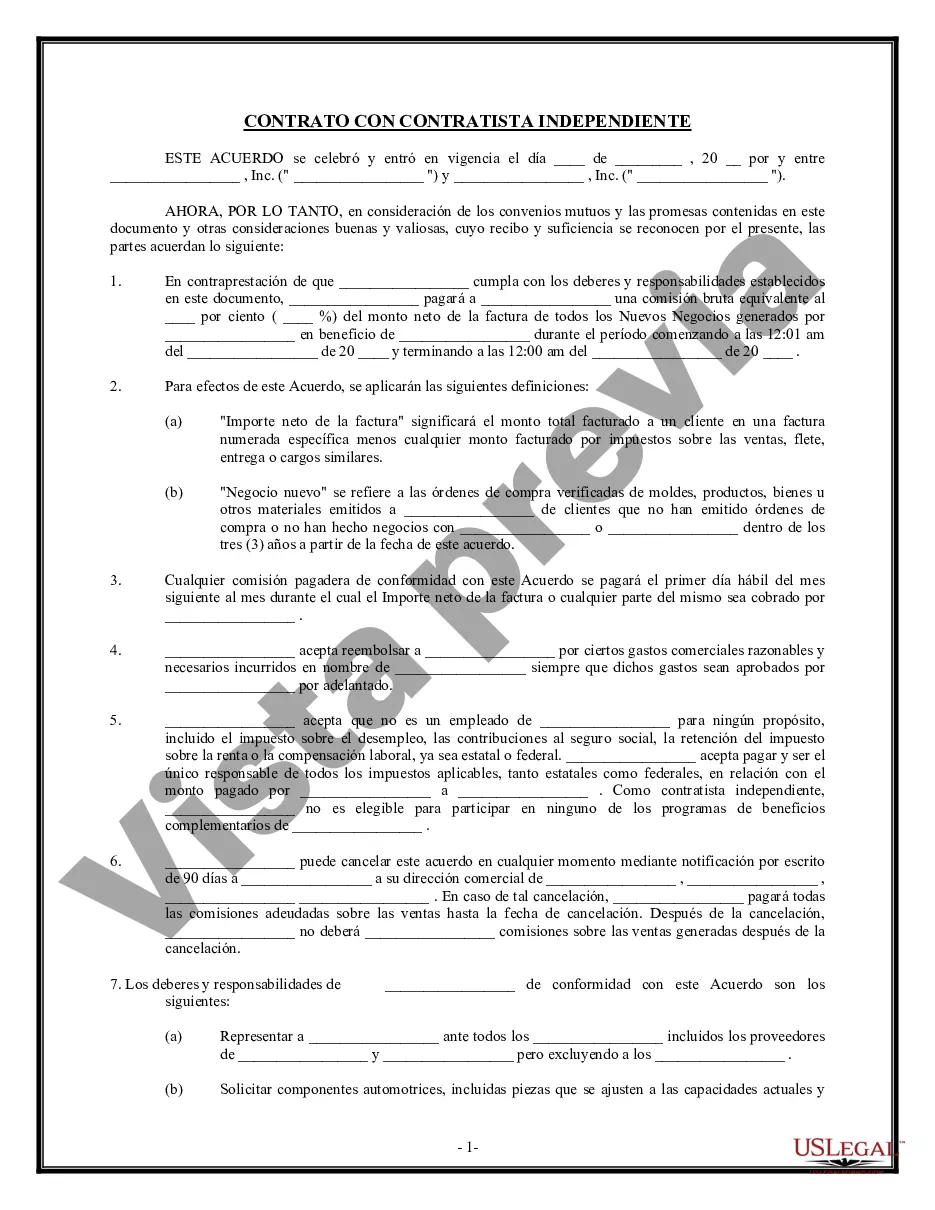

Cook Illinois is a reputable transportation company that offers self-employment opportunities through its independent contractor employment agreement. This agreement specifically focuses on commission-based work for generating new business. The Cook Illinois Self-Employed Independent Contractor Employment Agreement provides a structured framework for individuals who wish to work as independent contractors and earn commissions by bringing in new clients and business opportunities. Under this agreement, independent contractors have the freedom to work on their own terms and manage their schedules. They are responsible for prospecting, networking, and securing new business for Cook Illinois. The agreement outlines the terms and conditions for these independent contractors, ensuring clarity and fairness in the working relationship. The commission structure outlined in the agreement is designed to motivate and reward contractors for their efforts in acquiring new business. It typically involves a percentage-based commission that is paid out based on the revenue generated from the new clients or contracts secured by the contractor. The agreement may specify the exact commission rate, any thresholds or tiers for increased commissions, and the frequency of commission payments. In addition to the standard Cook Illinois Self-Employed Independent Contractor Employment Agreement for commission-based new business, there might be variations or specialized agreements tailored to specific industries or services. For example, Cook Illinois may offer different agreements for independent contractors focused on acquiring new business for its charter bus services, school transportation solutions, or corporate shuttle operations. These agreements would outline the unique requirements and expectations for contractors working in these different business sectors. In conclusion, the Cook Illinois Self-Employed Independent Contractor Employment Agreement for commission-based new business provides individuals with the opportunity to work independently while earning commissions by bringing in new clients and business opportunities for the company. Through this agreement, Cook Illinois ensures a fair working relationship and rewards contractors for their efforts in expanding the company's customer base.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Acuerdo de empleo de contratista independiente para trabajadores por cuenta propia: comisión por nuevos negocios - Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

How to fill out Cook Illinois Acuerdo De Empleo De Contratista Independiente Para Trabajadores Por Cuenta Propia: Comisión Por Nuevos Negocios?

Drafting paperwork for the business or personal needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's crucial to consider all federal and state laws and regulations of the specific region. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to generate Cook Self-Employed Independent Contractor Employment Agreement - commission for new business without professional assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Cook Self-Employed Independent Contractor Employment Agreement - commission for new business on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed document.

In case you still don't have a subscription, follow the step-by-step instruction below to obtain the Cook Self-Employed Independent Contractor Employment Agreement - commission for new business:

- Examine the page you've opened and check if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily obtain verified legal forms for any use case with just a couple of clicks!