Orange California Business Reducibility Checklist is a comprehensive tool used by businesses in Orange, California, to ensure proper deduction of expenses and compliance with local tax regulations. This checklist helps businesses identify eligible deductions and substantiate them with necessary documentation, resulting in potential tax savings. By following this checklist, businesses can organize their financial records and maximize their deductions within the boundaries of the law in Orange, California. Keywords: Orange California, business reducibility, checklist, tax regulations, local tax, expenses, documentation, financial records, tax savings. Different Types of Orange California Business Reducibility Checklists: 1. Small Business Reducibility Checklist: This checklist is specifically designed for small businesses operating in Orange, California. It covers common tax deductions applicable to small enterprises, such as office supplies, advertising expenses, and employee salaries. 2. Home-Based Business Reducibility Checklist: For businesses operating from home in Orange, California, this checklist focuses on deductions related to home office expenses, mortgage interest, utilities, and other relevant deductions. 3. Self-Employed Professional Reducibility Checklist: This checklist caters to self-employed professionals, such as freelancers, consultants, or independent contractors based in Orange, California. It includes deductions related to professional certifications, business travel, subscriptions, and industry-specific expenses. 4. Rental Property Business Reducibility Checklist: This checklist is for businesses involved in the rental property industry in Orange, California. It outlines deductions related to maintenance, repairs, property management fees, and depreciation of rental units. 5. Healthcare Business Reducibility Checklist: Designed for healthcare businesses, such as clinics, hospitals, or medical practices in Orange, California, this checklist covers deductions related to medical equipment, supplies, professional insurance, and employee benefits. 6. Restaurant Business Reducibility Checklist: Catering to restaurants and food service businesses in Orange, California, this checklist focuses on deductions applicable to the industry, such as food and beverage costs, kitchen equipment, employee wages, and advertising expenses. By utilizing the appropriate type of Orange California Business Reducibility Checklist based on their business's nature, industry, and size, businesses in Orange, California can simplify their tax preparation process, streamline deductions, and potentially reduce their tax liability while ensuring compliance with local tax regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orange California Lista de verificación de deducibilidad comercial - Business Deductibility Checklist

Description

How to fill out Orange California Lista De Verificación De Deducibilidad Comercial?

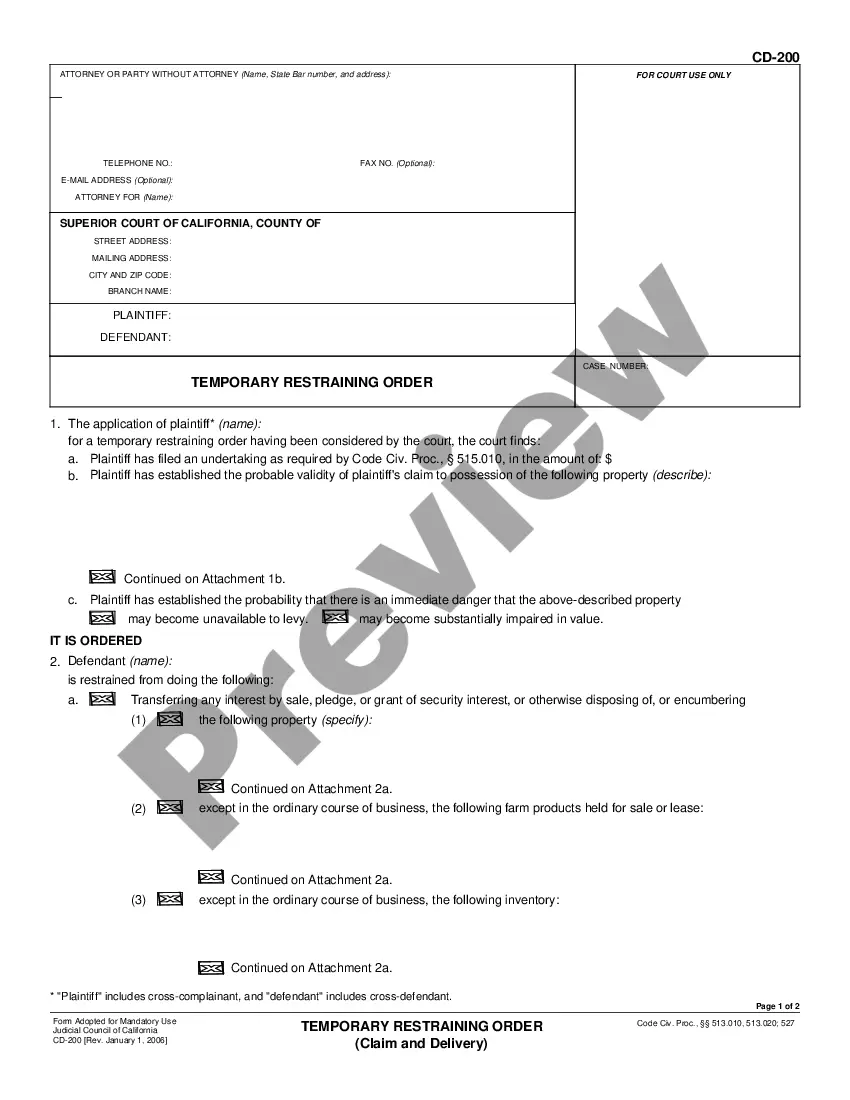

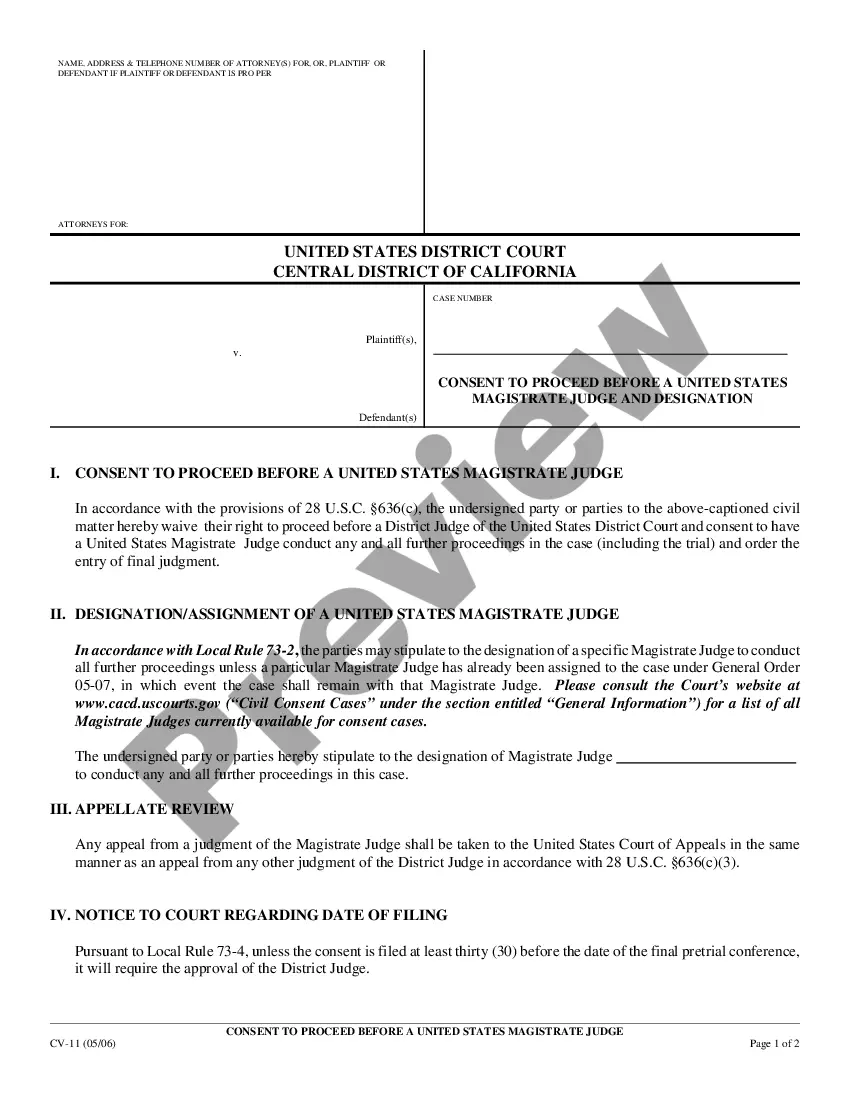

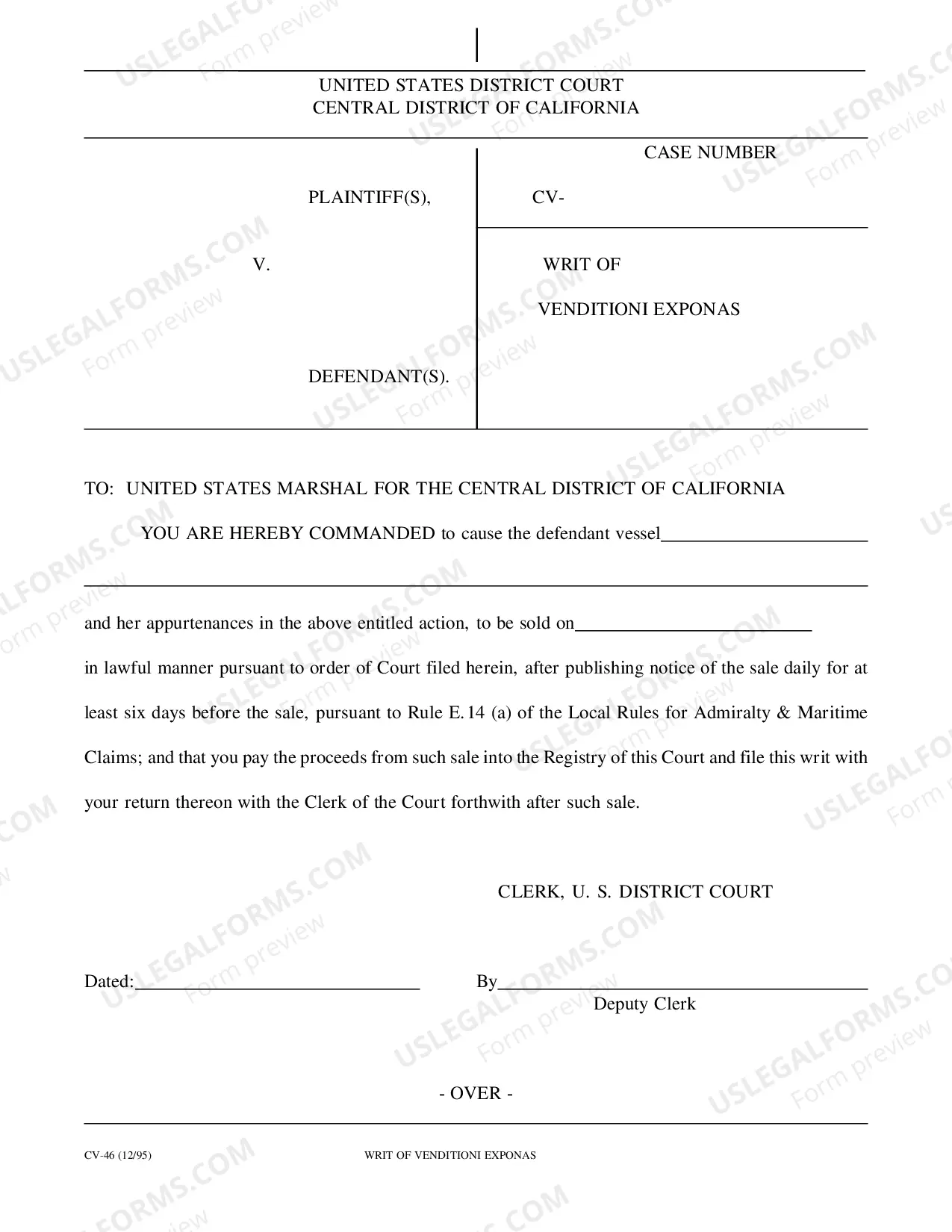

Preparing legal documentation can be burdensome. In addition, if you decide to ask a legal professional to draft a commercial contract, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Orange Business Deductibility Checklist, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario collected all in one place. Consequently, if you need the current version of the Orange Business Deductibility Checklist, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Orange Business Deductibility Checklist:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now once you find the needed sample and select the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Opt for the file format for your Orange Business Deductibility Checklist and save it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!