The Hennepin Minnesota Waiver of Qualified Joint and Survivor Annuity JSASA is a legal provision that allows participants in certain retirement plans to waive the requirement of receiving a joint and survivor annuity with their spouse as the primary beneficiary. This waiver grants participants the ability to choose an alternative form of distribution that suits their individual needs and preferences. The JSA is an important aspect of retirement planning as it ensures the financial security of both the participant and their spouse during their retirement years. It guarantees a stream of income for the rest of the participant's life, with a continuation of benefits for the surviving spouse. However, there may be situations where opting for a different form of distribution makes more sense, which is where the Hennepin Minnesota Waiver of JSA comes into play. By availing this waiver, participants can redirect their retirement plan benefits towards other financial goals or utilize the funds for personal expenses. This allows individuals greater flexibility and control over their retirement savings, enabling them to make decisions that align with their unique circumstances. Different types of Hennepin Minnesota Waiver of JSA may include: 1. Full Waiver of JSA: This type of waiver removes the requirement for a joint and survivor annuity, providing complete flexibility for the participant in determining how their retirement benefits are distributed. 2. Partial Waiver of JSA: In this scenario, participants may choose to receive a reduced joint and survivor annuity or opt for an alternative form of distribution for a portion of their retirement benefits, while still providing some financial protection for their spouse. 3. Temporary Waiver of JSA: Participants may avail a temporary waiver of the JSA to address specific financial circumstances or achieve short-term financial goals. Once the specified period ends, the normal distribution rules and requirements of a joint and survivor annuity would resume. It is important to note that the specifics of the Hennepin Minnesota Waiver of JSA may vary based on the retirement plan and the regulations governing that particular plan. It is advisable to consult with a qualified financial advisor or retirement plan administrator to fully understand the options and implications associated with the waiver.

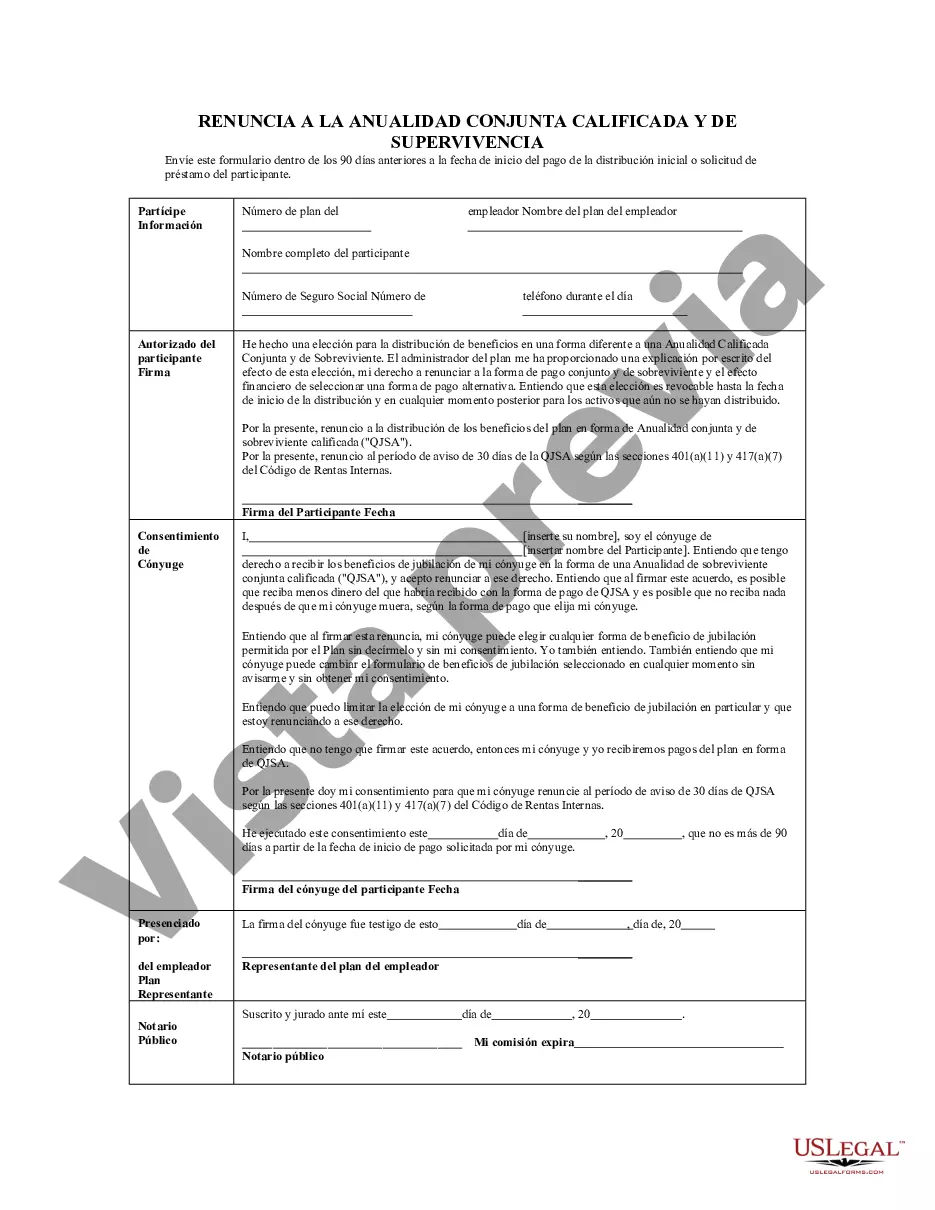

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Hennepin Minnesota Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

If you need to find a reliable legal form supplier to obtain the Hennepin Waiver of Qualified Joint and Survivor Annuity - QJSA, consider US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can select from over 85,000 forms arranged by state/county and case.

- The intuitive interface, number of supporting resources, and dedicated support team make it easy to locate and execute different papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply type to search or browse Hennepin Waiver of Qualified Joint and Survivor Annuity - QJSA, either by a keyword or by the state/county the document is intended for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Hennepin Waiver of Qualified Joint and Survivor Annuity - QJSA template and take a look at the form's preview and description (if available). If you're comfortable with the template’s language, go ahead and click Buy now. Create an account and select a subscription plan. The template will be immediately available for download as soon as the payment is completed. Now you can execute the form.

Handling your legal matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less costly and more affordable. Create your first business, arrange your advance care planning, create a real estate contract, or complete the Hennepin Waiver of Qualified Joint and Survivor Annuity - QJSA - all from the convenience of your home.

Sign up for US Legal Forms now!