The Clark Nevada Waiver of Qualified Joint and Survivor Annuity (JSA) is a significant component of retirement planning and pension benefits. It allows participants in certain retirement plans to waive the spousal survivor benefit provided by the plan in favor of other financial arrangements. The waiver option is particularly prevalent in the Clark County, Nevada area. A Qualified Joint and Survivor Annuity (JSA) is a type of pension plan that provides regular income to retired individuals and guarantees a continuation of benefits to the surviving spouse after the retiree's death. However, the Clark Nevada Waiver of JSA gives plan participants the option to forgo this spousal benefit in exchange for greater flexibility and control over their retirement funds. There are various types of Clark Nevada Waiver of JSA that individuals can consider based on their specific financial goals and circumstances. These options may include: 1. Partial Waiver: This allows plan participants to waive a portion of the JSA benefit in order to access a lump-sum or periodic distribution of funds. It provides individuals with the flexibility to allocate their retirement funds according to their individual needs. 2. Full Waiver: With a full waiver, plan participants completely opt out of the JSA benefit and choose alternative retirement income arrangements. This may involve investing in other financial products or utilizing funds for specific purposes such as healthcare expenses, education, or travel. 3. Conditional Waiver: In some cases, individuals may choose to waive the JSA benefit under certain conditions. For example, the waiver may only become effective if the spouse provides written consent or if the participant has no legal obligation to provide financial support to the spouse. 4. Retroactive Waiver: This type of waiver allows individuals who had previously elected the JSA benefit to change their minds and opt-out. Retirees may opt for a retroactive waiver to access their full retirement funds earlier or to make new financial arrangements. The Clark Nevada Waiver of Qualified Joint and Survivor Annuity provides retirees with the flexibility to customize their retirement income stream according to their personal needs and objectives. It is essential for individuals to thoroughly understand the implications, advantages, and potential drawbacks associated with each type of waiver before making any decisions regarding their pension benefits. Consulting with a qualified financial advisor or retirement planner is recommended to ensure an informed decision that meets the retiree's long-term financial objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

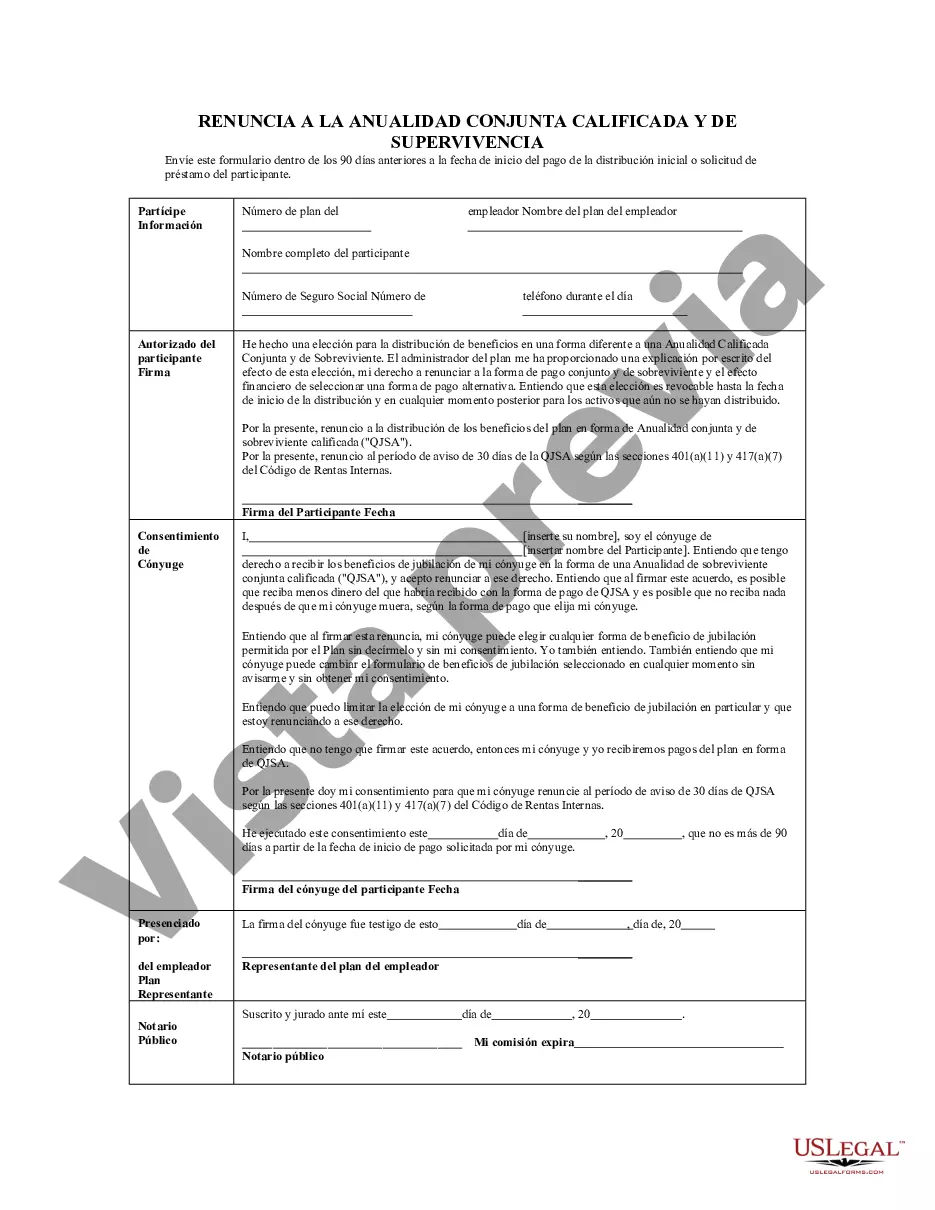

How to fill out Clark Nevada Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

Preparing legal paperwork can be burdensome. Besides, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Clark Waiver of Qualified Joint and Survivor Annuity - QJSA, it may cost you a lot of money. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Therefore, if you need the recent version of the Clark Waiver of Qualified Joint and Survivor Annuity - QJSA, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Clark Waiver of Qualified Joint and Survivor Annuity - QJSA:

- Look through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Clark Waiver of Qualified Joint and Survivor Annuity - QJSA and download it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!