Phoenix Arizona Business Reducibility Checklist is a comprehensive list of expenses and deductions that businesses in Phoenix, Arizona can claim to minimize their taxable income and maximize their after-tax profitability. This checklist helps businesses ensure that they are taking advantage of all available deductions and complying with the tax laws specific to Phoenix, Arizona. Some key items included in the Phoenix Arizona Business Reducibility Checklist are: 1. State and Local Taxes: Businesses can deduct various state and local taxes paid, such as sales tax, property tax, and business license fees. 2. Business Expenses: This category includes deductions for ordinary and necessary expenses incurred in running a business, such as rent, utilities, office supplies, advertising, and professional fees. 3. Employee-Related Deductions: Any expenses related to employees, such as salaries, wages, payroll taxes, employee benefits, and retirement contributions, can be deducted. 4. Vehicle Expenses: Businesses can deduct expenses related to business vehicles, including fuel, maintenance, lease or depreciation costs, and insurance premiums. 5. Travel and Entertainment: This category covers deductions for travel expenses, including airfare, lodging, meals, and entertainment, as long as they are directly related to business activities. 6. Insurance Premiums: Deductions for various insurance premiums, such as property insurance, liability insurance, and workers' compensation insurance. 7. Home Office Expenses: If you operate your business from a home office, you may be eligible to deduct a portion of your mortgage interest, property taxes, utilities, and other related expenses. 8. Professional Services: Deductions for fees paid to accountants, attorneys, and other professional service providers for business-related advice and assistance. 9. Charitable Contributions: If your business makes donations to qualified charities, these contributions can be deducted. 10. Depreciation and Amortization: Businesses can deduct the costs of certain assets over time through depreciation or amortization. Different types of Phoenix Arizona Business Reducibility Checklists may exist based on the specific industry or nature of the business. For instance, there could be separate checklists for retailers, restaurants, contractors, freelancers, or professionals like doctors, lawyers, and consultants. These industry-specific checklists provide tailored guidance on deductions and expenses relevant to each business type, ensuring accurate and optimal tax planning. In conclusion, the Phoenix Arizona Business Reducibility Checklist is a crucial tool for businesses in Phoenix, Arizona, enabling them to identify and claim applicable deductions, thus reducing their tax liability and increasing their overall financial health. By following the checklist, businesses can ensure compliance with local tax laws while maximizing their deductible expenses, ultimately enhancing their bottom line.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Lista de verificación de deducibilidad comercial - Business Deductibility Checklist

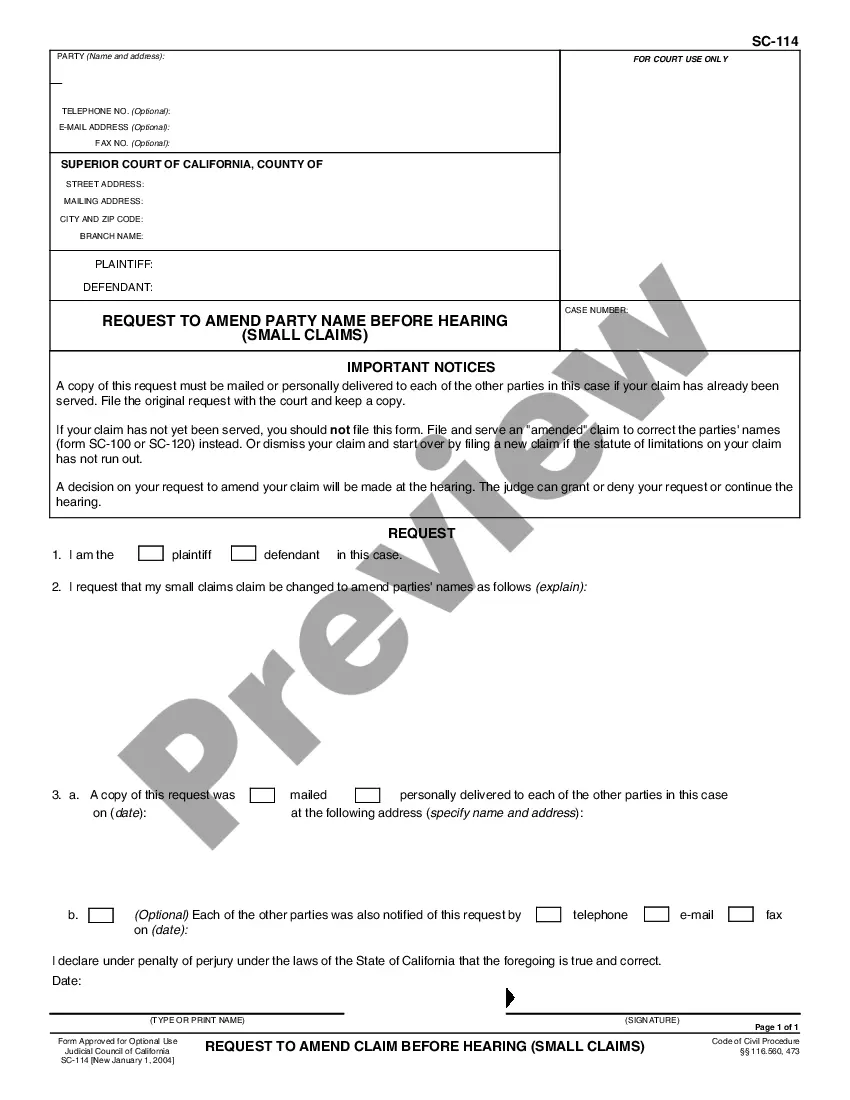

Description

How to fill out Phoenix Arizona Lista De Verificación De Deducibilidad Comercial?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a lawyer to draft a commercial contract, documents for ownership transfer, pre-marital agreement, divorce paperwork, or the Phoenix Business Deductibility Checklist, it may cost you a lot of money. So what is the most reasonable way to save time and money and create legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any scenario accumulated all in one place. Therefore, if you need the recent version of the Phoenix Business Deductibility Checklist, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Phoenix Business Deductibility Checklist:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Phoenix Business Deductibility Checklist and download it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!