The Kings New York Business Reducibility Checklist is a comprehensive tool designed to help business owners in New York ensure they are claiming all eligible tax deductions. By carefully going through this checklist, business owners can identify the expenses that qualify for tax deductions, reducing their overall tax liability and maximizing their profits. With its user-friendly format and detailed instructions, the Kings New York Business Reducibility Checklist covers various key areas of expenses that can be deducted, ranging from operating and start-up costs to marketing expenses and employee wages. This checklist ensures that no deductible expense is missed, which is crucial for businesses aiming to stay compliant with tax regulations while optimizing their financial position. The checklist encompasses different types of expenses commonly encountered by businesses, allowing business owners to easily navigate through the specific categories that pertain to their industry or situation. This includes: 1. Operating Expenses: This includes a range of regular and necessary expenses incurred to keep the business running smoothly. It covers costs such as rent, utilities, insurance premiums, office supplies, and professional services fees. 2. Start-up Costs: For businesses in their early stages, this section helps identify deductible expenses related to launching the business. These may include market research expenses, legal and consulting fees, advertising costs, and costs associated with acquiring or refining a business location. 3. Vehicle and Transportation Expenses: Catering to businesses that rely on transportation, this section helps calculate expenses related to business vehicles. It includes mileage, fuel costs, maintenance fees, and vehicle depreciation. 4. Employee Expenses: This section outlines the deductible expenses associated with employees, such as wages, employee benefits, training costs, and employee-related taxes. 5. Marketing and Advertising Expenses: Businesses heavily invested in marketing and advertising campaigns can utilize this section to identify deductible expenses. It covers costs related to online and offline advertising, website development, social media marketing, and promotional materials. 6. Travel and Entertainment Expenses: Perfect for businesses that often engage in business-related travel or client entertainment, this section helps identify eligible deductions for expenses such as airfare, lodging, meals, and entertainment. It is essential for business owners in New York to familiarize themselves with the Kings New York Business Reducibility Checklist and customize it to their specific needs. By utilizing this tool, business owners can accurately claim all eligible deductions, potentially leading to significant savings on their taxes and a stronger financial position for their business.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Lista de verificación de deducibilidad comercial - Business Deductibility Checklist

Description

How to fill out Kings New York Lista De Verificación De Deducibilidad Comercial?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal paperwork. To avoid pricey legal assistance when preparing the Kings Business Deductibility Checklist, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals searching for do-it-yourself templates for different life and business scenarios. All the forms can be used multiple times: once you pick a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Kings Business Deductibility Checklist from the My Forms tab.

For new users, it's necessary to make some more steps to get the Kings Business Deductibility Checklist:

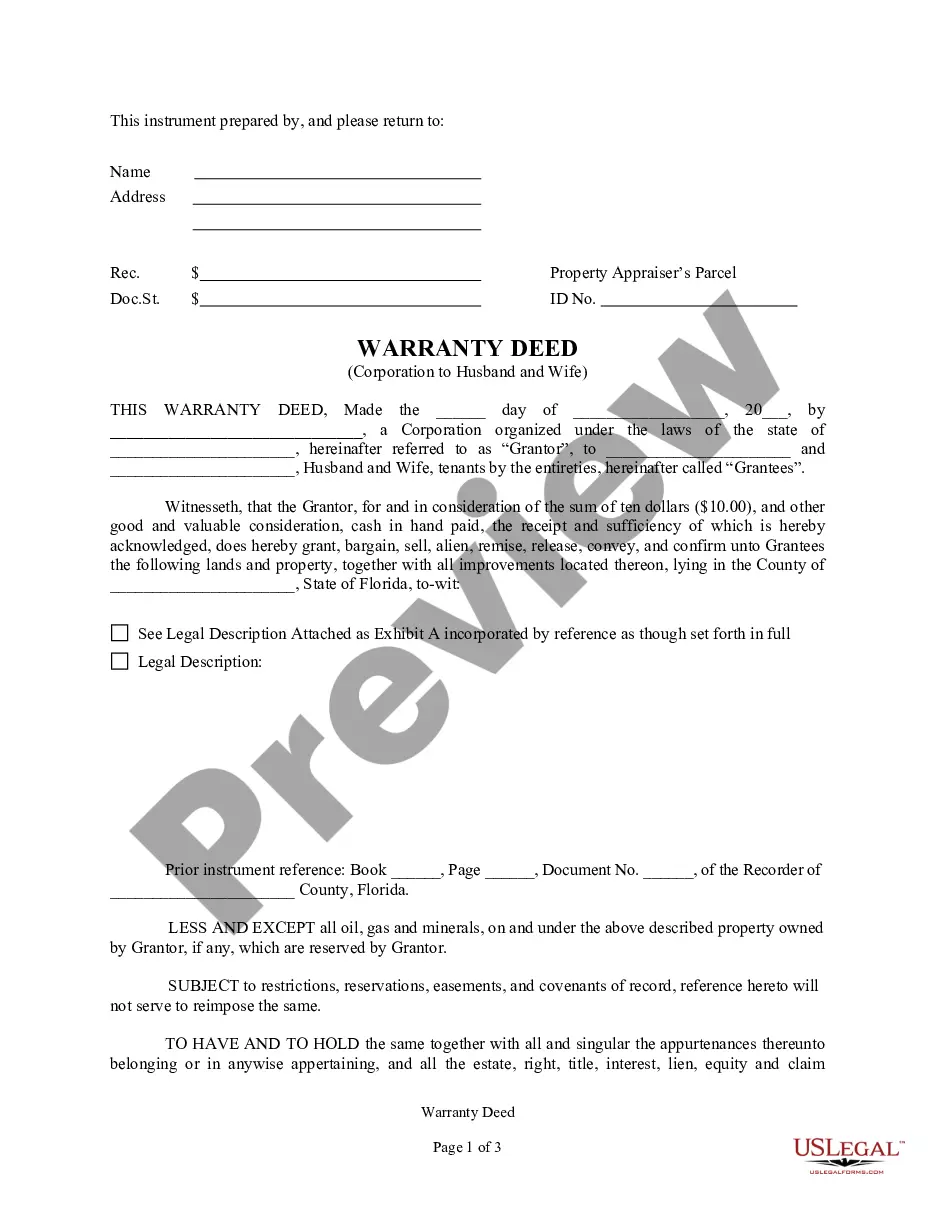

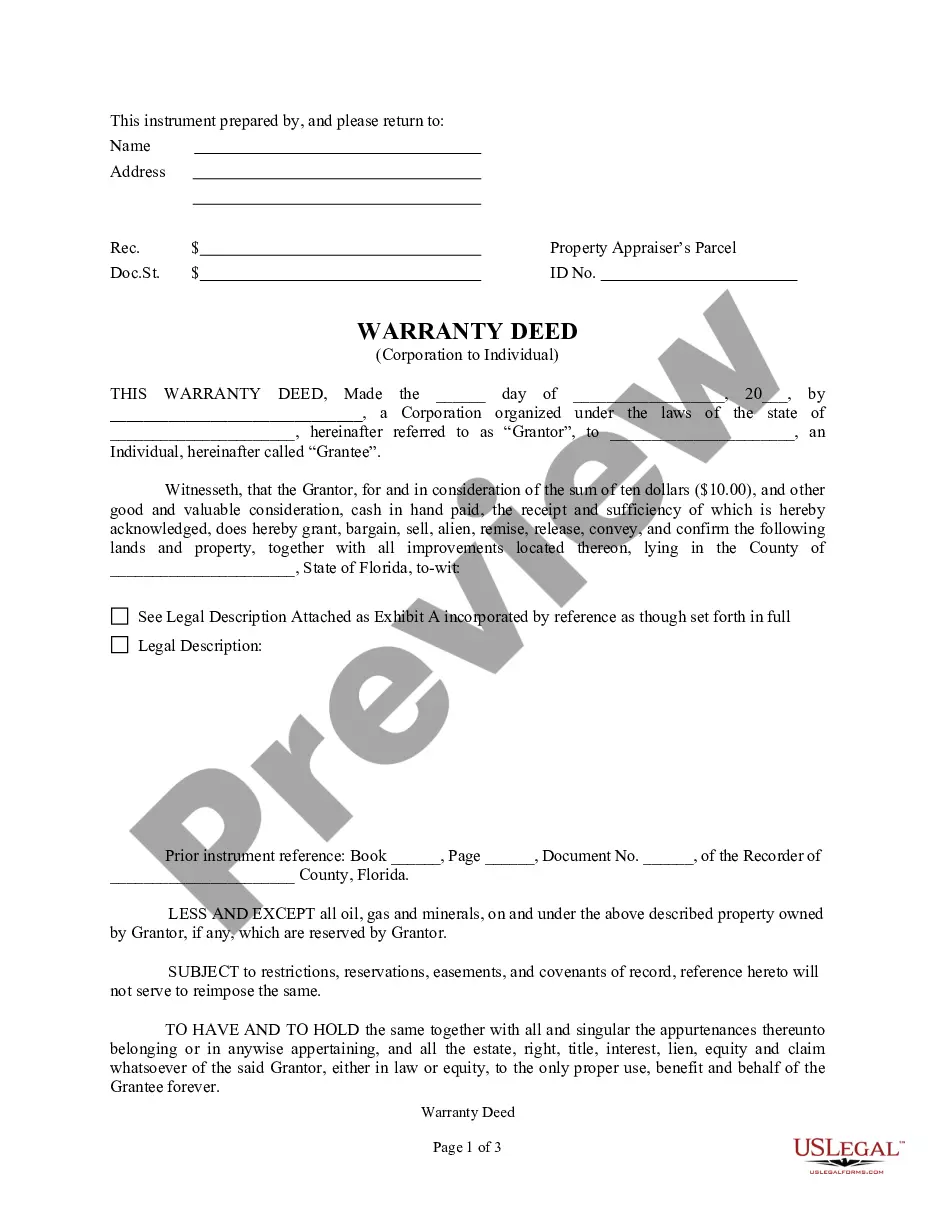

- Examine the page content to make sure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to get the template when you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!