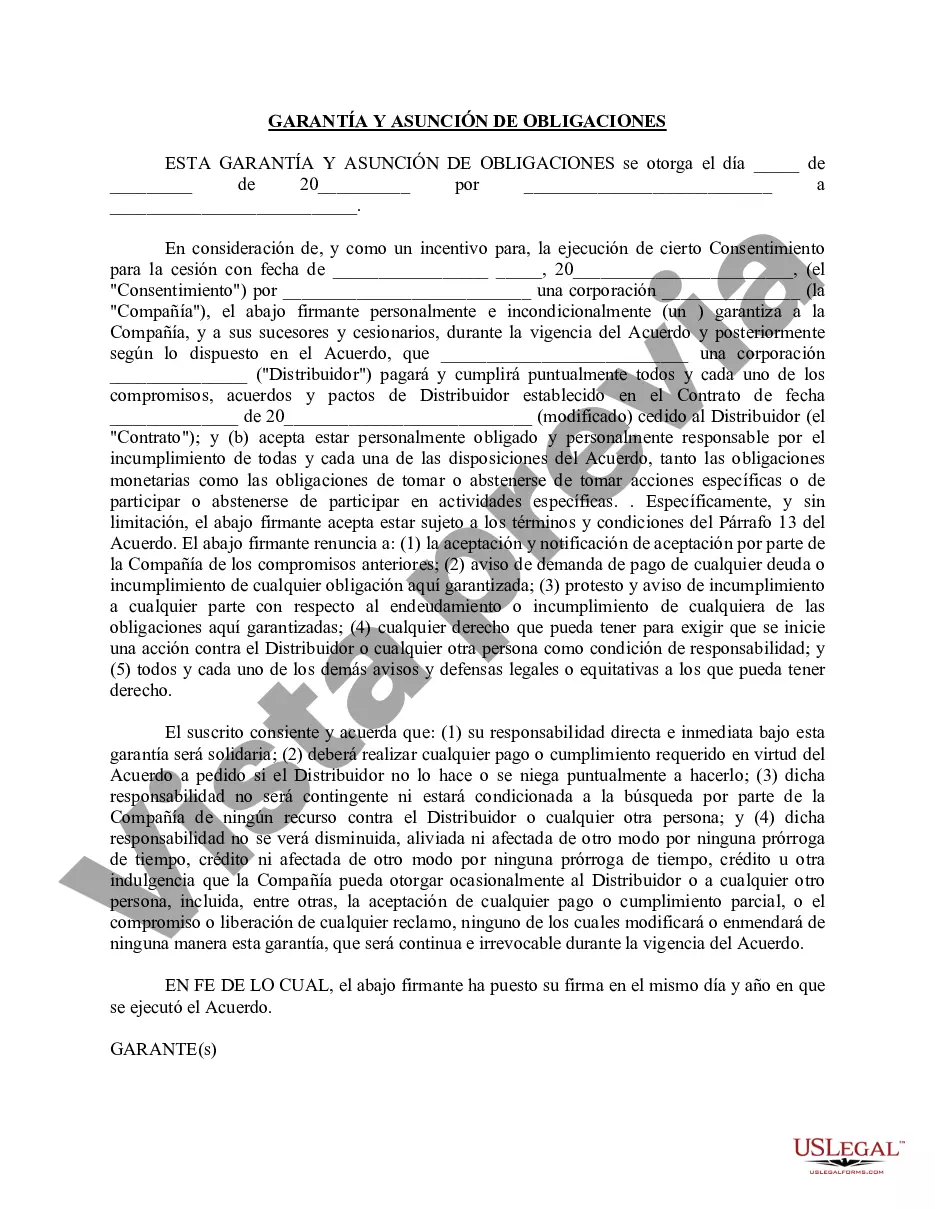

Title: Understanding San Bernardino California Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment Introduction: San Bernardino, California is a city located in the Inland Empire region, approximately 60 miles east of Los Angeles. It is home to a diverse community and offers a range of attractions, picturesque landscapes, and a growing business environment. This article will delve into the concept of San Bernardino California Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment, exploring its significance and potential types. 1. Definition: What is San Bernardino California Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment? San Bernardino California Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment refers to a legal agreement wherein a distributor guarantees the payment of distributorship funds to a corporation, in case the assignee fails to fulfill their financial obligations. This ensures that the corporation will receive the funds owed even if the assignee fails to make the payment. 2. Importance of Guaranty by Distributor to Corporation: This type of guaranty agreement is crucial for corporations safeguarding their financial interests when entering distribution agreements. It provides the corporation with a level of assurance that distributorship funds will be paid, mitigating potential risks associated with non-payment or default. 3. Types of San Bernardino California Guaranty by Distributor to Corporation: a. Limited Guaranty: A limited guaranty stipulates specific conditions and limitations on the distributor's responsibility for payment in case the assignee defaults. The guarantor's liability is typically limited to a certain amount or timeframe. b. Absolute Guaranty: An absolute guaranty holds the distributor fully responsible for payment if the assignee fails to meet their financial obligations. In this case, the guarantor assumes total liability for the distributorship funds. c. Continuing Guaranty: A continuing guaranty extends the guarantee beyond a single transaction or payment, covering multiple transactions until the assigned obligations are fulfilled or the agreement is terminated. 4. Procedures and Requirements: a. Written Agreement: San Bernardino California Guaranty by Distributor to Corporation must be established through a legally binding written agreement, signed by both the distributor and the corporation. This document should outline the terms, conditions, and responsibilities of each party involved. b. Assignment Consent: The distributor must obtain the corporation's consent to assign the distributorship rights to another entity or individual. c. Due Diligence: Before assigning the distributorship, it is essential to assess the assignee's financial capability and credibility to ensure they can meet the obligations. d. Documentation: Both parties should maintain copies of the agreement, assignment consent, and relevant financial records to substantiate any potential legal claims. Conclusion: San Bernardino California Guaranty by Distributor to Corporation is an essential legal agreement that protects the financial interests of corporations engaging in distribution agreements. By understanding the types and procedural requirements associated with this guaranty, corporations can minimize the risks associated with non-payment and ensure a secure financial relationship with their assigned distributors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Bernardino California Garantía del Distribuidor a la Corporación del Pago de los Fondos de Distribución por parte del Cesionario Debido a la Cesión - Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment

Description

How to fill out San Bernardino California Garantía Del Distribuidor A La Corporación Del Pago De Los Fondos De Distribución Por Parte Del Cesionario Debido A La Cesión?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare official paperwork that varies throughout the country. That's why having it all collected in one place is so helpful.

US Legal Forms is the biggest online collection of up-to-date federal and state-specific legal forms. Here, you can easily locate and download a document for any individual or business objective utilized in your county, including the San Bernardino Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Afterward, the San Bernardino Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to get the San Bernardino Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment:

- Make sure you have opened the correct page with your localised form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the San Bernardino Guaranty by Distributor to Corporation of Payment of Distributorship Funds by Assignee Due to Assignment on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!