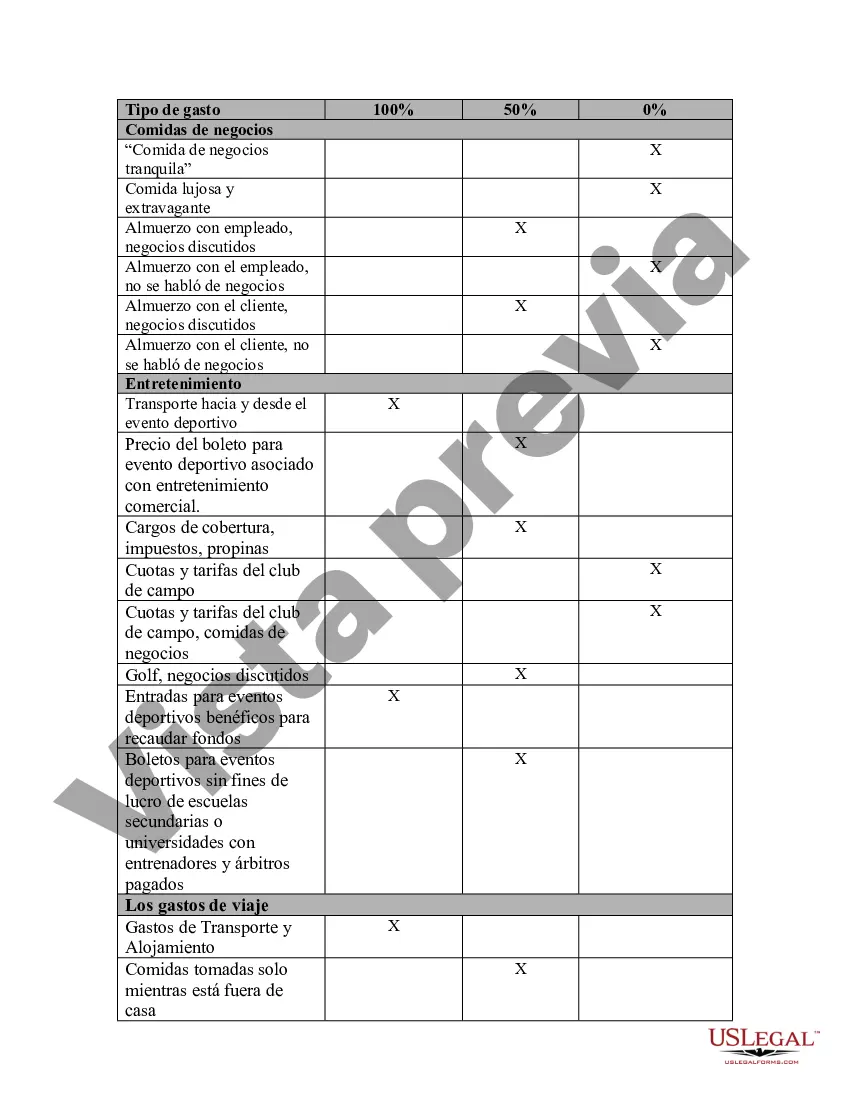

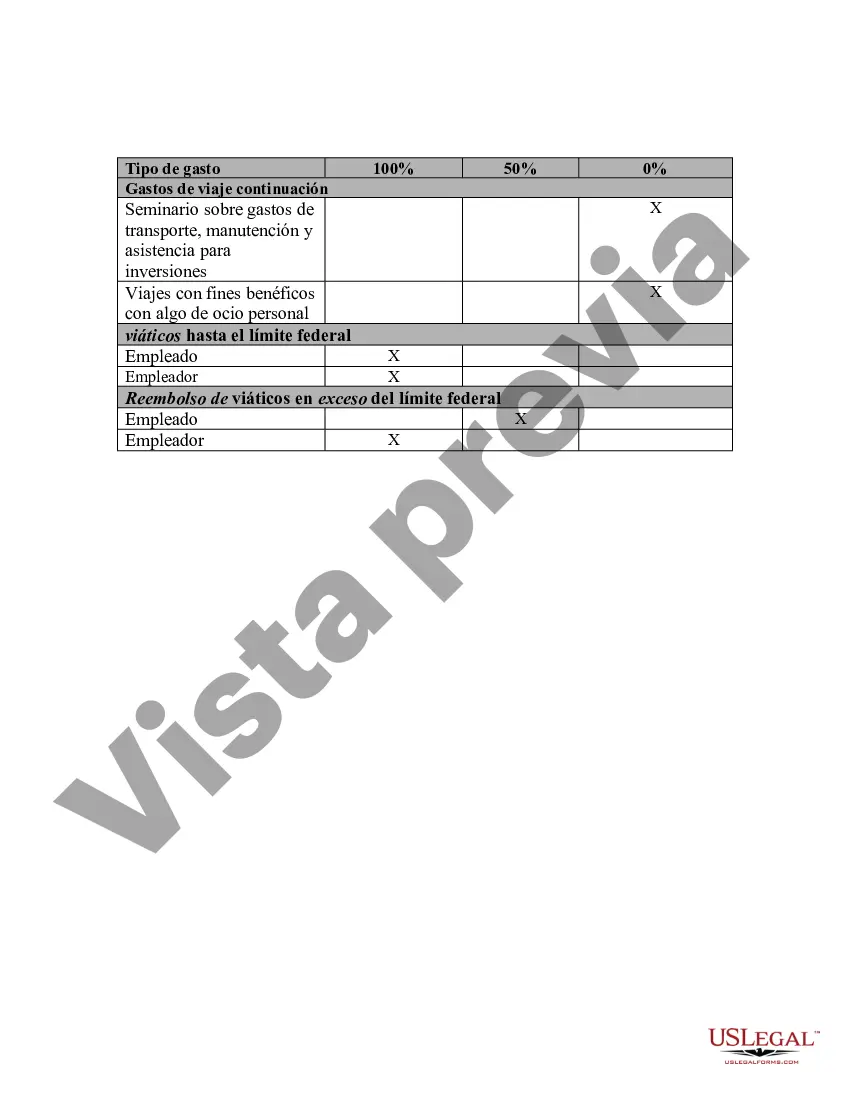

Collin Texas Business Reducibility Checklist is a comprehensive tool designed to assist business owners in identifying and tracking deductible expenses specific to the Collin County, Texas area. This checklist ensures that businesses can claim the maximum amount of deductions while complying with the local tax regulations. By utilizing this checklist, business owners can minimize their tax liability and effectively manage their financial records. The Collin Texas Business Reducibility Checklist covers a wide range of expenses that are eligible for deductions in the Collin County area. It includes key deductible categories such as office rent, utilities, business travel expenses, vehicle expenses, insurance premiums, advertising and marketing costs, professional fees, and employee wages. This checklist ensures that businesses don't miss out on any deductibles they are legally entitled to claim. Moreover, the Collin Texas Business Reducibility Checklist is tailored to accommodate various types of businesses operating in Collin County. It addresses the specific reducibility requirements for diverse industries, including retail, healthcare, real estate, hospitality, construction, and technology, among others. This customization allows businesses from different sectors to accurately document their deductible expenses, ensuring compliance with Collin County tax laws and maximizing their tax benefits. Using the Collin Texas Business Reducibility Checklist provides several advantages for businesses. It helps them maintain accurate financial records, which are crucial during tax audits or assessments. Business owners can confidently track their deductible expenses throughout the year, ensuring minimal disruptions during tax filing seasons. Furthermore, this checklist can serve as a valuable resource for tax planning, allowing businesses to strategize and allocate their resources efficiently. In summary, the Collin Texas Business Reducibility Checklist is a comprehensive resource that businesses operating in Collin County, Texas can utilize to streamline their tax processes and optimize deductions. By accurately documenting eligible expenses, businesses can reduce their tax liability, remain compliant with local regulations, and effectively manage their financial affairs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Lista de verificación de deducibilidad comercial - Business Deductibility Checklist

Description

How to fill out Collin Texas Lista De Verificación De Deducibilidad Comercial?

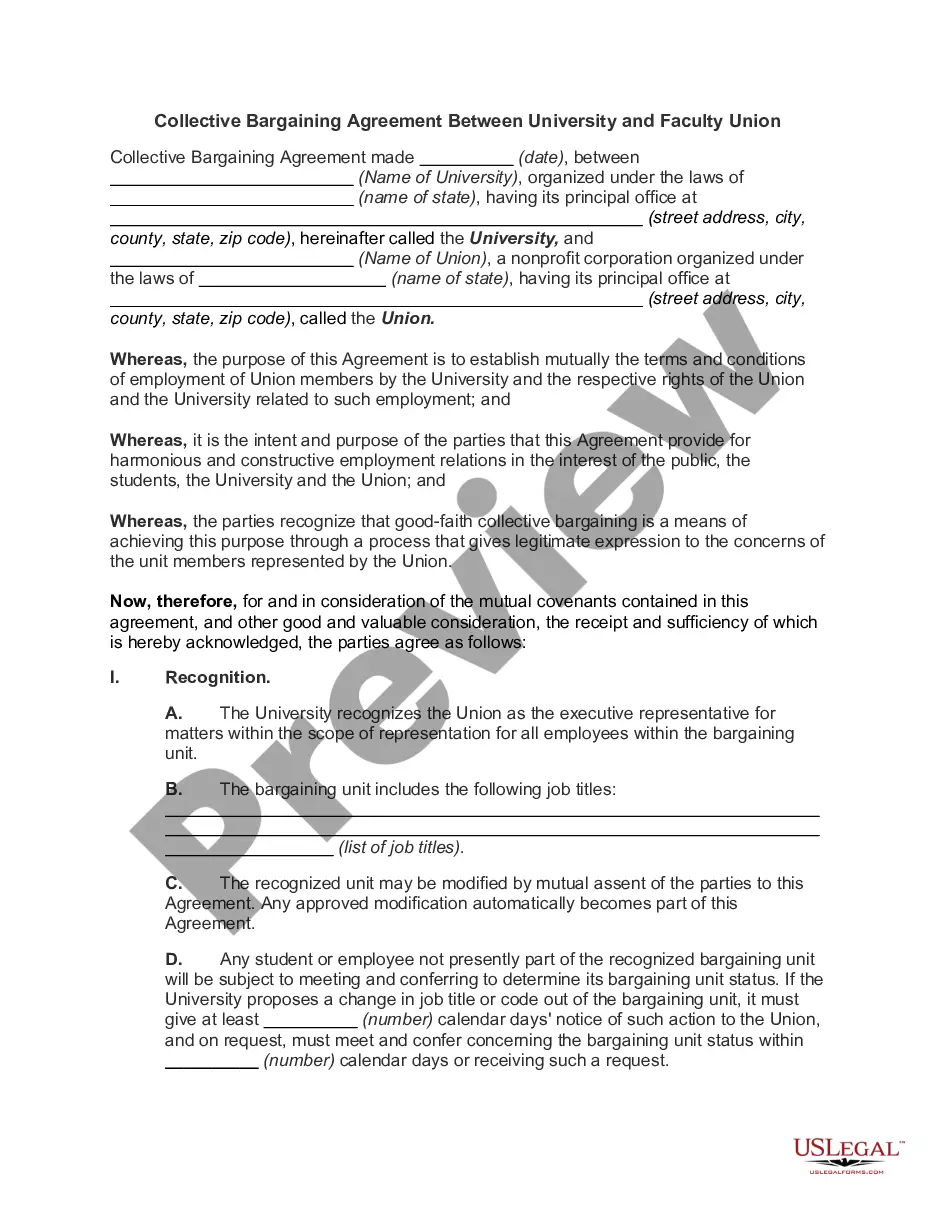

Preparing legal paperwork can be difficult. Besides, if you decide to ask an attorney to write a commercial contract, papers for ownership transfer, pre-marital agreement, divorce papers, or the Collin Business Deductibility Checklist, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is largest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Therefore, if you need the current version of the Collin Business Deductibility Checklist, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Collin Business Deductibility Checklist:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Collin Business Deductibility Checklist and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!