The Harris Texas Waiver of Qualified Joint and Survivor Annuity (JSA) is a crucial aspect of retirement planning and pension benefits in the state of Texas. It is designed to provide flexibility to employees who wish to waive the standard joint and survivor annuity option in favor of alternative distributions. The JSA is primarily aimed at married participants who have a vested interest in their pension plans. Under the JSA, if a participant elects to waive the standard joint and survivor annuity, their spouse's right to receive survivor benefits will be terminated. However, it is essential to note that this can only be done with the spouse's written consent. This waiver option allows individuals to customize their pension plan based on their unique circumstances and financial objectives. It may be useful in cases where the retiree and their spouse have alternative arrangements in place for meeting post-retirement financial needs or securing survivor benefits through other means. There might be different types or variations of the Harris Texas Waiver of Qualified Joint and Survivor Annuity (JSA) tailored to specific situations. These variations may include: 1. Partial JSA Waiver: This option enables participants to waive a portion of the joint and survivor annuity, allowing them to provide a reduced survivor benefit while securing greater income for themselves during retirement. 2. Reverse JSA Waiver: This variant allows the participant to waive the joint and survivor annuity in exchange for a higher initial benefit payable to their spouse if they outlive the retiree. 3. Temporary JSA Waiver: This type of waiver allows participants to temporarily suspend survivor benefit payments for a specified period, after which the payments can be resumed. It is important to consult with a qualified financial advisor or pension specialist to fully understand the implications and potential variations of the Harris Texas Waiver of Qualified Joint and Survivor Annuity (JSA). These professionals can provide personalized guidance based on individual circumstances, ensuring optimal retirement planning and financial security for both the retiree and their spouse.

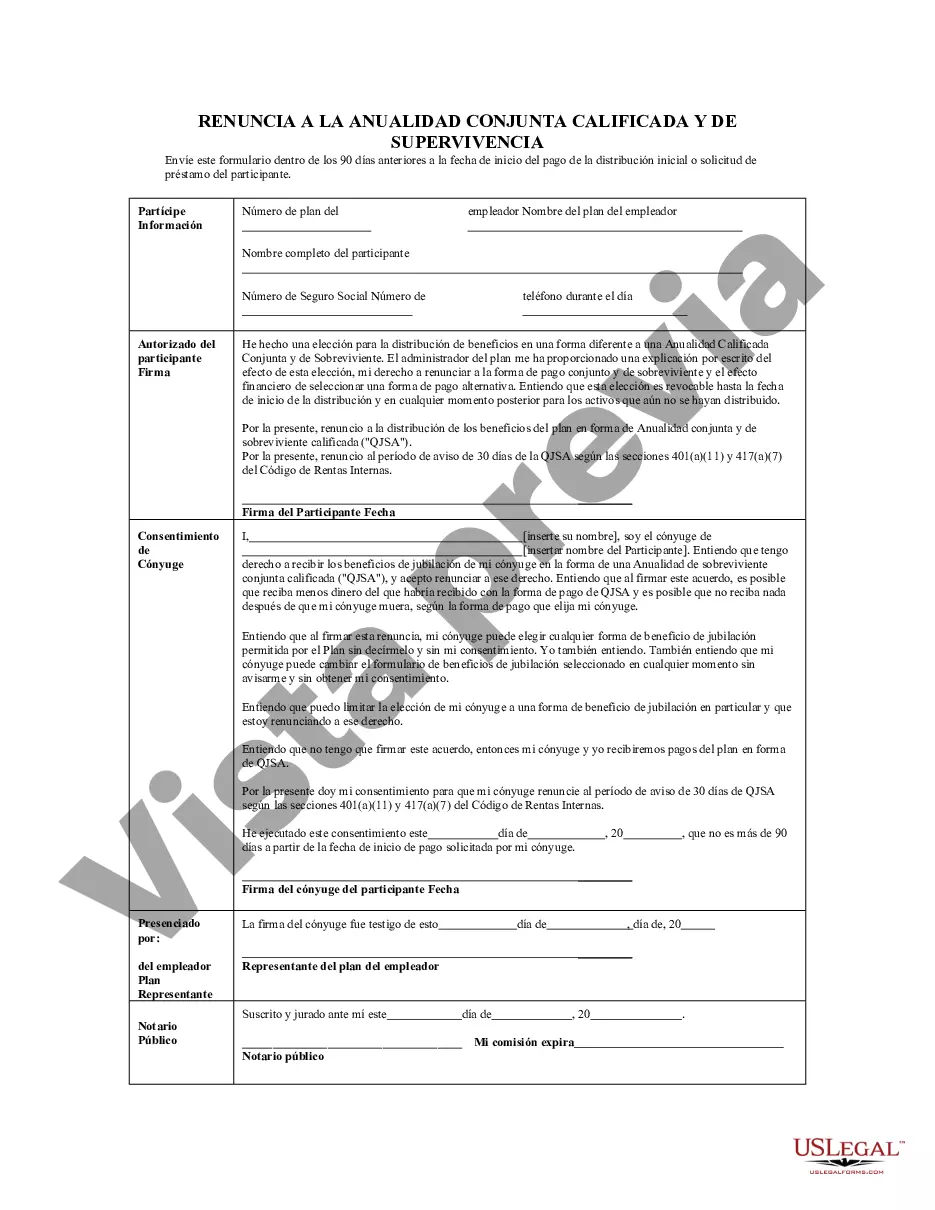

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Harris Texas Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

Do you need to quickly draft a legally-binding Harris Waiver of Qualified Joint and Survivor Annuity - QJSA or maybe any other form to handle your personal or corporate affairs? You can go with two options: contact a professional to write a legal document for you or create it entirely on your own. Luckily, there's a third option - US Legal Forms. It will help you receive neatly written legal documents without paying unreasonable fees for legal services.

US Legal Forms offers a rich catalog of over 85,000 state-specific form templates, including Harris Waiver of Qualified Joint and Survivor Annuity - QJSA and form packages. We provide documents for an array of use cases: from divorce paperwork to real estate document templates. We've been on the market for more than 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the needed document without extra hassles.

- First and foremost, carefully verify if the Harris Waiver of Qualified Joint and Survivor Annuity - QJSA is adapted to your state's or county's regulations.

- If the form has a desciption, make sure to check what it's suitable for.

- Start the search over if the document isn’t what you were seeking by utilizing the search box in the header.

- Choose the subscription that is best suited for your needs and move forward to the payment.

- Select the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Harris Waiver of Qualified Joint and Survivor Annuity - QJSA template, and download it. To re-download the form, simply head to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the templates we offer are reviewed by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!