Cook Illinois Determining Self-Employed Contractor Status is a vital process for both individuals and businesses operating in Cook County, Illinois. It involves determining whether a worker should be classified as an employee or a self-employed contractor. This distinction is crucial for tax purposes, labor laws, and liability issues. The primary purpose of determining self-employed contractor status in Cook Illinois is to assess the correct tax obligations for both the worker and the employer. Misclassification can lead to severe consequences, including penalties and legal liabilities. Thus, understanding the factors that differentiate employees from independent contractors is essential. To determine self-employment status in Cook Illinois, several key factors are considered. These factors include: 1. Control: The level of control an employer has over the worker's schedule, workspace, tools, and methodologies. Independent contractors have more autonomy over their work. 2. Financial arrangement: How the worker is compensated, whether they receive a salary or are paid per project. Independent contractors typically invoice for their services. 3. Employer benefits: Employees often receive benefits such as health insurance, retirement plans, and paid leave. Independent contractors are responsible for their own benefits. 4. Duration of the relationship: The length of the working relationship between the worker and the employer. Independent contractors often work on a project-by-project basis. 5. Integration: Whether the worker's services are an integral part of the employer's business operations. Employees tend to have ongoing responsibilities within the company. Cook Illinois also recognizes different types of self-employment contractor statuses, including: 1. 1099 Contractors: These are individuals who work on a contract basis and are paid through a 1099 form. They are responsible for reporting their income and paying self-employment taxes. 2. Gig Economy Workers: These are individuals who perform short-term or on-demand tasks through digital platforms, such as Uber drivers or Jackrabbit tankers. They are usually considered independent contractors. 3. Freelancers: These individuals provide specialized services to multiple clients, often in creative fields or professional services. They have the freedom to choose their projects and clients. 4. Sole Proprietors: These individuals run their own businesses and are liable for all business-related activities. They have full control over their work and typically have multiple clients. In conclusion, Cook Illinois Determining Self-Employed Contractor Status plays a vital role in ensuring proper taxation and compliance with labor laws within the county. Accurately classifying workers as either employees or independent contractors is crucial to avoid legal issues, provide fair compensation, and maintain a healthy business environment.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Determinación del estado de contratista que trabaja por cuenta propia - Determining Self-Employed Contractor Status

Description

How to fill out Cook Illinois Determinación Del Estado De Contratista Que Trabaja Por Cuenta Propia?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial agreement, documents for ownership transfer, pre-marital agreement, divorce papers, or the Cook Determining Self-Employed Contractor Status, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario accumulated all in one place. Therefore, if you need the latest version of the Cook Determining Self-Employed Contractor Status, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Cook Determining Self-Employed Contractor Status:

- Look through the page and verify there is a sample for your area.

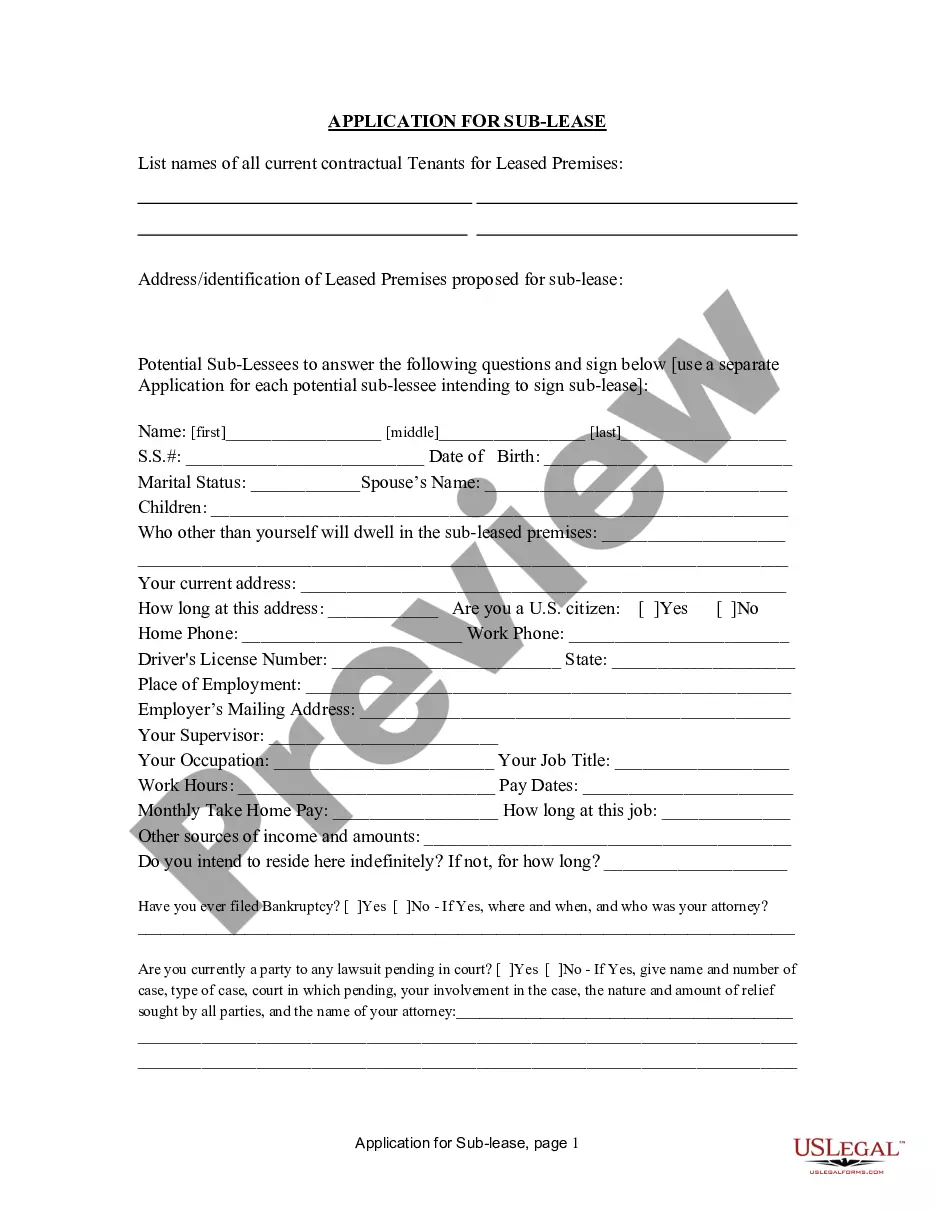

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Cook Determining Self-Employed Contractor Status and save it.

When finished, you can print it out and complete it on paper or import the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!