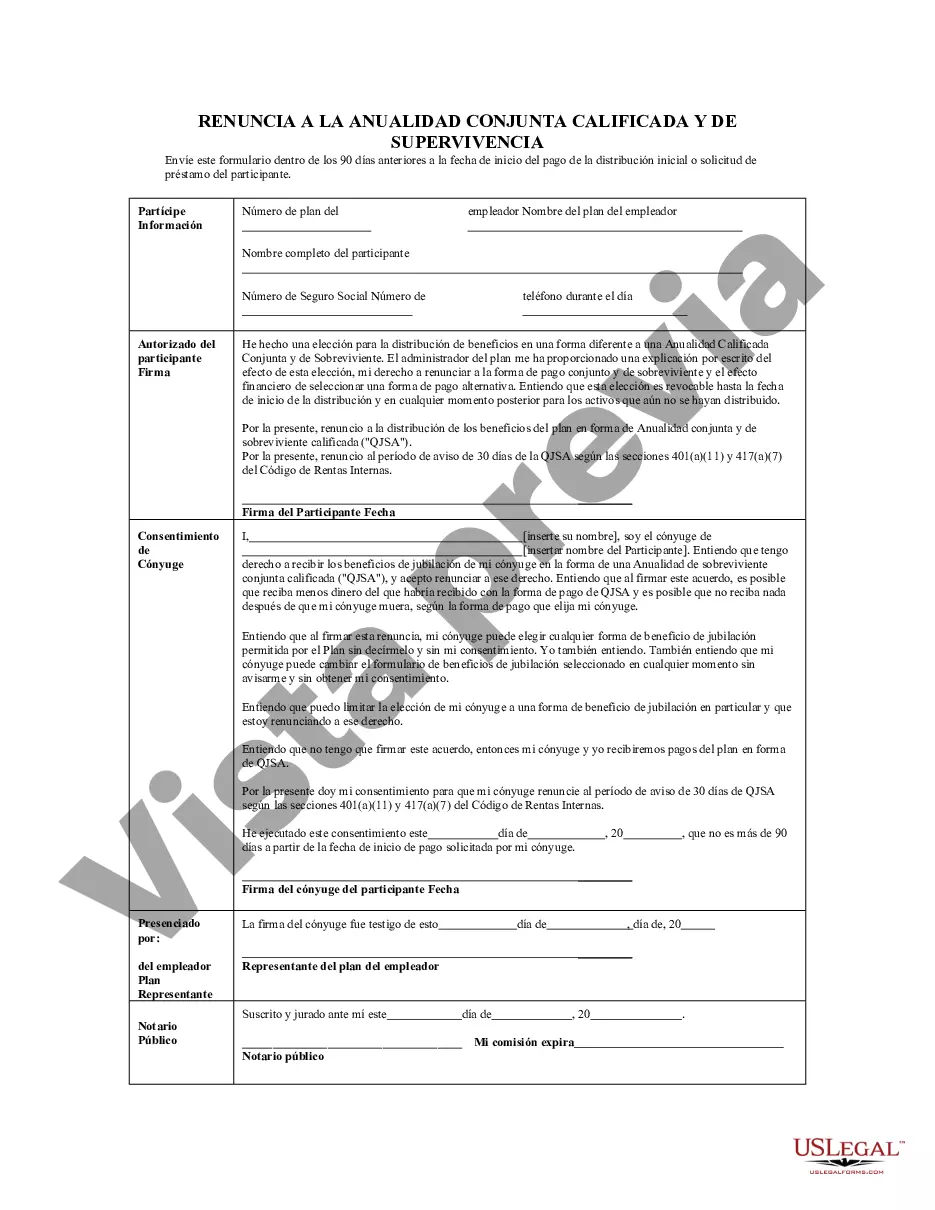

The Maricopa Arizona Waiver of Qualified Joint and Survivor Annuity (JSA) is a legal provision that allows individuals to waive their rights to the JSA benefit, which guarantees a surviving spouse a portion of the annuity after the policyholder's death. This waiver option provides greater flexibility and control over retirement assets for individuals living in Maricopa, Arizona. The JSA is a common provision found in retirement plans, including pension and other qualified retirement plans. It ensures that a surviving spouse receives a specific percentage of the annuity payments after the policyholder's death, usually 50% or more. However, the JSA might not be suitable for everyone, and some individuals may prefer to waive this benefit in favor of other options. The Maricopa Arizona Waiver of Qualified Joint and Survivor Annuity (JSA) offers several types of waivers depending on an individual's preferences and circumstances. These include: 1. Full waiver: Under this type of waiver, the annuity payments stop completely upon the policyholder's death, and there are no benefits provided to the surviving spouse. This option allows for greater control over the annuity funds and potentially allows for more estate planning flexibility. 2. Partial waiver: With a partial waiver, the surviving spouse receives a reduced percentage (less than 50%) of the annuity payments after the policyholder's death. This allows the policyholder to allocate a portion of the funds to another beneficiary or provide for other estate planning needs. 3. Period-certain waivers: This option allows individuals to specify a set period of time during which the annuity payments will continue even after their death. After the designated period, the annuity terminates, and the spouse no longer receives any benefits. This type of waiver can be useful for individuals who want to ensure income for a specific period, such as covering mortgage payments or other financial obligations. It is important to note that the decision to waive the JSA benefit is a significant one and should be made after careful consideration of an individual's financial goals, family circumstances, and consultation with an experienced financial advisor or attorney. The Maricopa Arizona Waiver of Qualified Joint and Survivor Annuity (JSA) provides individuals with the flexibility to choose the most suitable option for their unique needs and preferences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Maricopa Arizona Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

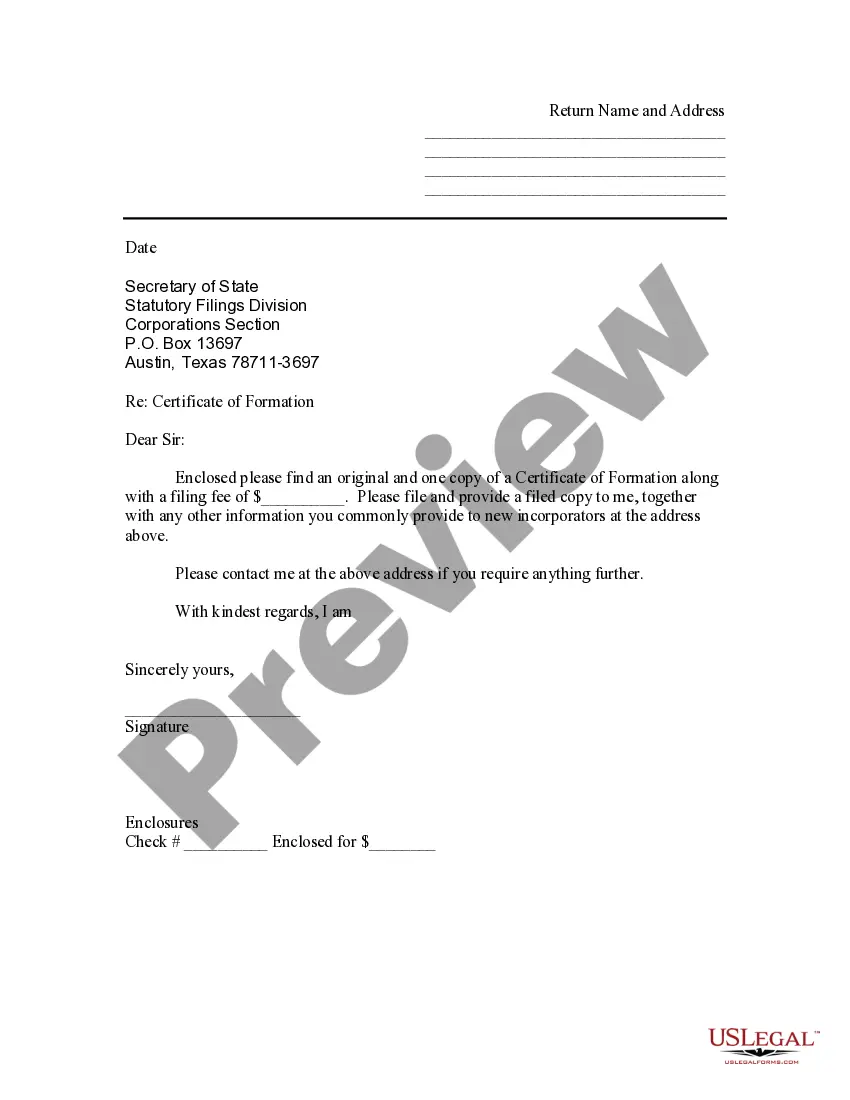

Are you looking to quickly draft a legally-binding Maricopa Waiver of Qualified Joint and Survivor Annuity - QJSA or probably any other document to manage your personal or business matters? You can go with two options: hire a legal advisor to write a valid document for you or create it entirely on your own. The good news is, there's a third option - US Legal Forms. It will help you get professionally written legal documents without having to pay unreasonable prices for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-compliant document templates, including Maricopa Waiver of Qualified Joint and Survivor Annuity - QJSA and form packages. We provide templates for an array of life circumstances: from divorce papers to real estate documents. We've been out there for over 25 years and gained a spotless reputation among our customers. Here's how you can become one of them and obtain the necessary template without extra troubles.

- To start with, carefully verify if the Maricopa Waiver of Qualified Joint and Survivor Annuity - QJSA is adapted to your state's or county's regulations.

- If the document has a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the template isn’t what you were hoping to find by using the search box in the header.

- Choose the plan that best fits your needs and move forward to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, find the Maricopa Waiver of Qualified Joint and Survivor Annuity - QJSA template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to buy and download legal forms if you use our services. In addition, the templates we offer are updated by industry experts, which gives you greater confidence when dealing with legal affairs. Try US Legal Forms now and see for yourself!