A Waiver of Qualified Joint and Survivor Annuity (JSA) is a crucial provision for retirement plans offered in Chicago, Illinois. It allows the plan participant to waive the default joint and survivor benefit options available to married participants, providing more flexibility and control over their retirement income. In Chicago, Illinois, there are two main types of JSA waivers commonly observed: the Spousal Consent Waiver and the Spousal Waiver. 1. Spousal Consent Waiver: This type of JSA waiver requires the plan participant to obtain written consent from their spouse, acknowledging the potential risks associated with waiving the default joint and survivor annuity options. With spousal consent, the participant can opt for other payout options that may better suit their financial circumstances or goals. 2. Spousal Waiver: Unlike the Spousal Consent Waiver, the Spousal Waiver allows the plan participant to waive the joint and survivor annuity options without the need for spousal consent. This waiver acknowledges the participant's desire to have full control over their retirement assets, enabling them to choose different payout options that might better align with their personal situation and retirement objectives. JSA waivers play a vital role in giving Chicago, Illinois, retirees the flexibility to customize their retirement plans to fit their unique needs. By considering the JSA waiver, participants can explore other options such as lump-sum distributions, annuities without survivor benefits, or even a combination of both. It is important to note that the availability and specifics of JSA waivers can vary between retirement plans and employers in Chicago, Illinois. Individuals must carefully review the terms of their specific retirement plan to understand the available JSA waiver options and any potential implications or consequences associated with their choice. Seeking guidance from a financial advisor or consulting the plan administrator can be beneficial in making an informed decision regarding the JSA waiver. In summary, Chicago, Illinois, offers various types of JSA waivers, such as the Spousal Consent Waiver and the Spousal Waiver. These waivers empower retirees to tailor their retirement plans according to their unique financial goals and circumstances, allowing them to make the most of their retirement savings.

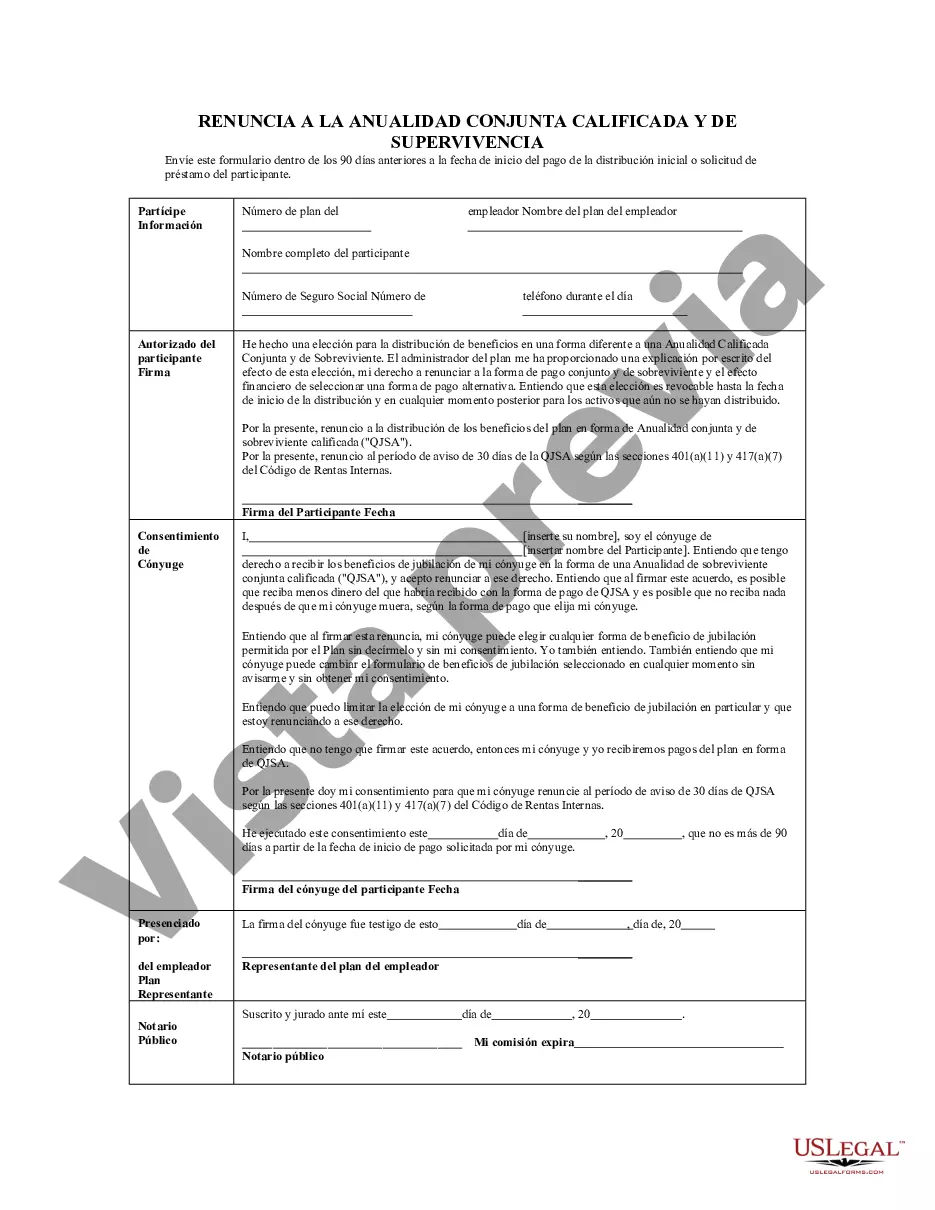

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Chicago Illinois Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

Drafting documents for the business or individual needs is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these aspects make it stressful and time-consuming to draft Chicago Waiver of Qualified Joint and Survivor Annuity - QJSA without professional help.

It's easy to avoid spending money on attorneys drafting your documentation and create a legally valid Chicago Waiver of Qualified Joint and Survivor Annuity - QJSA on your own, using the US Legal Forms online library. It is the greatest online collection of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the required document.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Chicago Waiver of Qualified Joint and Survivor Annuity - QJSA:

- Examine the page you've opened and verify if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To locate the one that suits your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever purchased never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any situation with just a couple of clicks!