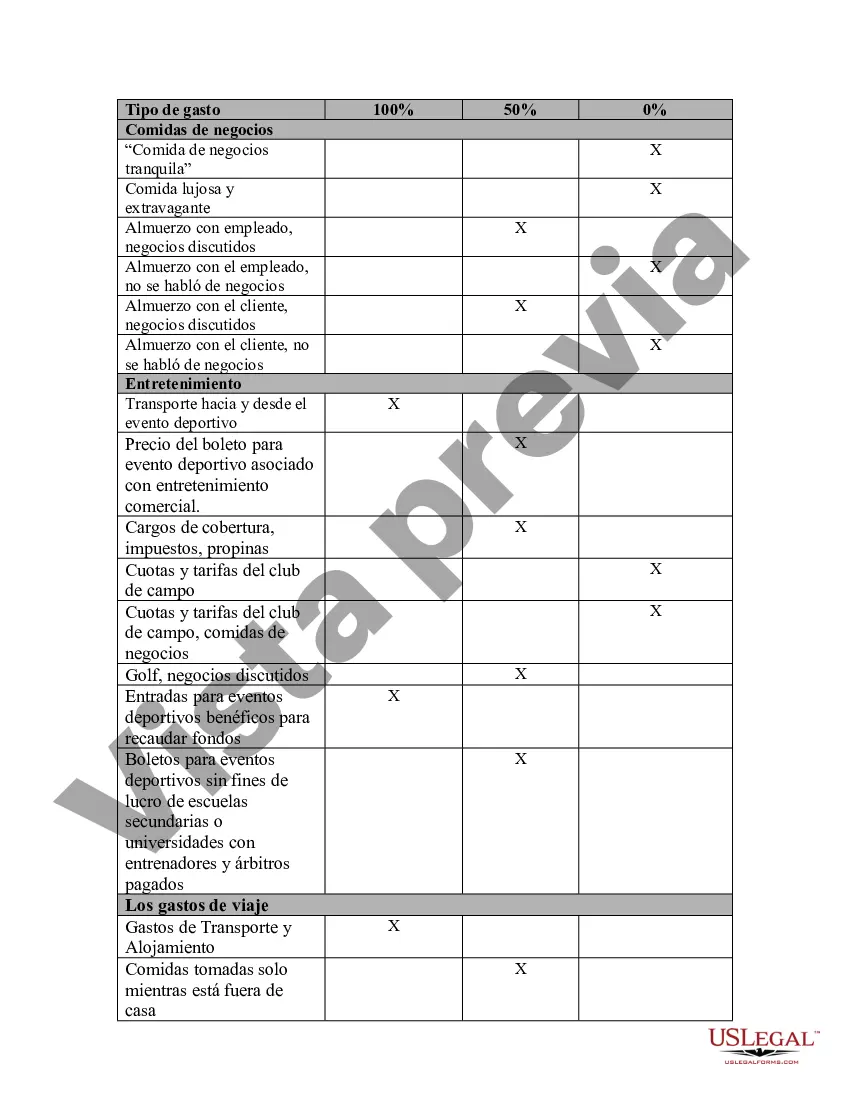

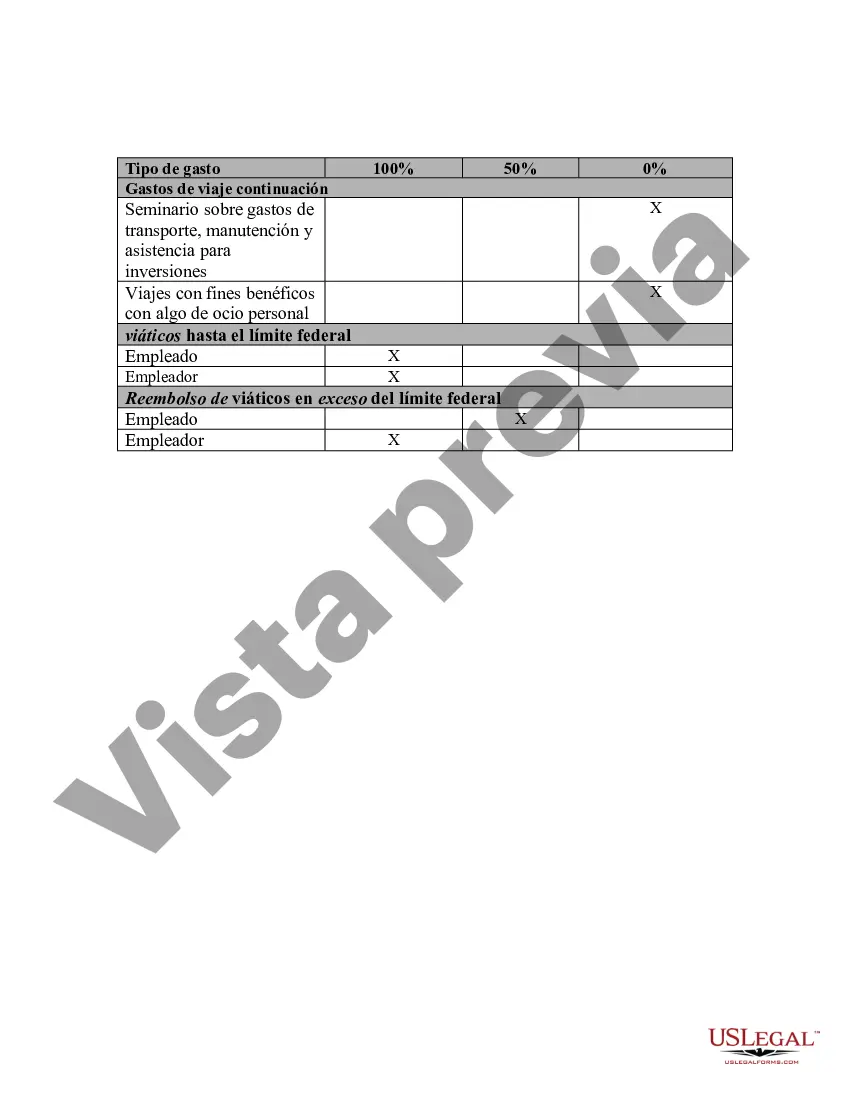

The Oakland Michigan Business Reducibility Checklist is an essential tool for businesses located in Oakland, Michigan, to ensure they maximize their tax deductions and remain compliant with local laws and regulations. This comprehensive checklist covers various aspects of business operations, enabling businesses to identify deductible expenses and properly document them for tax purposes. The checklist consists of multiple sections designed to cover different areas of business reducibility, including but not limited to: 1. Business Expenses: This section focuses on deductible expenses incurred during the normal course of business operations, such as office supplies, advertising, utilities, rent, insurance premiums, travel expenses, professional services, and wages paid to employees. 2. Home Office Deductions: For businesses operating from a home office, this section outlines the criteria for claiming deductions related to home office expenses, such as mortgage interest, property taxes, rent, utilities, and maintenance costs. 3. Vehicle Expenses: Businesses that utilize vehicles for commercial purposes can utilize this section to identify and document deductible expenses associated with vehicle usage, including fuel, repairs, maintenance, insurance, lease payments, and depreciation. 4. Entertainment and Meals: This section elucidates the guidelines for deducting entertainment and meal expenses incurred for business purposes, such as client meetings, networking events, and employee outings. 5. Retirement Contributions: The Oakland Michigan Business Reducibility Checklist also covers retirement plan contributions, including both employer and employee contributions, helping businesses ensure they are maximizing their retirement-related tax deductions. 6. Depreciation and Amortization: Businesses can refer to this section to understand the rules and regulations regarding the depreciation and amortization of assets, ensuring they claim the appropriate deductions based on the asset's useful life. 7. Section 179 Deductions: This portion focuses on the Section 179 deduction, which allows businesses to deduct the full cost of qualifying equipment or property purchases in the year of acquisition, rather than depreciating the cost over time. Having access to the Oakland Michigan Business Reducibility Checklist empowers businesses to stay organized, identify all eligible deductions, and maintain proper documentation. By closely following the checklist, businesses can significantly reduce their tax liability and minimize the risk of audits or fines related to improper deduction claims. In conclusion, the Oakland Michigan Business Reducibility Checklist is a valuable resource that covers various aspects of deductible expenses, including business expenses, home office deductions, vehicle expenses, entertainment and meals, retirement contributions, depreciation and amortization, and Section 179 deductions. Utilizing this checklist ensures businesses in Oakland, Michigan, can streamline their tax planning, optimize deductions, and enhance overall financial health.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Lista de verificación de deducibilidad comercial - Business Deductibility Checklist

Description

How to fill out Oakland Michigan Lista De Verificación De Deducibilidad Comercial?

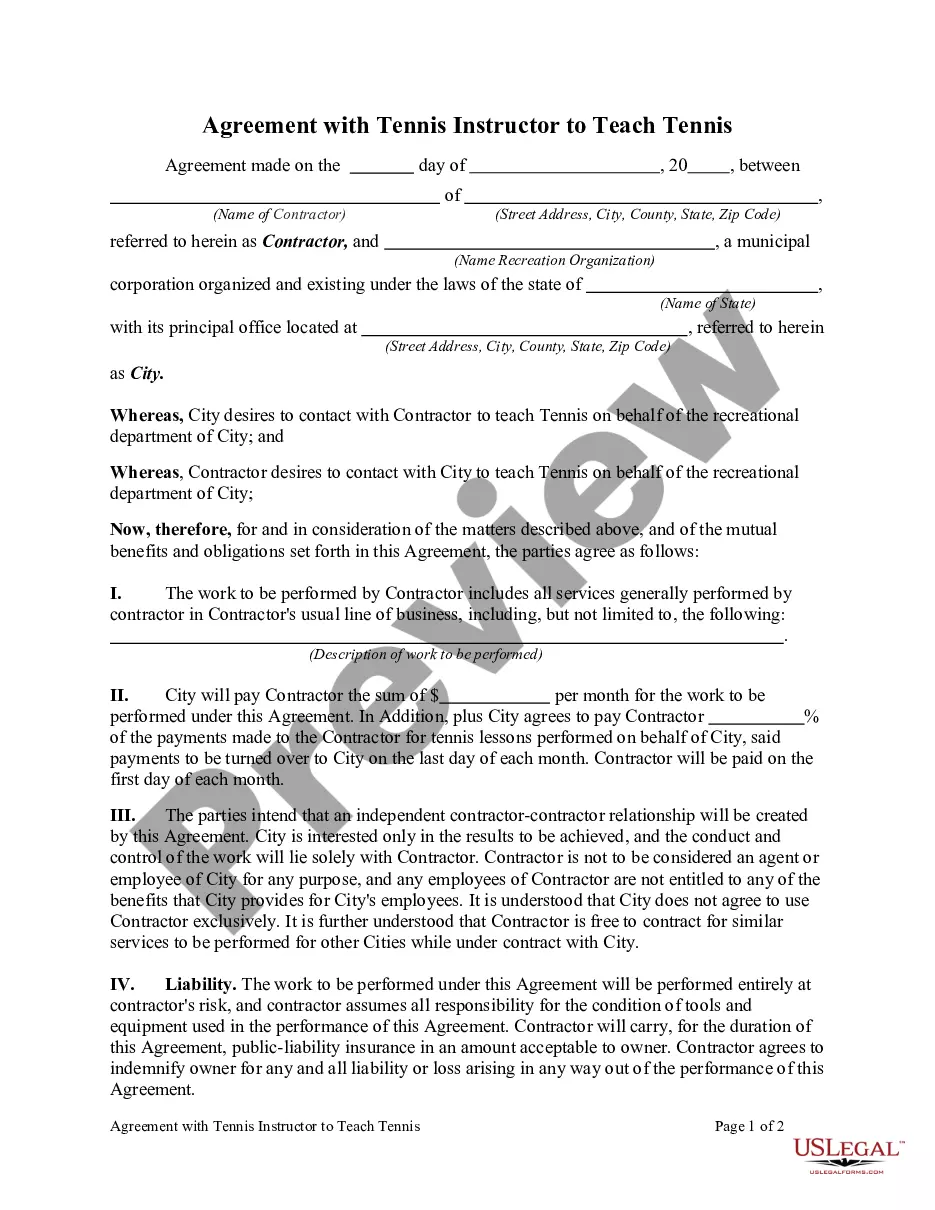

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to draft some of them from the ground up, including Oakland Business Deductibility Checklist, with a platform like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various categories varying from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching experience less challenging. You can also find information resources and guides on the website to make any tasks associated with paperwork execution straightforward.

Here's how to find and download Oakland Business Deductibility Checklist.

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state regulations can affect the legality of some records.

- Check the related forms or start the search over to locate the appropriate document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment method, and purchase Oakland Business Deductibility Checklist.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Oakland Business Deductibility Checklist, log in to your account, and download it. Needless to say, our website can’t replace a lawyer entirely. If you need to deal with an exceptionally difficult case, we recommend using the services of a lawyer to examine your document before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to provider for many different legal forms for millions of users. Become one of them today and get your state-specific documents with ease!