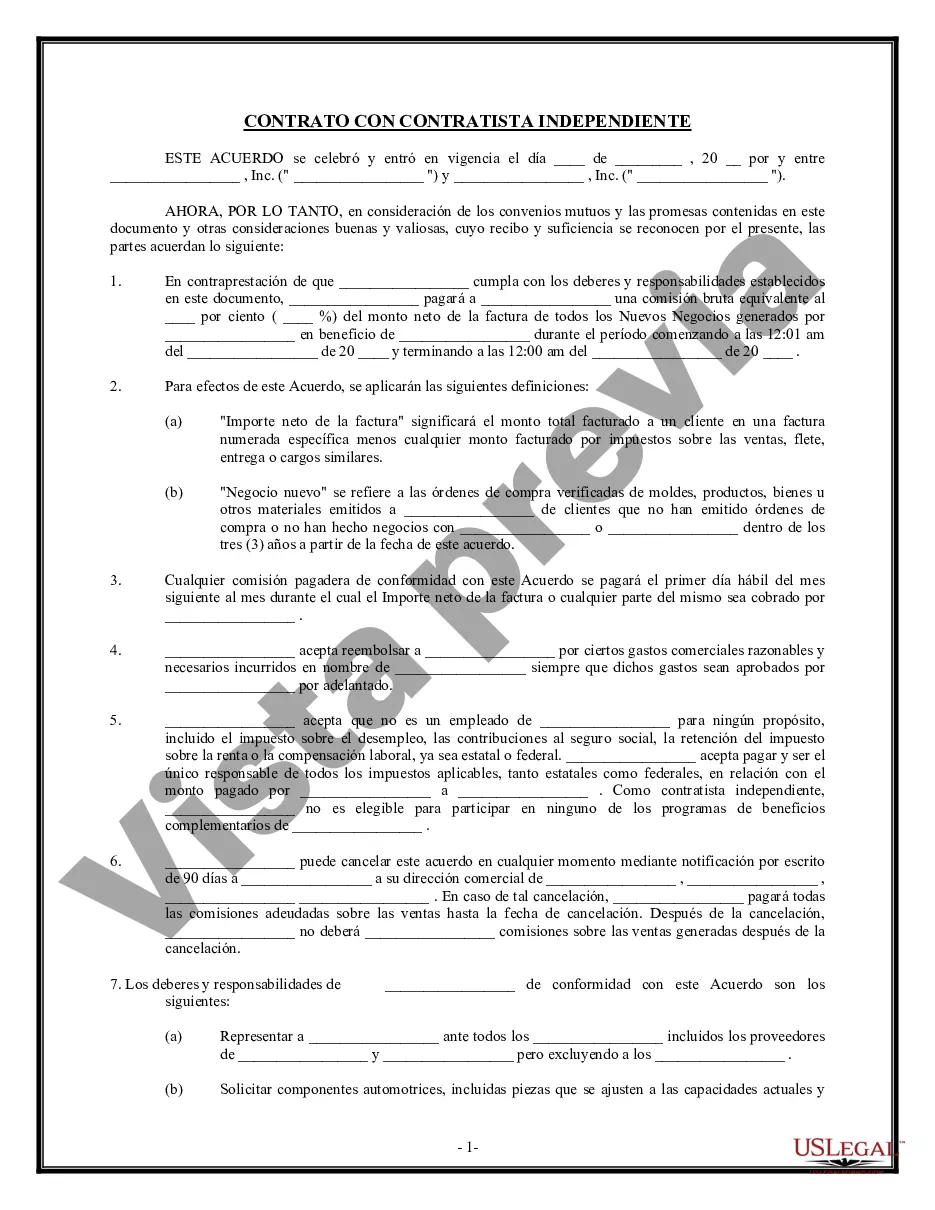

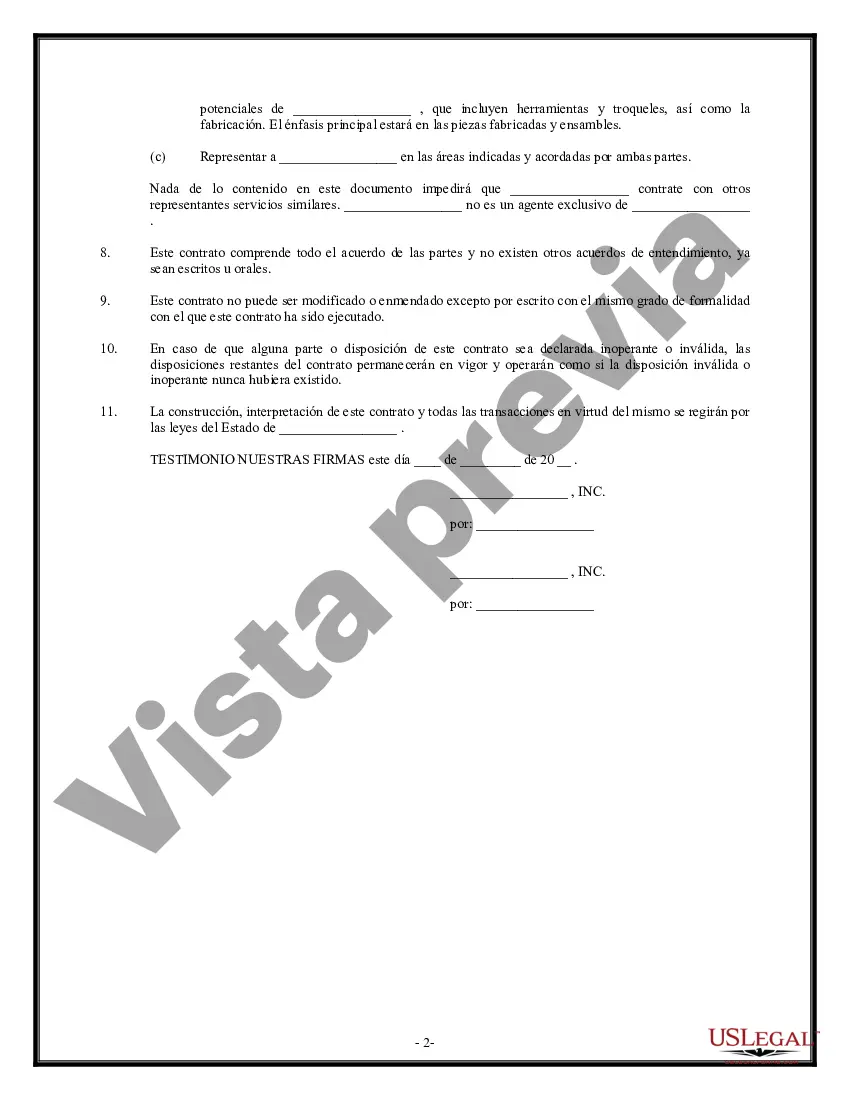

Maricopa Arizona Self-Employed Independent Contractor Employment Agreement: Commission for New Business A Maricopa Arizona Self-Employed Independent Contractor Employment Agreement as commission for new business is a specific type of employment contract entered into between a self-employed independent contractor and a company based in Maricopa, Arizona. This agreement outlines the terms, conditions, and expectations regarding the contractor's services to generate new business and earn commission in return. In this type of agreement, the emphasis is on the independent contractor's ability to promote and sell products or services on behalf of the company. The contractor is responsible for identifying potential customers, generating leads, closing sales, and ultimately growing the business. The commission structure outlined in the agreement serves as an incentive for the contractor to achieve and exceed sales targets, as they are compensated based on the sales they bring in. Within the realm of Maricopa Arizona Self-Employed Independent Contractor Employment Agreements, various variations and specific terms may exist. These include: 1. Straight Commission Agreement: In this agreement, the independent contractor receives compensation solely in the form of commission based on the sales they generate. No separate salary or base pay is provided. The commission percentage can either be fixed or tiered, depending on the volume or value of new business the contractor brings to the company. 2. Base + Commission Agreement: This type of agreement combines a base salary with a commission structure. The contractor receives a regular base pay in addition to a commission for new business generated. The base salary provides a steady income stream while incentivizing the contractor to strive for higher sales and earn additional commission. 3. Exclusive Agreement: This agreement establishes an exclusive relationship between the contractor and the hiring company. It clarifies that the contractor is solely authorized to represent and promote the company's products or services within a specific region or industry. This type of agreement ensures focus and dedication from the contractor, as they become the primary point of contact for potential customers. 4. Non-Exclusive Agreement: In contrast to an exclusive agreement, a non-exclusive agreement permits the contractor to work with multiple companies concurrently, even those offering similar products or services. This type of agreement allows for greater flexibility and diversification of income streams for the contractor. Maricopa Arizona Self-Employed Independent Contractor Employment Agreements with commission for new business provide benefits to both the contractor and the hiring company. The contractor gains the freedom to manage their work schedule, potential to earn uncapped income based on performance, and the opportunity to build valuable sales and marketing skills. For the company, it offers cost-effective access to skilled professionals while limiting the financial risk associated with employing full-time sales personnel. In summary, a Maricopa Arizona Self-Employed Independent Contractor Employment Agreement with commission for new business establishes a mutually beneficial relationship between the contractor and the hiring company. It motivates the contractor to drive sales growth, while providing the company with a flexible and results-driven sales force.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acuerdo de empleo de contratista independiente para trabajadores por cuenta propia: comisión por nuevos negocios - Self-Employed Independent Contractor Employment Agreement - commission for new business

Description

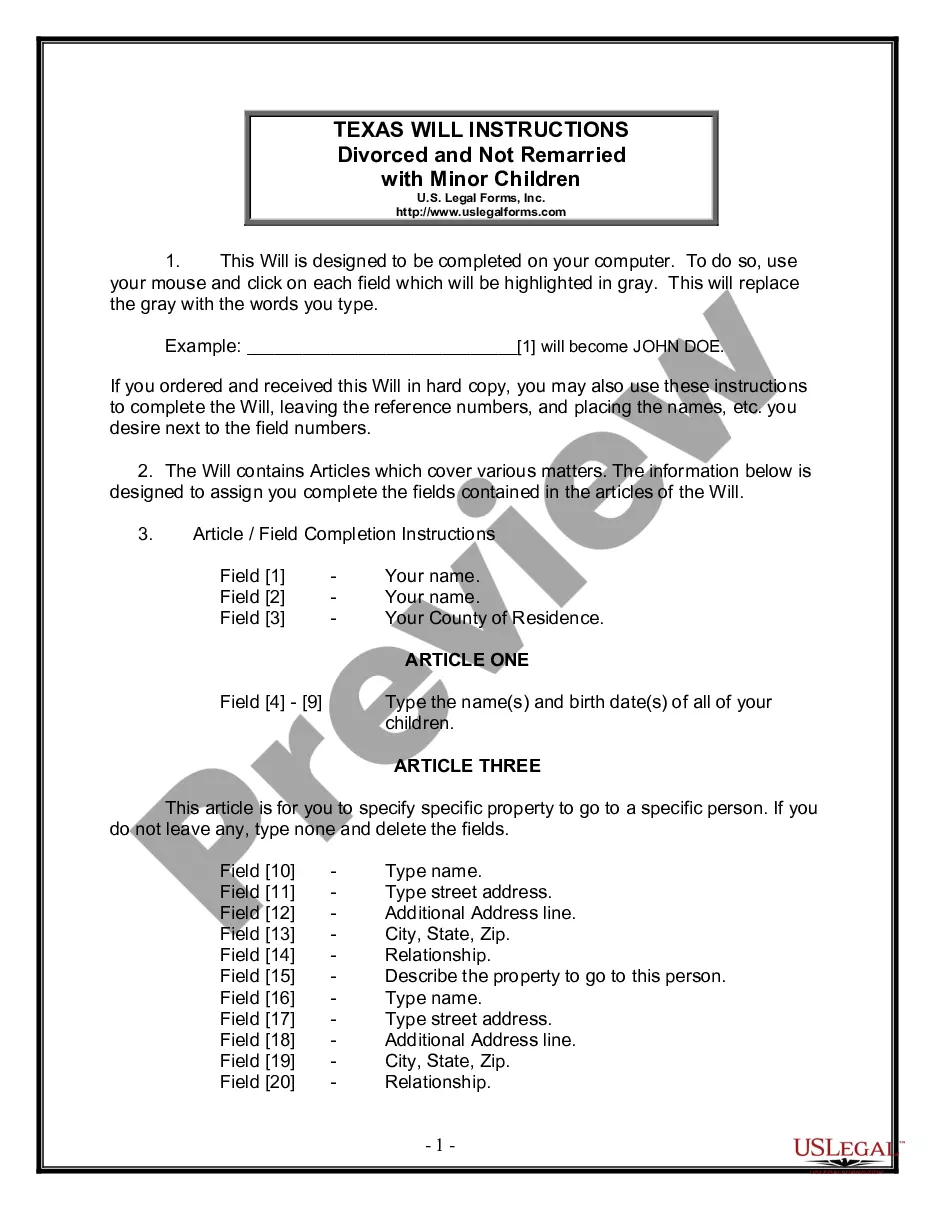

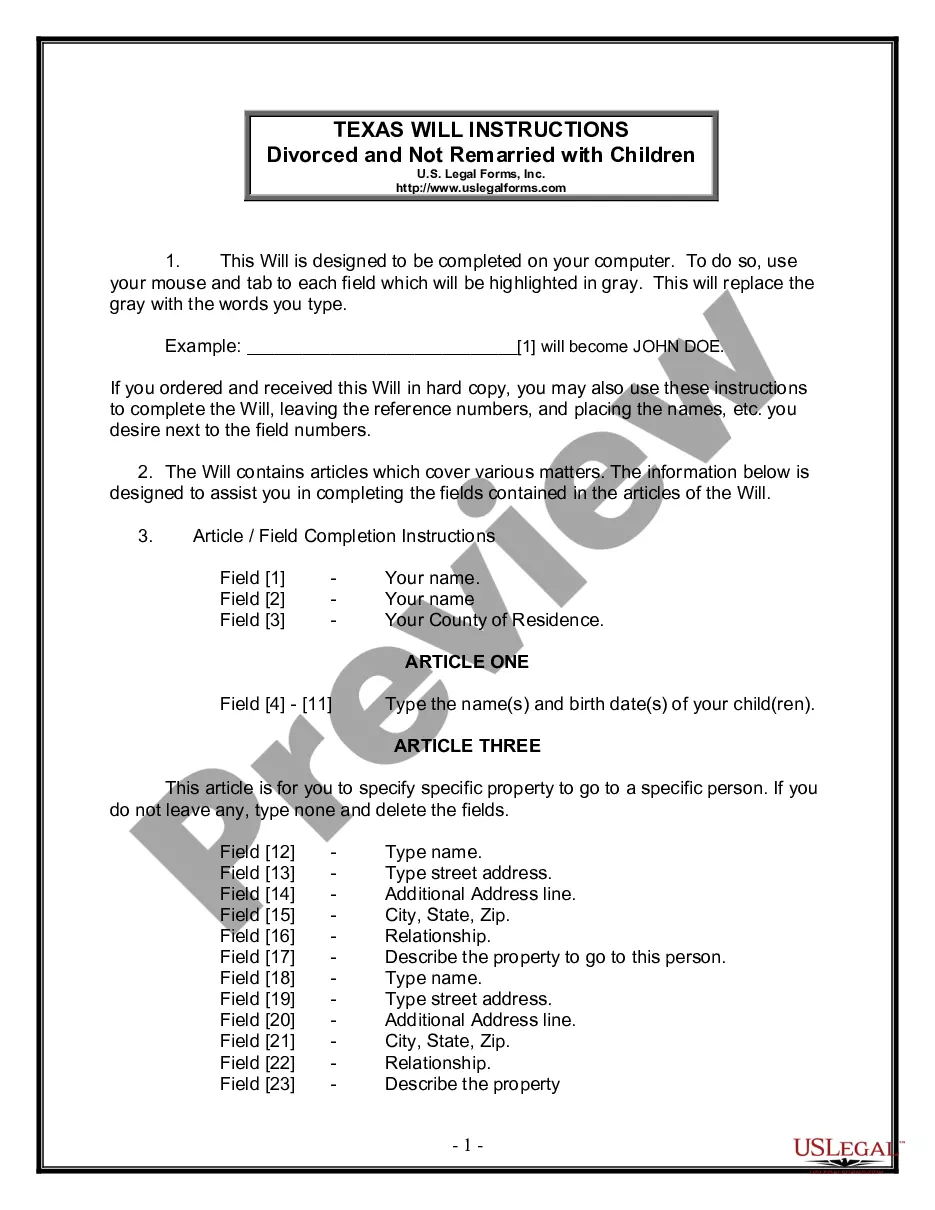

How to fill out Maricopa Arizona Acuerdo De Empleo De Contratista Independiente Para Trabajadores Por Cuenta Propia: Comisión Por Nuevos Negocios?

Draftwing documents, like Maricopa Self-Employed Independent Contractor Employment Agreement - commission for new business, to manage your legal affairs is a challenging and time-consumming task. Many circumstances require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can acquire your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal documents created for different scenarios and life situations. We make sure each form is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal problems compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how straightforward it is to get the Maricopa Self-Employed Independent Contractor Employment Agreement - commission for new business form. Go ahead and log in to your account, download the form, and customize it to your needs. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before getting Maricopa Self-Employed Independent Contractor Employment Agreement - commission for new business:

- Ensure that your document is compliant with your state/county since the rules for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Maricopa Self-Employed Independent Contractor Employment Agreement - commission for new business isn’t something you were hoping to find, then use the header to find another one.

- Sign in or register an account to begin using our service and get the form.

- Everything looks great on your side? Click the Buy now button and select the subscription plan.

- Select the payment gateway and enter your payment information.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to locate and buy the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!