The Miami-Dade Florida Commercial Lease Agreement for Restaurant is a legally binding document that outlines the terms and conditions between the landlord and tenant for a commercial property intended for use as a restaurant in Miami-Dade County, Florida. This agreement ensures that both parties understand their rights and responsibilities throughout the lease term, providing a foundation for a successful landlord-tenant relationship. Key terms and clauses typically included in a Miami-Dade Florida Commercial Lease Agreement for Restaurant include: 1. Parties Involved: Clearly identifies the landlord, tenant, and any additional guarantors involved in the lease agreement. 2. Premises Description: Provides a detailed description of the commercial property, including the address, square footage, and any specific areas reserved for the restaurant's use (e.g., dining area, kitchen, storage space). 3. Lease Term: Specifies the duration of the lease agreement, including the start and end dates. It may also include provisions for lease renewal or termination. 4. Rent and Deposit: Outlines the rent amount, how it will be paid (monthly, quarterly, etc.), and the due date. It may also cover details regarding rent escalation and late payment penalties. Additionally, the agreement typically includes a security deposit clause, specifying the amount required and the conditions for its return. 5. Permitted Use: Defines the permissible use of the commercial space solely as a restaurant and may include any restrictions related to the type of cuisine, liquor license, or operating hours. 6. Maintenance and Repairs: Clarifies the responsibilities of the landlord and tenant regarding property maintenance, repairs, and any associated costs. It may detail obligations such as maintaining HVAC systems, plumbing, electrical wiring, or structural elements. 7. Improvements and Alterations: Determines whether the tenant is allowed to make any modifications or improvements to the property and under what conditions. It may address issues such as obtaining necessary permits, restoration at the end of the lease, or potential rent adjustments. 8. Utilities and Operating Expenses: Specifies which party is responsible for paying utilities (water, electricity, gas, etc.) and other operating expenses associated with the property, such as property taxes, insurance, or common area maintenance (CAM) fees. 9. Insurance Requirements: Outlines the type and minimum amount of insurance coverage required by the tenant and any additional insurance requirements, such as naming the landlord as an additional insured. 10. Indemnification and Liability: Establishes the tenant's liability for injuries or damages that occur on the leased premises and outlines the process of indemnification. 11. Assignment and Subleasing: Addresses the tenant's rights or limitations regarding assigning the lease or subleasing the premises. 12. Default and Remedies: Details the consequences of a default by either party, including eviction proceedings or additional fees. Types of Miami-Dade Florida Commercial Lease Agreements for Restaurants may include variations based on factors such as duration (short-term or long-term lease), specific terms unique to the restaurant industry (e.g., provisions for outdoor seating, drive-thru facilities), or leasing in different areas of Miami-Dade County (e.g., Miami Beach, Coral Gables, or Aventura). Each type aims to cater to specific requirements or preferences of tenants and landlords in different circumstances to ensure a mutually beneficial lease arrangement.

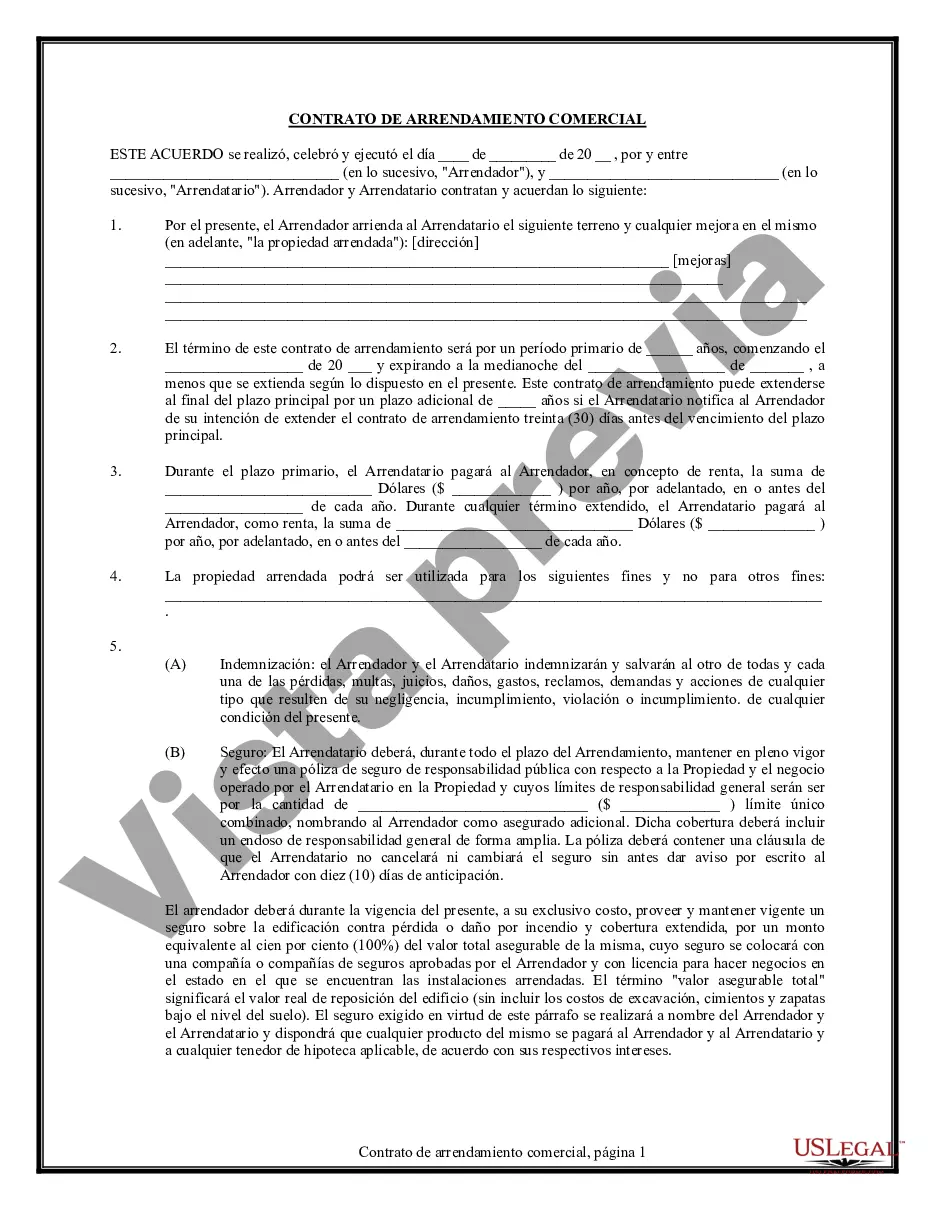

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Contrato de Arrendamiento Comercial para Restaurante - Commercial Lease Agreement for Restaurant

State:

Multi-State

County:

Miami-Dade

Control #:

US-807LT-2

Format:

Word

Instant download

Description

Lease of property for commercial purposes. Average complexity.

The Miami-Dade Florida Commercial Lease Agreement for Restaurant is a legally binding document that outlines the terms and conditions between the landlord and tenant for a commercial property intended for use as a restaurant in Miami-Dade County, Florida. This agreement ensures that both parties understand their rights and responsibilities throughout the lease term, providing a foundation for a successful landlord-tenant relationship. Key terms and clauses typically included in a Miami-Dade Florida Commercial Lease Agreement for Restaurant include: 1. Parties Involved: Clearly identifies the landlord, tenant, and any additional guarantors involved in the lease agreement. 2. Premises Description: Provides a detailed description of the commercial property, including the address, square footage, and any specific areas reserved for the restaurant's use (e.g., dining area, kitchen, storage space). 3. Lease Term: Specifies the duration of the lease agreement, including the start and end dates. It may also include provisions for lease renewal or termination. 4. Rent and Deposit: Outlines the rent amount, how it will be paid (monthly, quarterly, etc.), and the due date. It may also cover details regarding rent escalation and late payment penalties. Additionally, the agreement typically includes a security deposit clause, specifying the amount required and the conditions for its return. 5. Permitted Use: Defines the permissible use of the commercial space solely as a restaurant and may include any restrictions related to the type of cuisine, liquor license, or operating hours. 6. Maintenance and Repairs: Clarifies the responsibilities of the landlord and tenant regarding property maintenance, repairs, and any associated costs. It may detail obligations such as maintaining HVAC systems, plumbing, electrical wiring, or structural elements. 7. Improvements and Alterations: Determines whether the tenant is allowed to make any modifications or improvements to the property and under what conditions. It may address issues such as obtaining necessary permits, restoration at the end of the lease, or potential rent adjustments. 8. Utilities and Operating Expenses: Specifies which party is responsible for paying utilities (water, electricity, gas, etc.) and other operating expenses associated with the property, such as property taxes, insurance, or common area maintenance (CAM) fees. 9. Insurance Requirements: Outlines the type and minimum amount of insurance coverage required by the tenant and any additional insurance requirements, such as naming the landlord as an additional insured. 10. Indemnification and Liability: Establishes the tenant's liability for injuries or damages that occur on the leased premises and outlines the process of indemnification. 11. Assignment and Subleasing: Addresses the tenant's rights or limitations regarding assigning the lease or subleasing the premises. 12. Default and Remedies: Details the consequences of a default by either party, including eviction proceedings or additional fees. Types of Miami-Dade Florida Commercial Lease Agreements for Restaurants may include variations based on factors such as duration (short-term or long-term lease), specific terms unique to the restaurant industry (e.g., provisions for outdoor seating, drive-thru facilities), or leasing in different areas of Miami-Dade County (e.g., Miami Beach, Coral Gables, or Aventura). Each type aims to cater to specific requirements or preferences of tenants and landlords in different circumstances to ensure a mutually beneficial lease arrangement.

Free preview