financial advisors, or legal professionals for precise details and guidance. In summary, Allegheny Pennsylvania Waiver of Qualified Joint and Survivor Annuity JSASA provides retirement plan participants with options to modify the default annuity payment provisions. These waivers offer greater flexibility in determining the form and distribution of retirement benefits, based on individual circumstances and financial goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Allegheny Pennsylvania Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

Creating forms, like Allegheny Waiver of Qualified Joint and Survivor Annuity - QJSA, to manage your legal matters is a challenging and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal affairs into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website features more than 85,000 legal documents created for various cases and life circumstances. We ensure each form is in adherence with the laws of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Allegheny Waiver of Qualified Joint and Survivor Annuity - QJSA form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding process of new users is fairly straightforward! Here’s what you need to do before getting Allegheny Waiver of Qualified Joint and Survivor Annuity - QJSA:

- Make sure that your template is specific to your state/county since the regulations for creating legal documents may differ from one state another.

- Learn more about the form by previewing it or going through a quick description. If the Allegheny Waiver of Qualified Joint and Survivor Annuity - QJSA isn’t something you were looking for, then use the header to find another one.

- Sign in or register an account to start using our website and get the form.

- Everything looks good on your side? Click the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment details.

- Your form is ready to go. You can go ahead and download it.

It’s easy to find and purchase the needed template with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!