Miami-Dade Florida Waiver of Qualified Joint and Survivor Annuity (JSA) is a legal provision that allows individuals to choose alternative options for their retirement benefits. This waiver provides retirees with flexibility in deciding how their retirement savings should be distributed upon their death. With the JSA waiver, individuals can opt for annuity plans that are different from the default Qualified Joint and Survivor Annuity. The Qualified Joint and Survivor Annuity (JSA) is the standard payment option for retirement plans, which ensures that the surviving spouse receives a portion of the retiree's pension benefits after their death. However, the JSA waiver allows retirees to deviate from this default setting and select alternative options that better suit their specific needs. There are several types of Miami-Dade Florida Waiver of Qualified Joint and Survivor Annuity (JSA) that individuals can choose from based on their financial situation and preferences. These options may include: 1. Lump-Sum Distribution: This option allows retirees to receive their entire retirement savings as a one-time payment, providing immediate access to their funds. This can be useful for retirees who prefer having a lump sum to manage their finances according to their unique requirements. 2. Life-only Annuity: With this option, retirees receive a fixed monthly payment for the rest of their lives, but no survivor benefits are provided to their spouse or beneficiaries after their death. This may be an attractive choice for individuals who prioritize maximizing their retirement income and do not have dependents who would benefit from survivor benefits. 3. Installment Payments: Retirees may select to receive their retirement savings in regular installments over a specified period, such as 5, 10, or 20 years. This option allows retirees to have predictable income for a fixed duration while maintaining control over the remaining funds after the chosen period. 4. Customized Beneficiary: Some waivers offer retirees the ability to designate a specific beneficiary, such as a child, grandchild, or close friend, to receive the remaining retirement savings upon their death. This option can be beneficial for individuals who want to allocate their funds to someone other than their spouse. It is important for individuals to carefully consider their financial situation, retirement goals, and future plans before deciding to waive the Qualified Joint and Survivor Annuity (JSA). Consulting a financial advisor or seeking legal guidance can help retirees make an informed decision and choose the most suitable option for their circumstances. In conclusion, the Miami-Dade Florida Waiver of Qualified Joint and Survivor Annuity (JSA) provides retirees with the flexibility to customize their retirement benefit distribution based on their individual needs. This waiver offers different options, such as lump-sum payments, life-only annuities, installment payments, and customized beneficiaries, allowing retirees to make choices aligned with their financial goals and personal circumstances.

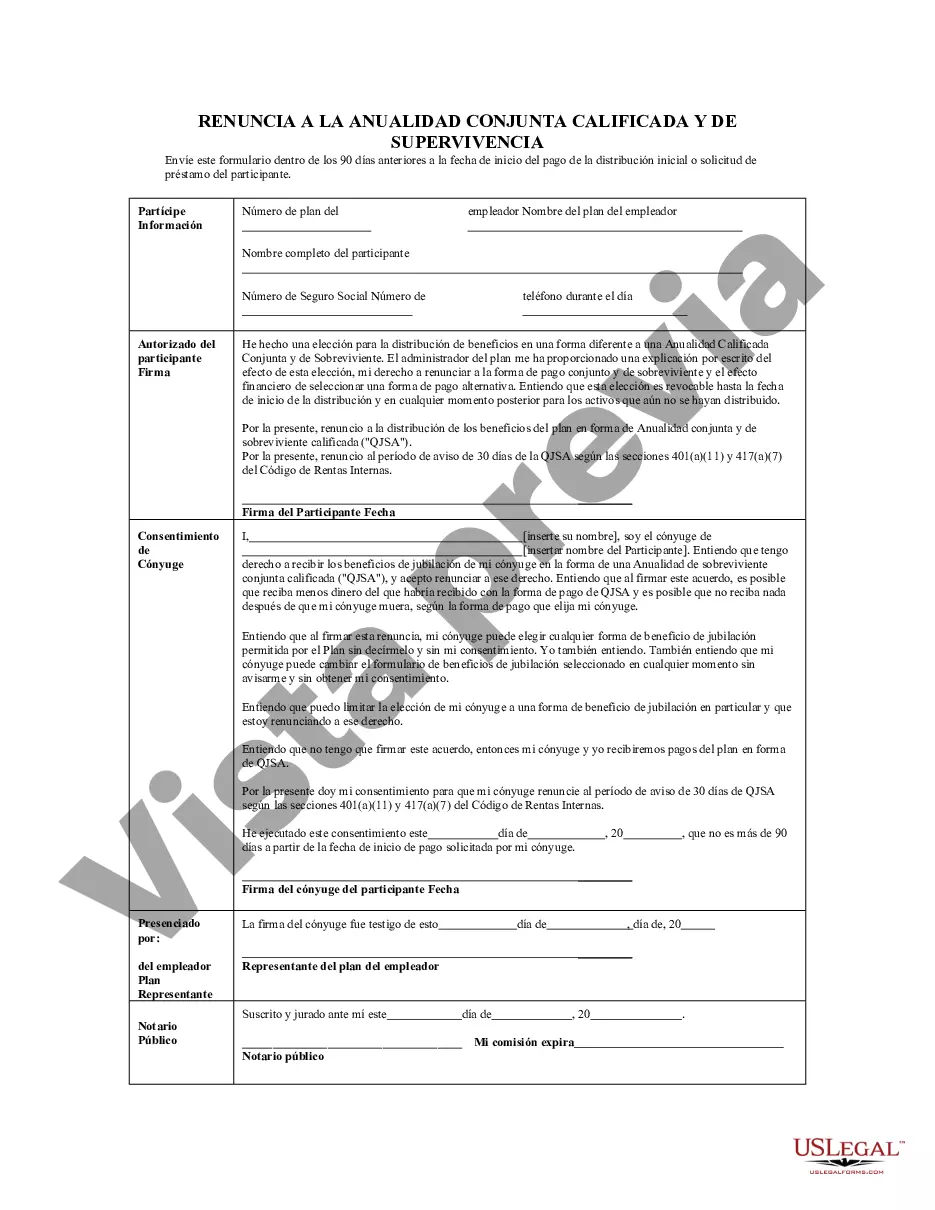

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-493EM

Format:

Word

Instant download

Description

Este formulario permite que un participante del plan de jubilación y el cónyuge del participante renuncien a la distribución de beneficios en la forma de un plan calificado conjunto y

Miami-Dade Florida Waiver of Qualified Joint and Survivor Annuity (JSA) is a legal provision that allows individuals to choose alternative options for their retirement benefits. This waiver provides retirees with flexibility in deciding how their retirement savings should be distributed upon their death. With the JSA waiver, individuals can opt for annuity plans that are different from the default Qualified Joint and Survivor Annuity. The Qualified Joint and Survivor Annuity (JSA) is the standard payment option for retirement plans, which ensures that the surviving spouse receives a portion of the retiree's pension benefits after their death. However, the JSA waiver allows retirees to deviate from this default setting and select alternative options that better suit their specific needs. There are several types of Miami-Dade Florida Waiver of Qualified Joint and Survivor Annuity (JSA) that individuals can choose from based on their financial situation and preferences. These options may include: 1. Lump-Sum Distribution: This option allows retirees to receive their entire retirement savings as a one-time payment, providing immediate access to their funds. This can be useful for retirees who prefer having a lump sum to manage their finances according to their unique requirements. 2. Life-only Annuity: With this option, retirees receive a fixed monthly payment for the rest of their lives, but no survivor benefits are provided to their spouse or beneficiaries after their death. This may be an attractive choice for individuals who prioritize maximizing their retirement income and do not have dependents who would benefit from survivor benefits. 3. Installment Payments: Retirees may select to receive their retirement savings in regular installments over a specified period, such as 5, 10, or 20 years. This option allows retirees to have predictable income for a fixed duration while maintaining control over the remaining funds after the chosen period. 4. Customized Beneficiary: Some waivers offer retirees the ability to designate a specific beneficiary, such as a child, grandchild, or close friend, to receive the remaining retirement savings upon their death. This option can be beneficial for individuals who want to allocate their funds to someone other than their spouse. It is important for individuals to carefully consider their financial situation, retirement goals, and future plans before deciding to waive the Qualified Joint and Survivor Annuity (JSA). Consulting a financial advisor or seeking legal guidance can help retirees make an informed decision and choose the most suitable option for their circumstances. In conclusion, the Miami-Dade Florida Waiver of Qualified Joint and Survivor Annuity (JSA) provides retirees with the flexibility to customize their retirement benefit distribution based on their individual needs. This waiver offers different options, such as lump-sum payments, life-only annuities, installment payments, and customized beneficiaries, allowing retirees to make choices aligned with their financial goals and personal circumstances.

Free preview