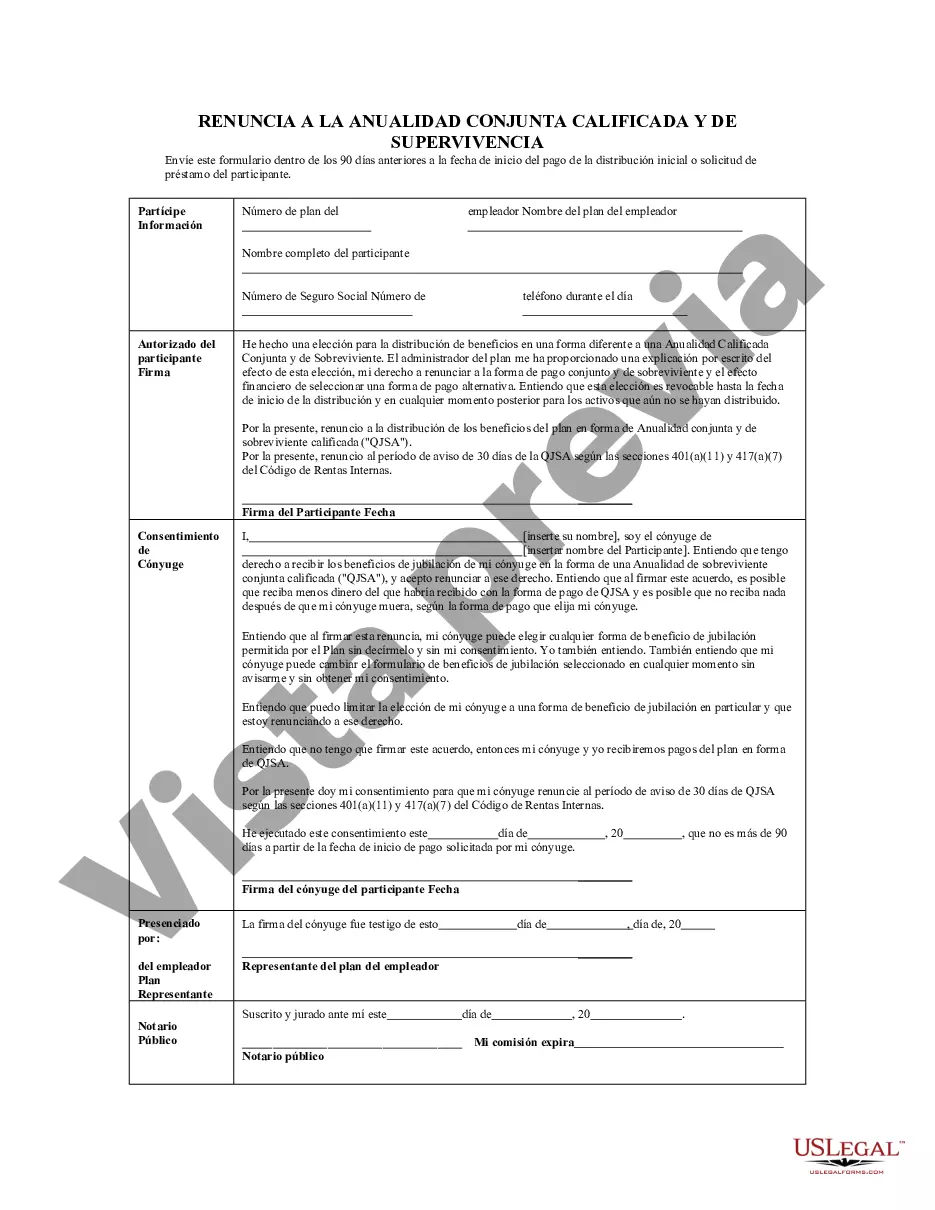

Santa Clara, California Waiver of Qualified Joint and Survivor Annuity (JSA) is a provision that allows individuals to waive their rights to certain pension benefits in order to designate an alternative beneficiary. This waiver is often used in retirement plans, particularly in cases where the participant wants to ensure that a specific beneficiary receives the benefits after their death. The JSA is a legal protection designed to safeguard the financial stability of the annuity or pension plan holder's spouse or domestic partner by ensuring that they continue to receive a portion of the retirement benefits even after the participant's death. The JSA provision requires that the survivor annuity be paid to the designated beneficiary, usually the spouse, for their lifetime as well. In Santa Clara, California, there may be variations or modifications of the JSA. Some examples include: 1. Optional Waiver of JSA: This type of waiver allows plan participants to waive the JSA provisions and instead designate a different beneficiary for their pension benefits. It may be used when the participant has financial obligations or wishes to allocate the benefits to someone other than their spouse or domestic partner. 2. Limited JSA: In certain cases, participants may choose a limited JSA, which provides a reduced survivor annuity to the beneficiary. This option allows the plan holder to retain a larger portion of the benefits during their lifetime while still providing some level of financial protection to the surviving spouse or domestic partner. 3. Contingent JSA: A contingent JSA allows the participant to designate a primary beneficiary for the survivor annuity. However, if the primary beneficiary predeceases the participant, the contingent beneficiary will then receive the benefits. This provision offers an additional layer of protection in case the primary beneficiary cannot receive the survivor annuity. It is crucial to carefully review and understand the specific terms and provisions of the Santa Clara, California Waiver of Qualified Joint and Survivor Annuity (JSA) in order to make informed decisions regarding retirement planning and beneficiary designations. Consulting with legal and financial professionals is strongly recommended ensuring compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Santa Clara California Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Santa Clara California Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

If you need to find a reliable legal paperwork provider to find the Santa Clara Waiver of Qualified Joint and Survivor Annuity - QJSA, look no further than US Legal Forms. No matter if you need to start your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to locate and download the appropriate form.

- You can browse from over 85,000 forms categorized by state/county and situation.

- The intuitive interface, number of supporting materials, and dedicated support make it easy to get and complete various papers.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply type to look for or browse Santa Clara Waiver of Qualified Joint and Survivor Annuity - QJSA, either by a keyword or by the state/county the form is created for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply find the Santa Clara Waiver of Qualified Joint and Survivor Annuity - QJSA template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be instantly ready for download as soon as the payment is processed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive variety of legal forms makes this experience less expensive and more reasonably priced. Create your first company, arrange your advance care planning, create a real estate contract, or execute the Santa Clara Waiver of Qualified Joint and Survivor Annuity - QJSA - all from the comfort of your home.

Join US Legal Forms now!