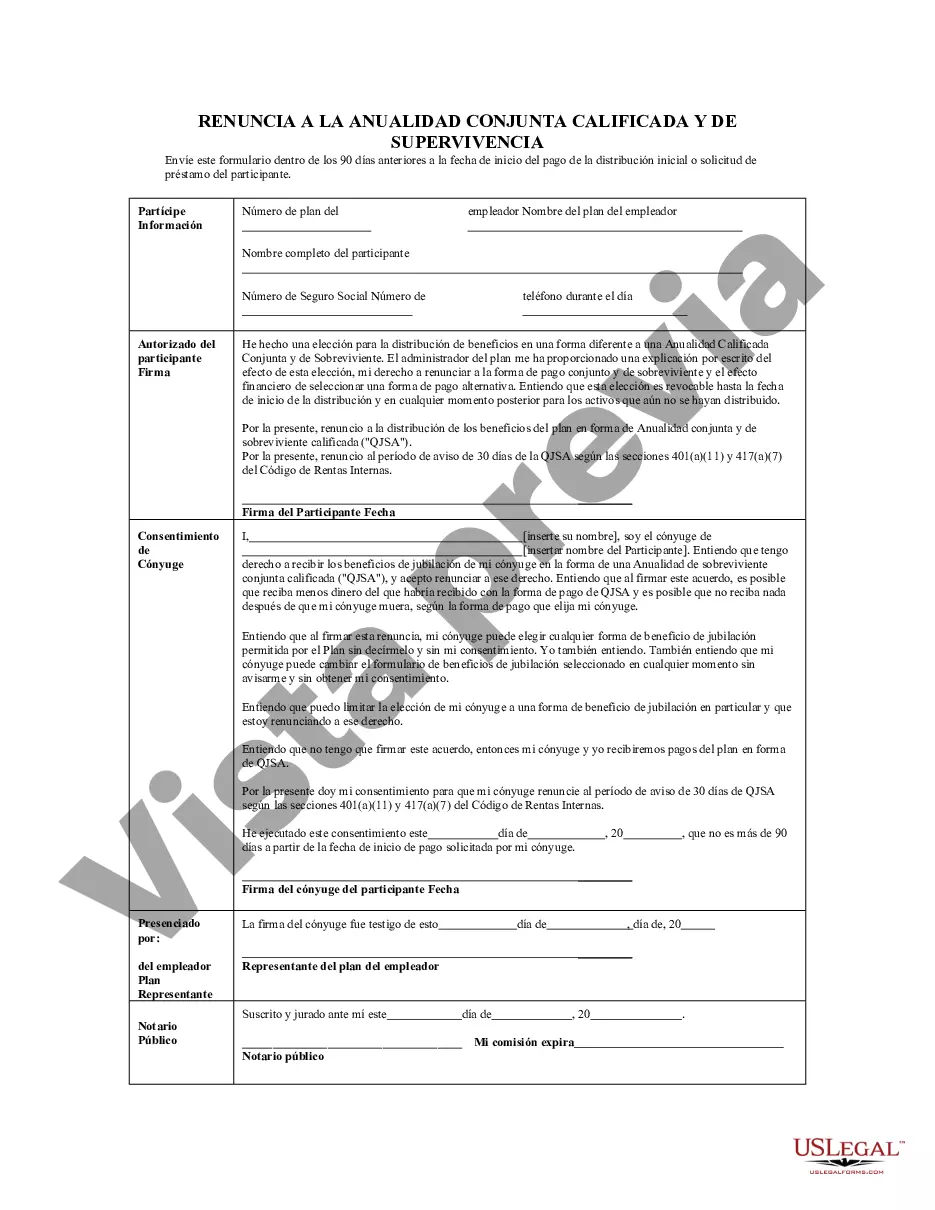

San Jose, California Waiver of Qualified Joint and Survivor Annuity (JSA) is an important aspect of retirement planning and financial management. JSA is a provision available for participants in qualified retirement plans, such as pension plans and 401(k) plans, that allows the participant to waive the default requirement of providing a joint and survivor annuity to their spouse upon retirement. This waiver is subject to certain conditions and must be exercised with the consent of the participant's spouse. In San Jose, California, individuals who wish to exercise the Waiver of Qualified Joint and Survivor Annuity must fully understand its implications and requirements. This detailed description aims to provide comprehensive information, covering different types of JSA waivers and their relevance in retirement planning. 1. Basic JSA Waiver: The basic JSA waiver allows a participant to choose to receive their retirement benefits as a single life annuity, without providing a survivor annuity for their spouse. This waiver enables the participant to receive higher monthly retirement income, as the annuity payments are calculated based on the participant's life expectancy alone. 2. 50% JSA Waiver: Alternatively, participants may opt for a 50% JSA waiver, which provides a reduced survivor annuity benefit to the spouse. Under this option, the participant will receive lower monthly retirement income compared to the basic JSA waiver, as a portion of the annuity is allocated to the spouse's future financial security. 3. Survivor Directed JSA Waiver: In some cases, San Jose, California allows participants to exercise a survivor-directed JSA waiver, which permits the spouse to redirect the waived survivor annuity portion to another beneficiary or a trust. The beneficiary would then receive the survivor annuity upon the participant's death, providing flexibility and control over the distribution of the retirement benefits. Understanding the requirements and implications of the JSA waiver is crucial for individuals planning for retirement in San Jose, California. Before making any decisions, it is recommended to consult with a qualified financial advisor or retirement planner who can provide personalized guidance based on individual circumstances and goals. In conclusion, San Jose, California offers various types of JSA waivers to participants in qualified retirement plans. These waivers allow individuals to customize their retirement income distribution and provide for their spouses according to their unique needs. It is essential to research and seek professional advice to determine the most suitable JSA waiver option for a successful retirement plan in San Jose, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out San Jose California Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

How much time does it usually take you to create a legal document? Given that every state has its laws and regulations for every life sphere, finding a San Jose Waiver of Qualified Joint and Survivor Annuity - QJSA meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often expensive. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. Apart from the San Jose Waiver of Qualified Joint and Survivor Annuity - QJSA, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Specialists verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is remarkably straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can get the document in your profile at any moment later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your San Jose Waiver of Qualified Joint and Survivor Annuity - QJSA:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the corresponding option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the San Jose Waiver of Qualified Joint and Survivor Annuity - QJSA.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!