Dallas, Texas Waiver of Qualified Joint and Survivor Annuity (JSA) is a crucial aspect of retirement planning for individuals residing in Dallas, Texas. A JSA refers to a pension plan provision that guarantees a surviving spouse will receive a specific portion of a participant's pension benefits after their demise. However, in some cases, the participant may choose to waive this provision, allowing for different variations of the JSA. One type of Dallas, Texas Waiver of JSA is the Partial Waiver. In this case, the participant waives a portion of their pension benefits to be payable to the surviving spouse. This type of waiver is commonly utilized when both partners in a marriage have substantial retirement savings or other financial resources, and therefore, they decide to limit the survivor's benefits to a specific amount. Another type of waiver is the Full Waiver. This means that the participant completely waives the survivor's benefits, leaving no portion of their pension benefits for the surviving spouse. This option may be chosen if the participant and their spouse have alternative means of financial support or if they wish to designate their pension benefits to other beneficiaries, such as children or charitable organizations. It's important to note that the Dallas, Texas Waiver of JSA can have significant implications for the surviving spouse, as it affects their financial security after the participant's passing. It is crucial for individuals considering a waiver of JSA to carefully evaluate their financial circumstances, consult with a financial advisor or attorney experienced in retirement planning, and thoroughly assess the potential impact of this decision. In summary, the Dallas, Texas Waiver of Qualified Joint and Survivor Annuity (JSA) allows participants to choose whether they want to guarantee their surviving spouse a portion of their pension benefits. Different types of waivers include the Partial Waiver and the Full Waiver, each offering varying levels of survivor benefits. It is essential for individuals to carefully consider their financial situation and seek professional advice before making any decisions regarding JSA waivers.

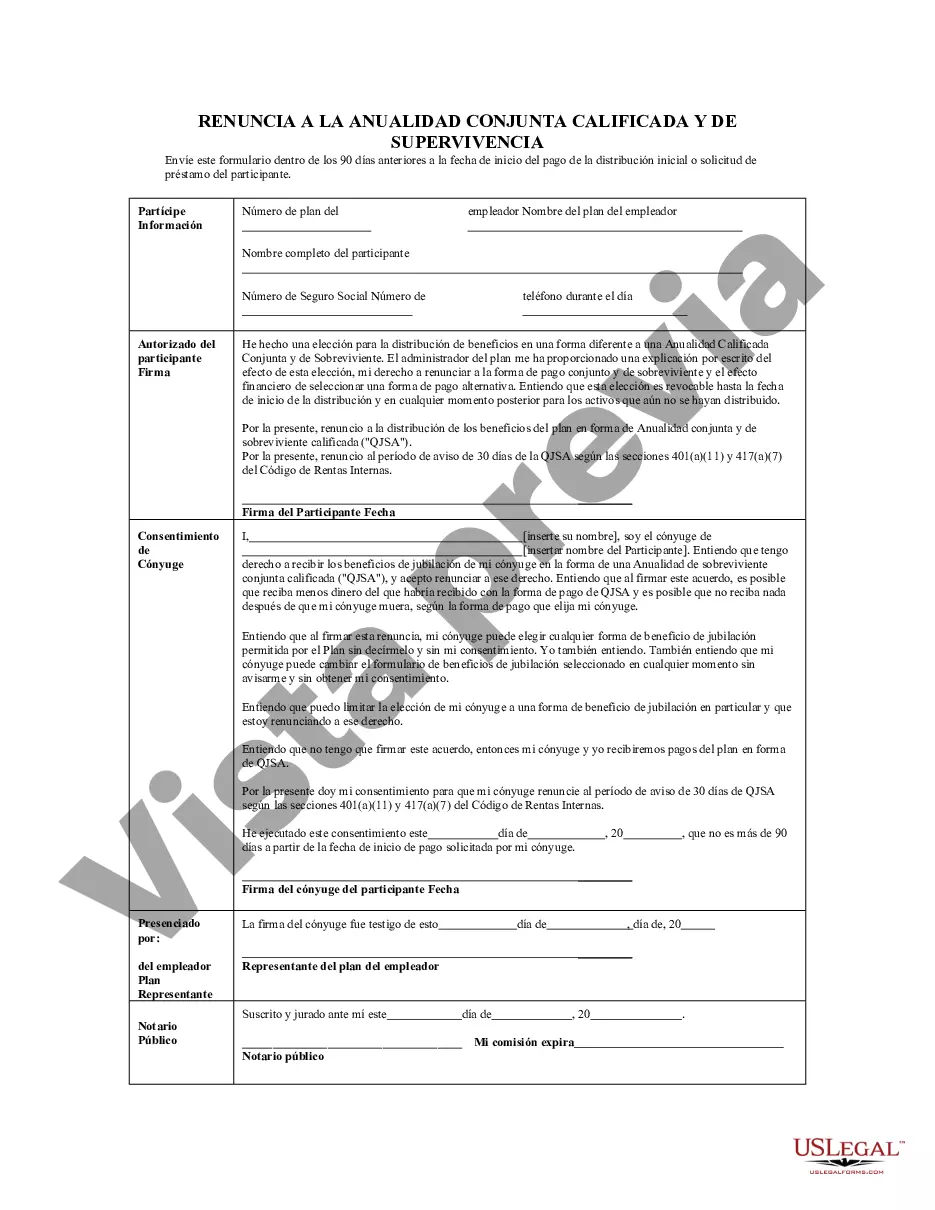

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Dallas Texas Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

Do you need to quickly draft a legally-binding Dallas Waiver of Qualified Joint and Survivor Annuity - QJSA or maybe any other form to handle your own or corporate matters? You can go with two options: contact a legal advisor to write a legal document for you or draft it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get neatly written legal paperwork without paying sky-high fees for legal services.

US Legal Forms offers a rich collection of more than 85,000 state-specific form templates, including Dallas Waiver of Qualified Joint and Survivor Annuity - QJSA and form packages. We offer templates for a myriad of use cases: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary template without extra hassles.

- To start with, double-check if the Dallas Waiver of Qualified Joint and Survivor Annuity - QJSA is adapted to your state's or county's laws.

- If the form has a desciption, make sure to check what it's suitable for.

- Start the search over if the form isn’t what you were looking for by utilizing the search box in the header.

- Choose the plan that best suits your needs and proceed to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can simply log in to it, locate the Dallas Waiver of Qualified Joint and Survivor Annuity - QJSA template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Additionally, the documents we offer are reviewed by law professionals, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!