Palm Beach Florida Waiver of Qualified Joint and Survivor Annuity (JSA) is a legal provision that allows participants in certain retirement plans to forgo the standard joint and survivor annuity payout option. This waiver gives individuals the flexibility to choose an alternative payout structure that better suits their personal financial needs and goals. Under the typical JSA, a retirement plan participant is required to select a joint and survivor annuity, ensuring that their spouse or beneficiary will continue to receive income after their death. However, some individuals may prefer to have more control over their retirement assets or have specific financial obligations that warrant a different approach. The waiver of JSA in Palm Beach, Florida, provides individuals with the ability to opt for other payout options, such as a single-life annuity or a lump-sum payment. This allows retirees to customize their income distribution based on their individual circumstances and priorities. It's important to note that the availability and eligibility criteria for the Palm Beach Florida Waiver of JSA may vary depending on the specific retirement plan and employer. Some employers may offer different variations of the JSA waiver, including: 1. Partial Waiver: This allows the retiree to select a reduced joint and survivor annuity, providing a lower lifetime benefit amount for the retiree and a reduced survivor benefit for the spouse or beneficiary. 2. Spousal Consent Waiver: With this variation, the retirement plan participant can waive the JSA protection only if their spouse provides written consent. This ensures that both spouses are involved in the decision-making process. 3. Fixed-Term Annuity: Some retirement plans may offer the option to receive annuity payments for a fixed period, rather than for the lifetime of the retiree or their beneficiary. This variation can be beneficial for individuals who want to receive income for a specific time frame, such as to cover a mortgage or other short-term financial obligations. It is crucial for individuals considering the waiver of JSA in Palm Beach, Florida, to carefully review the terms, consequences, and implications of their chosen payout option. Seeking guidance from a financial advisor or consulting the retirement plan administrator is highly recommended ensuring that their decision aligns with their long-term financial objectives and safeguards their spouse or beneficiary's financial security.

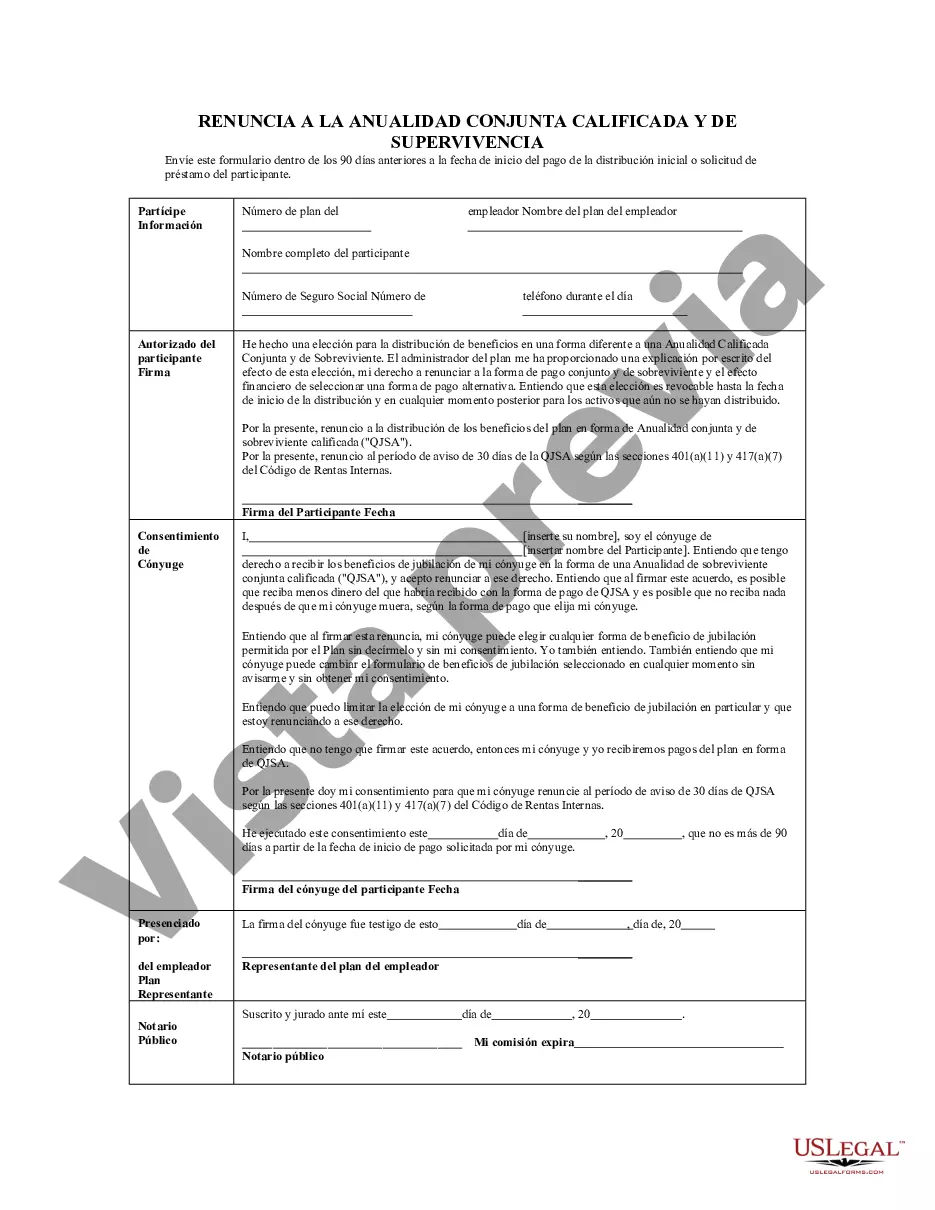

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Palm Beach Florida Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

If you need to find a trustworthy legal document supplier to get the Palm Beach Waiver of Qualified Joint and Survivor Annuity - QJSA, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can select from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, variety of supporting materials, and dedicated support team make it simple to find and complete various documents.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

Simply type to look for or browse Palm Beach Waiver of Qualified Joint and Survivor Annuity - QJSA, either by a keyword or by the state/county the form is intended for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Palm Beach Waiver of Qualified Joint and Survivor Annuity - QJSA template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and click Buy now. Register an account and choose a subscription option. The template will be instantly available for download once the payment is processed. Now you can complete the form.

Handling your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes this experience less costly and more affordable. Create your first company, organize your advance care planning, draft a real estate agreement, or execute the Palm Beach Waiver of Qualified Joint and Survivor Annuity - QJSA - all from the comfort of your home.

Sign up for US Legal Forms now!