Los Angeles, California, Waiver of Qualified Joint and Survivor Annuity (JSA) is a legal provision primarily applicable to retirement plans. It allows participants to forgo the requirement of providing a spousal survivor benefit to their spouse upon retirement, should they choose to do so. This detailed description will cover the basics of JSA, its purpose, its application in Los Angeles, and any variations or alternatives that might exist within this context. JSA is a provision mandated by the Employee Retirement Income Security Act of 1974 (ERICA) and Internal Revenue Code (IRC). It ensures that retirement plans, such as pension plans, 401(k)s, or similar employer-sponsored programs, provide a form of annuity that can continue after the participant's death, allowing spousal beneficiaries to receive income and financial security. In Los Angeles, California, the Waiver of Qualified Joint and Survivor Annuity serves to provide flexibility to retirement plan participants. It allows an individual to decline the default JSA option, where their spouse automatically becomes the beneficiary and continues to receive a portion of the annuity payments after the participant's death. By opting for the waiver, retirees may choose to receive a higher monthly annuity payment or designate an alternate beneficiary, such as a child or another family member, rather than their spouse. It is important to note that specific regulations and requirements for JSA waivers may vary depending on the retirement plan and the state. However, in Los Angeles, California, the basic principles of JSA waivers generally remain the same. Different types or variations of the Los Angeles California Waiver of Qualified Joint and Survivor Annuity (JSA) include: 1. Full Waiver: This allows the retiree to completely waive the JSA requirement, redirecting all annuity payments solely to themselves during their lifetime. Upon their death, no spousal or other survivor benefits will be payable unless a separate beneficiary is designated. 2. Partial Waiver: In some cases, retirees may opt for a partial waiver, where a reduced spousal survivor benefit is provided, ensuring some financial protection for the spouse in case of the retiree's death. This allows the retiree to receive a higher annuity payment during their lifetime while maintaining a smaller survivor benefit for the spouse. It is essential for individuals in Los Angeles or any other location to thoroughly understand the intricacies of the JSA waiver rules within their specific retirement plan and consult with a qualified financial advisor or attorney to make informed decisions regarding their annuity distribution and spousal survivor benefits.

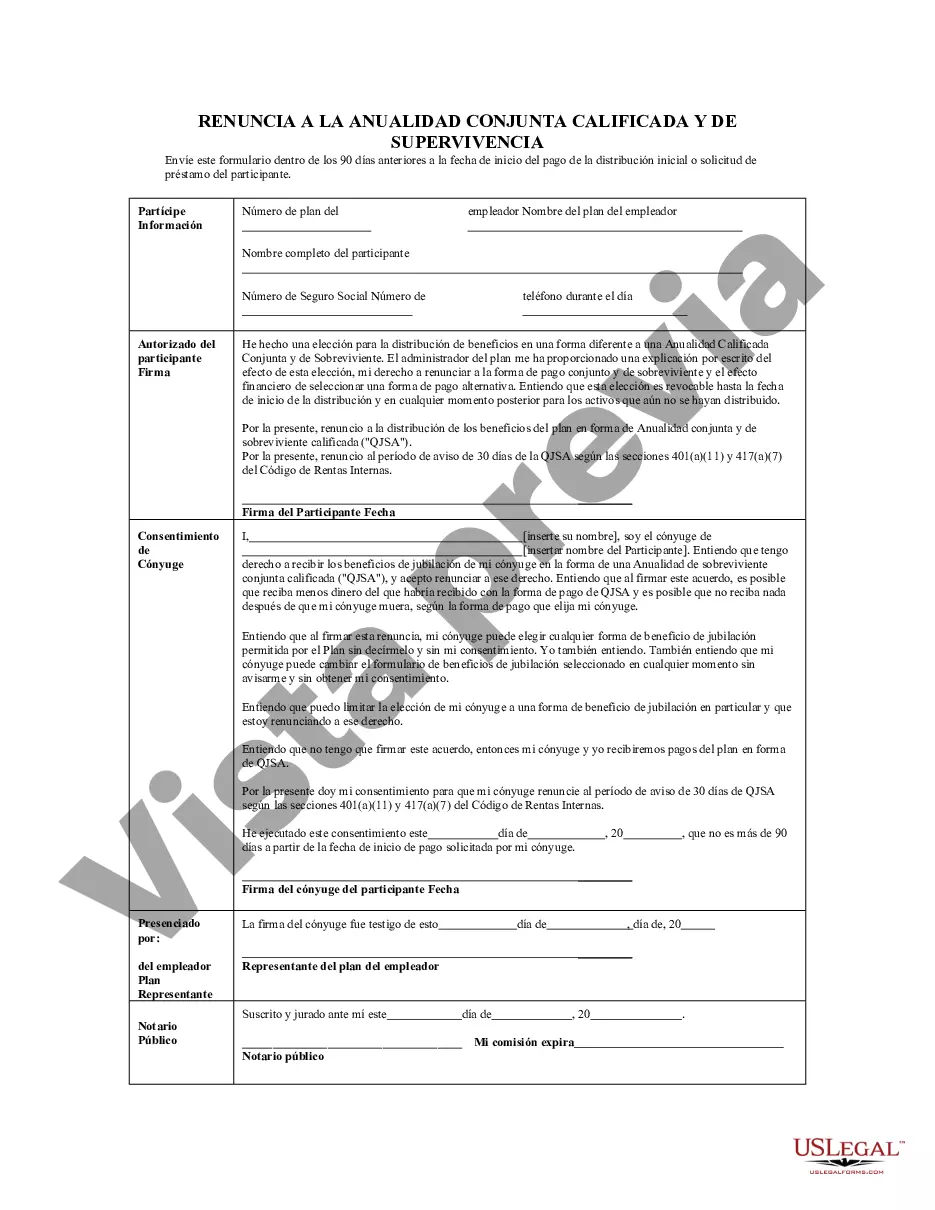

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Los Angeles California Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare official documentation that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal templates. Here, you can easily find and get a document for any personal or business objective utilized in your region, including the Los Angeles Waiver of Qualified Joint and Survivor Annuity - QJSA.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Los Angeles Waiver of Qualified Joint and Survivor Annuity - QJSA will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to get the Los Angeles Waiver of Qualified Joint and Survivor Annuity - QJSA:

- Ensure you have opened the proper page with your regional form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Look for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Los Angeles Waiver of Qualified Joint and Survivor Annuity - QJSA on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!