Harris Texas Determining Self-Employed Contractor Status refers to the process of classifying individuals who work as independent contractors in the state of Texas, particularly in Harris County. This assessment is crucial for both employers and workers, as it determines the legal and tax obligations associated with the employment relationship. Being classified as a self-employed contractor comes with certain benefits and responsibilities, and understanding this status is essential for compliance with the relevant laws and regulations. In relation to Harris Texas Determining Self-Employed Contractor Status, there are various types that may apply, depending on the specific circumstances and industry. Some common classifications include: 1. Harris Texas Independent Contractor Status: This category generally applies to individuals who have their own business and provide services to clients or companies. These independent contractors are responsible for managing their own expenses, taxes, and other business-related matters. 2. Harris Texas Freelancer Classification: Freelancers are self-employed individuals who offer their services on a flexible basis to multiple clients or companies. They are typically paid per project or on an agreed-upon rate and are responsible for their own business operations. 3. Harris Texas Gig Economy Worker Status: This classification refers to individuals who perform short-term, on-demand tasks or work through digital platforms. These workers are often considered as independent contractors and have to manage their own taxes, insurance, and other aspects of their work. Determining self-employed contractor status in Harris Texas involves considering several factors. These factors generally include the level of control exercised by the employer over the worker, the worker's financial independence, the nature of the work relationship, and the presence of a written contract. It is important to note that each case is unique, and the determination of one's employment status should be approached with careful consideration of all relevant circumstances. To ensure compliance with Harris Texas laws, employers and workers should familiarize themselves with the guidelines and regulations set by the Texas Workforce Commission and the Internal Revenue Service (IRS). Consulting with legal professionals or tax experts experienced in Harris Texas employment classification can also provide valuable guidance in correctly determining self-employment contractor status and understanding its implications. Overall, Harris Texas Determining Self-Employed Contractor Status plays a significant role in defining the relationship between employers and those they engage as independent contractors. Thoroughly understanding the various types of self-employed contractor classifications, along with the associated responsibilities and legal requirements, is vital to avoid any legal disputes or complications while conducting business in Harris County, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Determinación del estado de contratista que trabaja por cuenta propia - Determining Self-Employed Contractor Status

Description

How to fill out Harris Texas Determinación Del Estado De Contratista Que Trabaja Por Cuenta Propia?

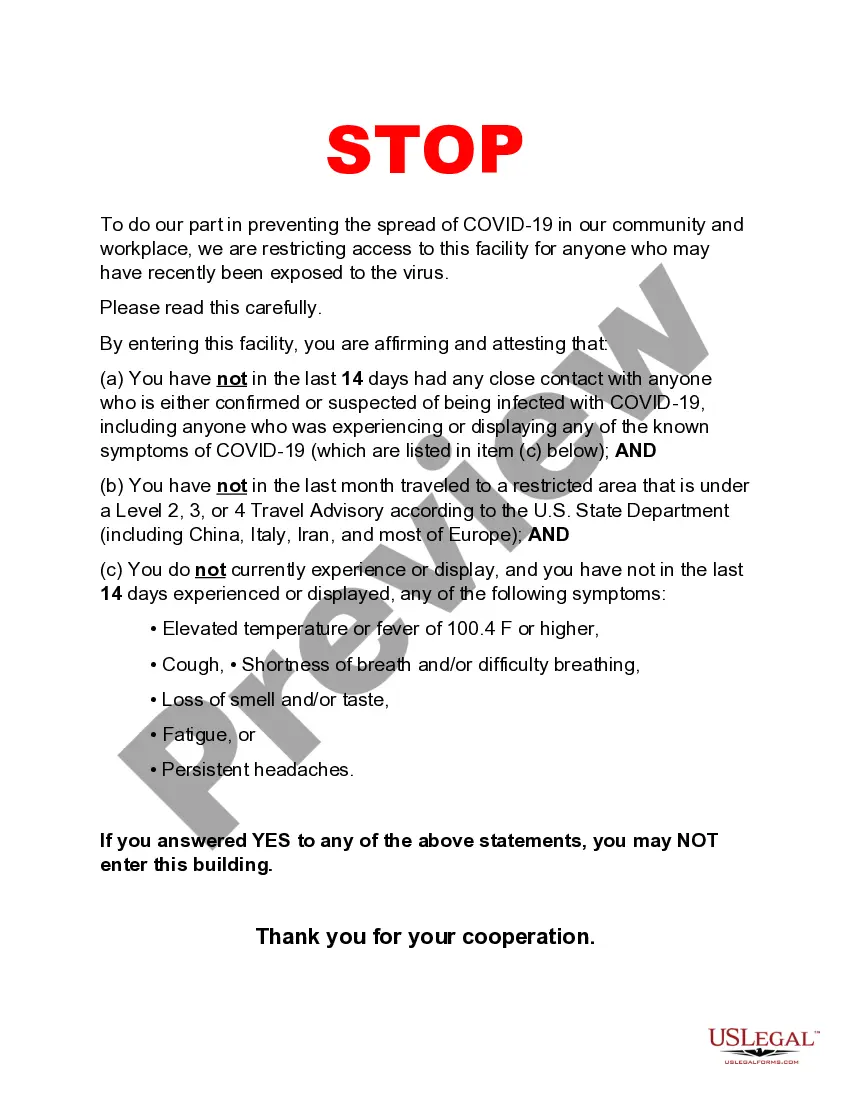

Do you need to quickly draft a legally-binding Harris Determining Self-Employed Contractor Status or probably any other form to manage your own or business affairs? You can select one of the two options: contact a professional to write a valid document for you or create it entirely on your own. Luckily, there's an alternative option - US Legal Forms. It will help you receive professionally written legal documents without having to pay sky-high fees for legal services.

US Legal Forms offers a huge collection of more than 85,000 state-specific form templates, including Harris Determining Self-Employed Contractor Status and form packages. We offer documents for an array of life circumstances: from divorce paperwork to real estate documents. We've been out there for over 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, double-check if the Harris Determining Self-Employed Contractor Status is tailored to your state's or county's laws.

- If the document has a desciption, make sure to check what it's suitable for.

- Start the searching process again if the template isn’t what you were hoping to find by utilizing the search box in the header.

- Select the plan that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Harris Determining Self-Employed Contractor Status template, and download it. To re-download the form, simply head to the My Forms tab.

It's stressless to find and download legal forms if you use our services. In addition, the paperwork we offer are reviewed by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!