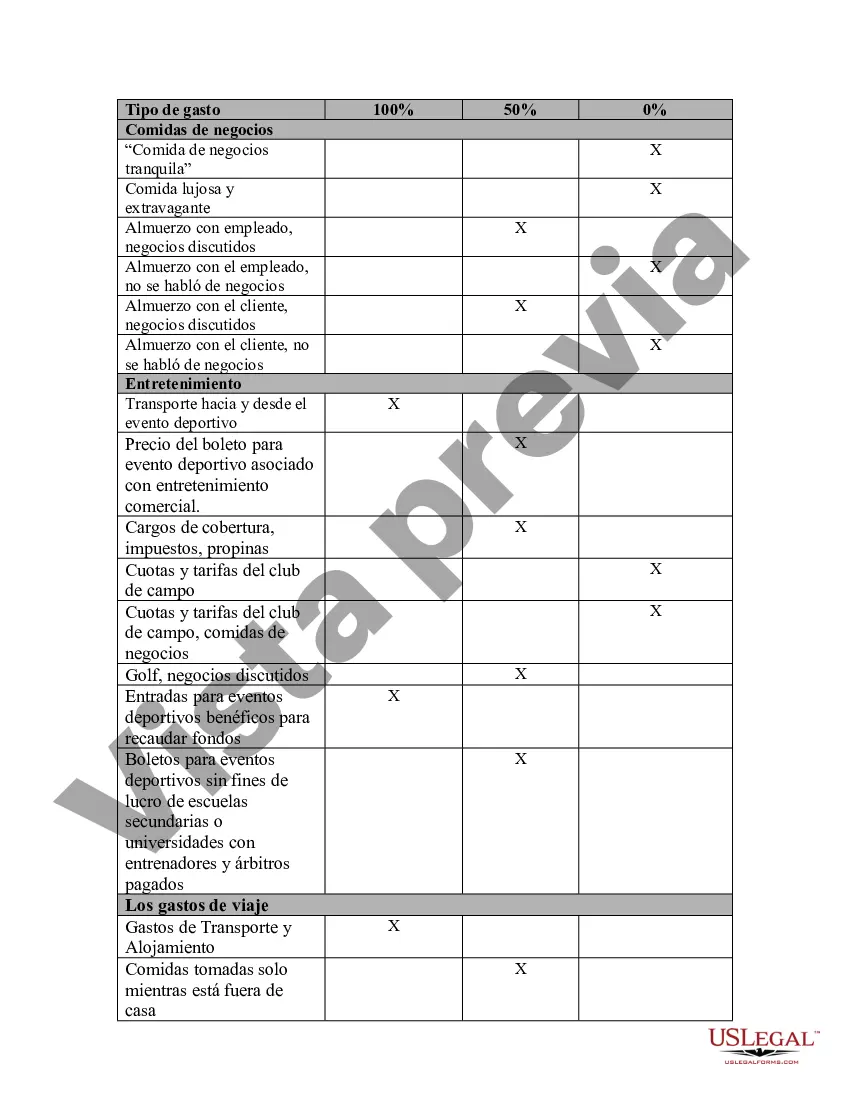

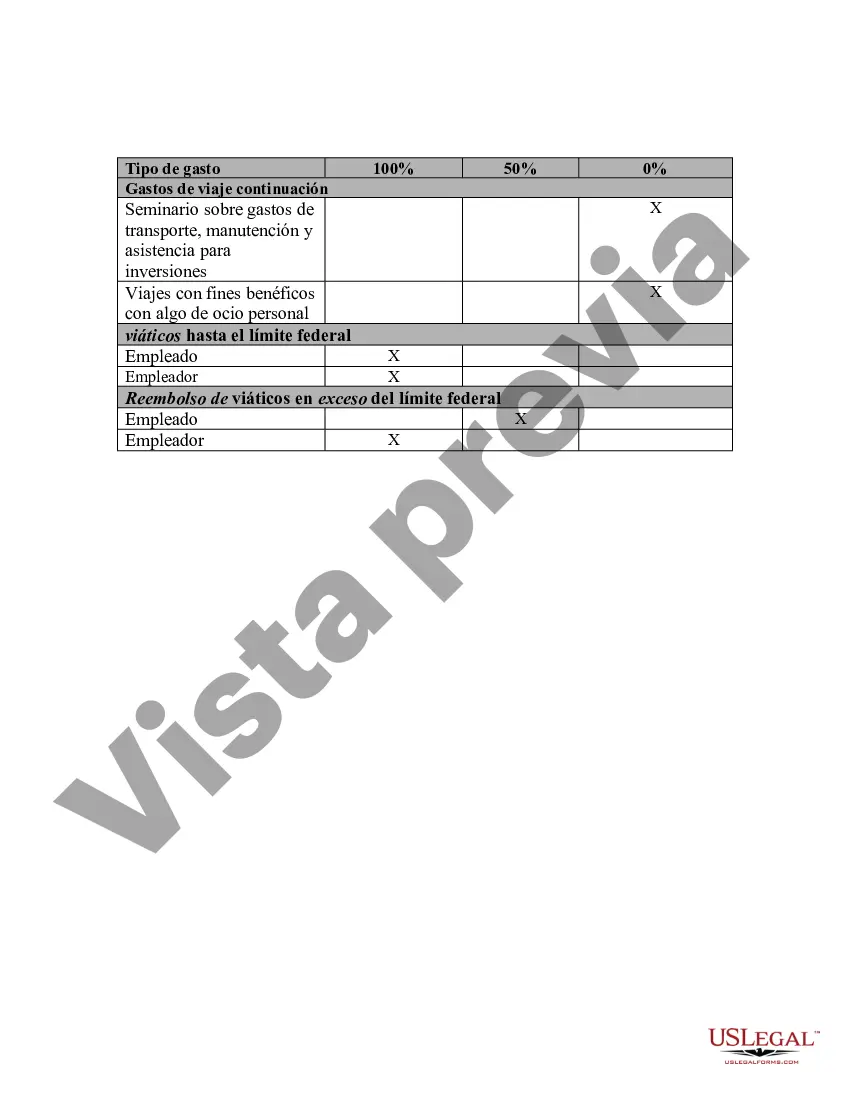

Travis Texas Business Reducibility Checklist is a comprehensive tool designed to assist businesses in identifying and maximizing potential tax deductions in Travis County, Texas. This checklist helps business owners and tax professionals ensure that all eligible expenses are properly documented and claimed, ultimately reducing their tax liability. With the constantly evolving tax regulations, utilizing a thorough reducibility checklist is crucial to avoid missing out on valuable deductions. Here are some relevant keywords associated with Travis Texas Business Reducibility Checklist: 1. Business tax deductions: The checklist helps businesses identify various deductible expenses they can claim on their tax returns, such as operating expenses, business travel, employee benefits, and more. 2. Travis County tax regulations: As tax laws and regulations may differ across jurisdictions, this checklist focuses specifically on the rules and guidelines applicable to businesses operating within Travis County, Texas. 3. Eligible expenses: The checklist outlines different types of expenses that businesses can potentially deduct, including office rent, utilities, business insurance, marketing and advertising costs, professional fees, and depreciation of assets. 4. Documentation requirements: Proper documentation is crucial when claiming deductions. This checklist provides businesses with a comprehensive list of the documentation needed for each deductible expense, such as receipts, invoices, mileage logs, and contracts. 5. Maximizing tax savings: By following this checklist, businesses can ensure they are taking full advantage of all available deductions, thereby reducing their taxable income and maximizing their tax savings. Some specific types of Travis Texas Business Reducibility Checklists that may exist include: 1. Small Business Reducibility Checklist: This checklist is tailored for small businesses operating in Travis County, focusing on deductions and expenses commonly applicable to this category, such as home office deductions, startup costs, and self-employment taxes. 2. Sole Proprietorship Reducibility Checklist: Aimed at sole proprietors in Travis County, Texas, this checklist emphasizes deductions relevant to self-employed individuals, including health insurance premiums, retirement contributions, and self-employment taxes. 3. Rental Property Reducibility Checklist: Geared towards businesses or individuals who own rental properties in Travis County, this checklist outlines deductible expenses specific to rental properties, such as repairs, mortgage interest, property taxes, and depreciation. By using the Travis Texas Business Reducibility Checklist that aligns with their business type, businesses can ensure that they are capturing all eligible deductions while adhering to the specific regulations of Travis County, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Lista de verificación de deducibilidad comercial - Business Deductibility Checklist

Description

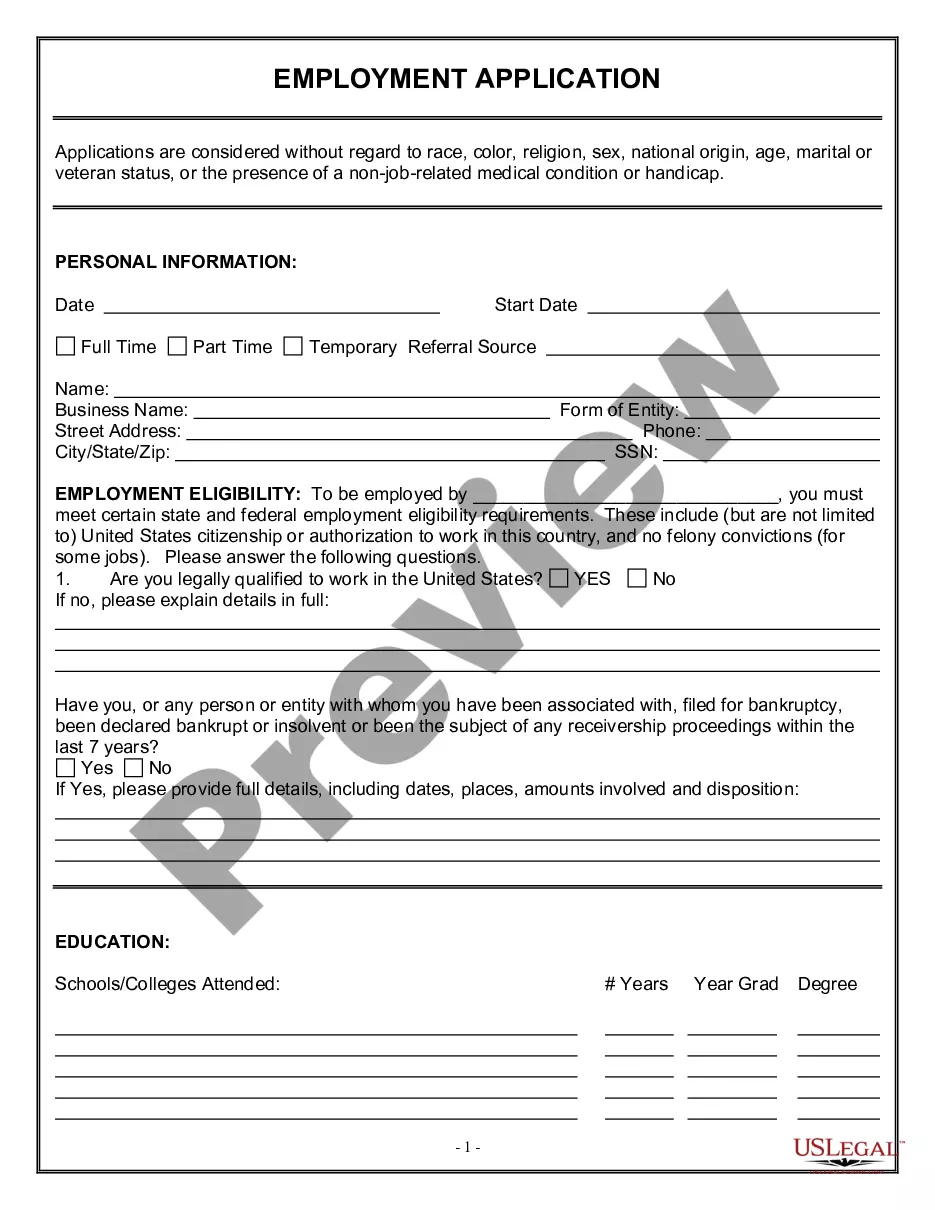

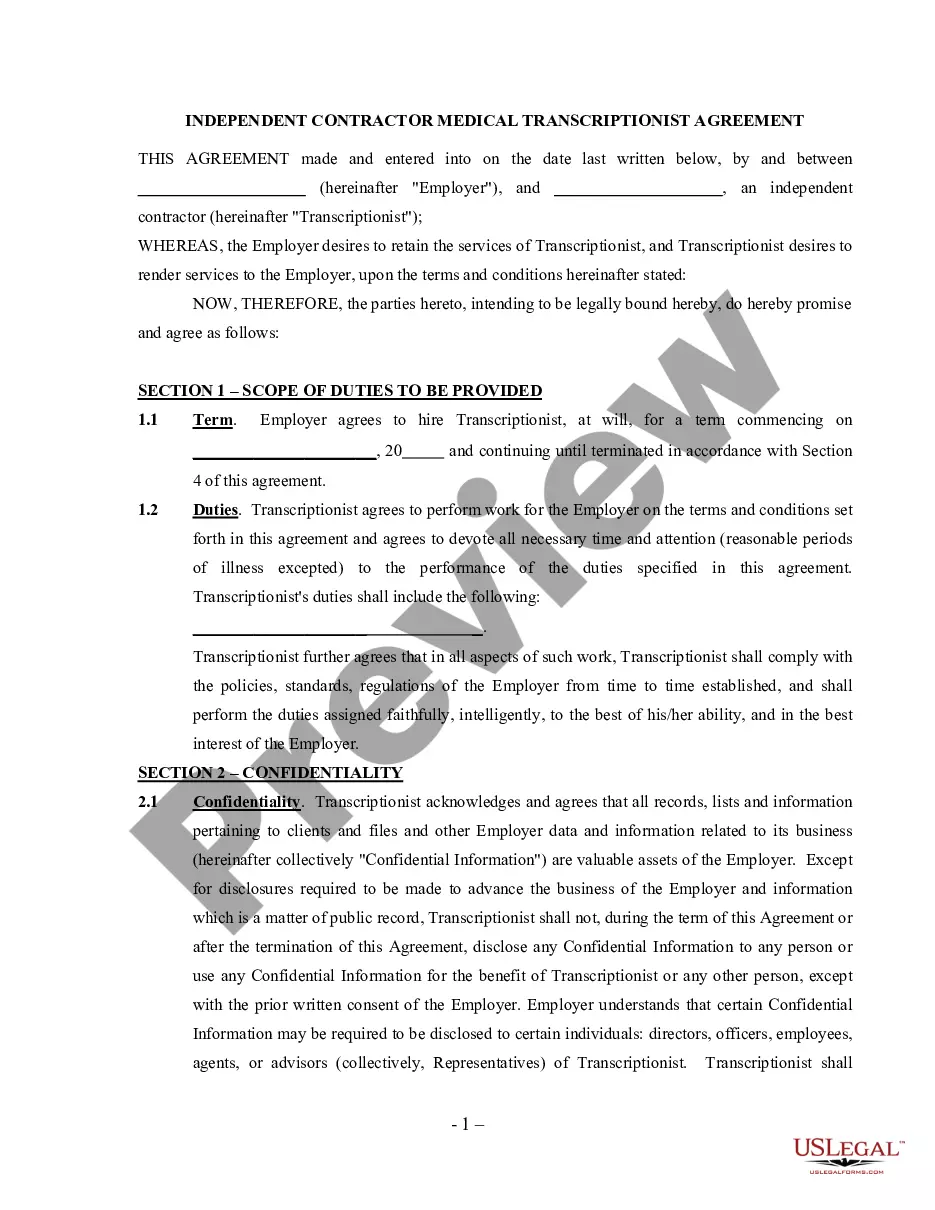

How to fill out Travis Texas Lista De Verificación De Deducibilidad Comercial?

Creating paperwork, like Travis Business Deductibility Checklist, to manage your legal matters is a challenging and time-consumming task. A lot of circumstances require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can consider your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents intended for a variety of scenarios and life situations. We make sure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal issues associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how effortless it is to get the Travis Business Deductibility Checklist form. Simply log in to your account, download the template, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as easy! Here’s what you need to do before getting Travis Business Deductibility Checklist:

- Ensure that your form is specific to your state/county since the rules for creating legal documents may vary from one state another.

- Learn more about the form by previewing it or going through a brief intro. If the Travis Business Deductibility Checklist isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to start using our website and download the form.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment details.

- Your template is all set. You can try and download it.

It’s easy to find and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!