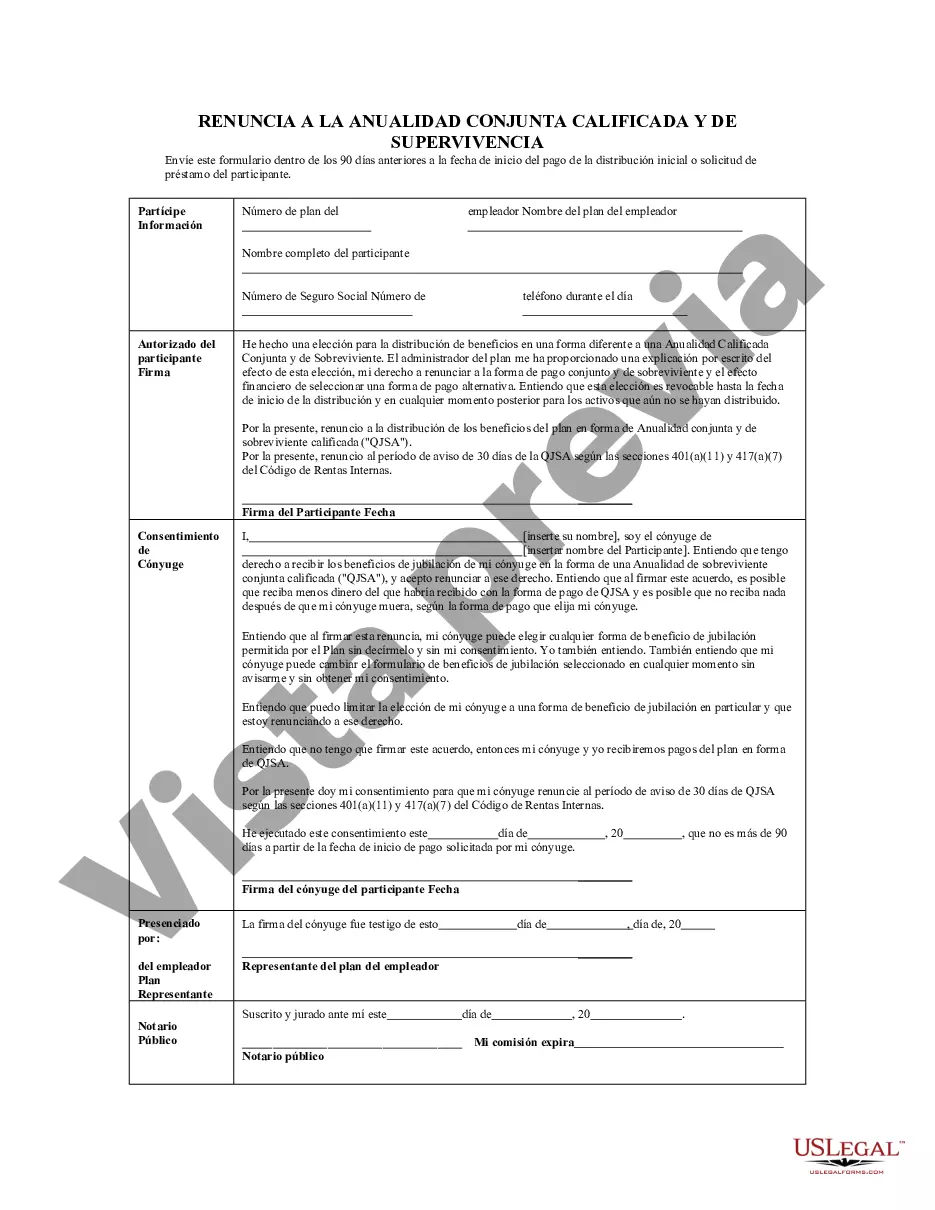

Travis Texas Waiver of Qualified Joint and Survivor Annuity (JSA), also known as the Travis Texas JSA Waiver, is a legal document used in retirement plans to provide additional flexibility for plan participants. Understanding this waiver is crucial for individuals who have retirement accounts in the Travis County region of Texas, as it affects the distribution of retirement benefits and survivor benefits. Here's a detailed description of what the Travis Texas Waiver of Qualified Joint and Survivor Annuity entails and its different types: The JSA is a requirement under the Employee Retirement Income Security Act (ERICA), which is designed to protect the spouses of retirement plan participants. It ensures that a surviving spouse receives a benefit from the participant's retirement plan, even if the participant dies before retirement. JSA generally provides a joint and survivor annuity for married participants, which guarantees a monthly income to the participant and, upon their death, to their surviving spouse. However, the Travis Texas JSA Waiver allows participants to waive the requirement of providing a joint and survivor annuity to their spouse as the default option. This waiver grants participants more control over how their retirement benefits are distributed and potentially allows for other distribution options, such as a lump sum or a single-life annuity. There are different types of Travis Texas JSA waivers available, including: 1. Full JSA Waiver: This waiver completely eliminates the requirement of providing a joint and survivor annuity for the participant's spouse. With this waiver, the participant can choose alternative forms of distribution, such as a lump sum or a single-life annuity, without any survivor benefit to their spouse. 2. Partial JSA Waiver: In this case, the participant can waive a portion of the joint and survivor annuity, while retaining a reduced survivor benefit for their spouse. This option allows for more flexibility in the distribution of retirement benefits, as the participant can allocate a portion of their benefits for their spouse while also receiving a higher benefit during their lifetime. It's important to note that the decision to waive the JSA is significant and should be carefully considered, as it potentially affects the financial well-being of both the participant and their spouse. Before making any decisions or signing the Travis Texas JSA waiver, it's advisable to consult with a qualified financial advisor or an attorney specializing in retirement planning. In conclusion, the Travis Texas Waiver of Qualified Joint and Survivor Annuity (JSA) is a legal document offering retirement plan participants in Travis County, Texas, the option to waive the default requirement of providing a joint and survivor annuity to their spouse. By obtaining a JSA waiver, individuals gain greater flexibility in how their retirement benefits are distributed, allowing for alternative options like lump sum payments or single-life annuities. Understanding the different types of Travis Texas JSA waivers, including the full and partial waivers, is essential when making decisions related to retirement planning in Travis County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Renuncia a la anualidad conjunta y de sobreviviente calificada - QJSA - Waiver of Qualified Joint and Survivor Annuity - QJSA

Description

How to fill out Travis Texas Renuncia A La Anualidad Conjunta Y De Sobreviviente Calificada - QJSA?

Creating forms, like Travis Waiver of Qualified Joint and Survivor Annuity - QJSA, to manage your legal affairs is a challenging and time-consumming process. Many cases require an attorney’s participation, which also makes this task expensive. However, you can acquire your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms crafted for a variety of scenarios and life situations. We make sure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Travis Waiver of Qualified Joint and Survivor Annuity - QJSA form. Simply log in to your account, download the form, and personalize it to your needs. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as easy! Here’s what you need to do before downloading Travis Waiver of Qualified Joint and Survivor Annuity - QJSA:

- Ensure that your template is specific to your state/county since the rules for creating legal papers may differ from one state another.

- Discover more information about the form by previewing it or reading a brief description. If the Travis Waiver of Qualified Joint and Survivor Annuity - QJSA isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to start utilizing our service and download the document.

- Everything looks good on your end? Hit the Buy now button and select the subscription plan.

- Select the payment gateway and type in your payment details.

- Your form is all set. You can try and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive library. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!