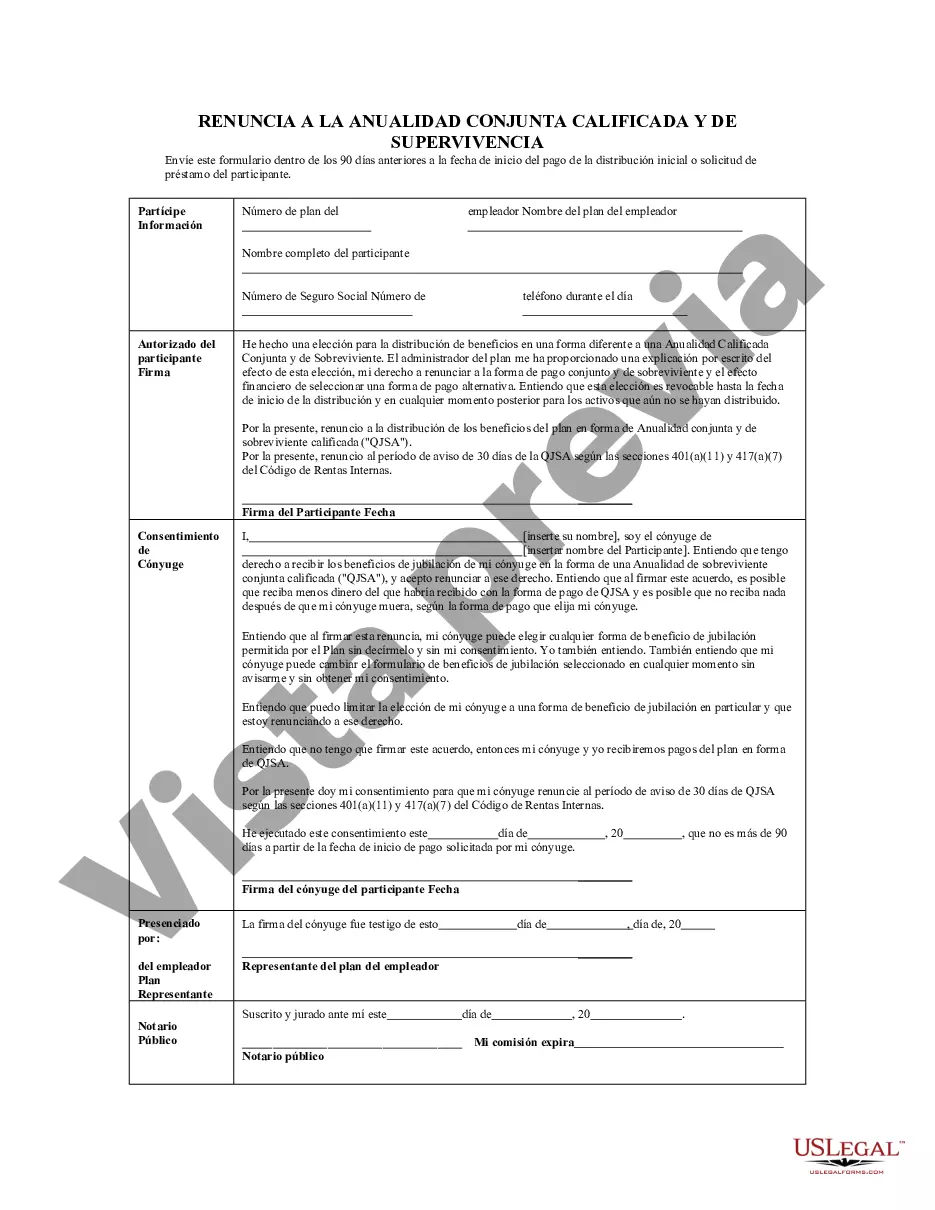

The Bexar County, Texas Waiver of Qualified Joint and Survivor Annuity (JSA) is a crucial aspect of retirement planning for individuals who have participated in certain employee benefit plans. This waiver allows the plan participant to elect a different form of benefit payment other than the traditional JSA, thereby providing greater flexibility in retirement planning. The Qualified Joint and Survivor Annuity (JSA) is a retirement benefit option that ensures the financial security of both an employee and their spouse during their retirement years. Under this default plan option, the employee receives a lifetime annuity payment, while their surviving spouse continues to receive a portion of that annuity after the employee's death. The JSA guarantees the provision of income to a surviving spouse, offering a measure of financial stability even after the primary earner passes away. It is a risk management tool that guards against the uncertainties of a retiree's lifespan and protects the spouse from becoming financially vulnerable. However, Bexar County, Texas recognizes that individuals may have unique circumstances that require greater flexibility in their retirement planning. Hence, the county offers different types of Waiver of Qualified Joint and Survivor Annuity (JSA) options for employees to choose from based on their specific needs and preferences. These options are: 1. Single Life Annuity: This waiver allows the retiree to receive a higher monthly benefit, sacrificing the guarantee of continued payments to a surviving spouse. It is a suitable option for individuals who do not have a dependent spouse or who have planned for alternative sources of income for their spouse. 2. Term Certain Annuity: With this waiver, the retiree receives a guaranteed payment for a specific number of years, regardless of their lifespan. If the retiree passes away before the end of the specified term, any remaining payments are typically transferred to their designated beneficiary. This option is ideal for individuals who wish to ensure a fixed income for a specific period, such as covering college expenses or paying off a mortgage. 3. Lump Sum Payment: In some cases, employees may choose to waive the JSA annuity altogether and opt for a one-time lump sum distribution at retirement. This option provides immediate access to the retirement funds, allowing individuals to invest or allocate the funds according to their specific financial goals and objectives. In conclusion, the Bexar County, Texas Waiver of Qualified Joint and Survivor Annuity (JSA) offers various alternatives to the traditional JSA annuity payment. These waivers provide employees with the flexibility to tailor their retirement plan based on their unique circumstances, providing greater control over their financial future. Whether opting for a Single Life Annuity, Term Certain Annuity, or a Lump Sum Payment, individuals can make informed decisions that align with their retirement goals and priorities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Bexar Texas Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life scenarios demand you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any personal or business purpose utilized in your region, including the Bexar Waiver of Qualified Joint and Survivor Annuity - QJSA.

Locating samples on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Bexar Waiver of Qualified Joint and Survivor Annuity - QJSA will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to obtain the Bexar Waiver of Qualified Joint and Survivor Annuity - QJSA:

- Ensure you have opened the proper page with your local form.

- Use the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template satisfies your needs.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Decide on the suitable subscription plan, then log in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Bexar Waiver of Qualified Joint and Survivor Annuity - QJSA on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!