A Montgomery Maryland Commercial Lease Agreement for Tenant refers to a legally binding contract between a landlord and a tenant concerning the rental of a commercial property located in Montgomery County, Maryland. This agreement outlines the terms and conditions that both parties agreed upon, ensuring a smooth and mutually beneficial leasing arrangement. Keywords: 1. Montgomery Maryland: This refers to the specific location of the commercial lease agreement, which is in Montgomery County, Maryland. 2. Commercial Lease Agreement: It emphasizes that the lease is for a commercial property, rather than a residential one. 3. Tenant: This indicates that the agreement pertains to the tenant, who is the individual or business entity renting the property. 4. Landlord: The landlord refers to the property owner or the authorized representative who is leasing the commercial space to the tenant. Montgomery Maryland encompasses various types of commercial lease agreements, each designed to cater to specific tenant needs and property types. Some common types include: 1. Triple Net Lease Agreement: This type of agreement places the responsibility for property expenses such as taxes, insurance, and maintenance on the tenant. In addition to the monthly rent, the tenant is responsible for covering these costs. 2. Full-Service Lease Agreement: In this type of lease, the landlord covers most or all of the property expenses, including utilities, maintenance, taxes, and insurance. The tenant pays a higher rent to account for these included services. 3. Gross Lease Agreement: Here, the tenant pays a fixed monthly rent, and all property expenses are included in the rent. The landlord takes care of expenses, such as utilities, taxes, insurance, and maintenance, relieving the tenant of these responsibilities. 4. Modified Gross Lease Agreement: This type of lease combines elements of both the triple net and gross lease agreements. While some expenses, such as taxes and insurance, are included in the rent (similar to a gross lease), the tenant may be responsible for utilities and maintenance costs. 5. Percentage Lease Agreement: Typically used for retail spaces, this agreement includes a base rent along with a percentage of the tenant's sales or gross revenue. It is important to note that these are general classifications, and the terms and conditions of each commercial lease agreement may vary depending on the specific negotiations between the landlord and tenant. Consulting with legal professionals and understanding local laws and regulations is crucial to ensure a comprehensive and fair lease agreement.

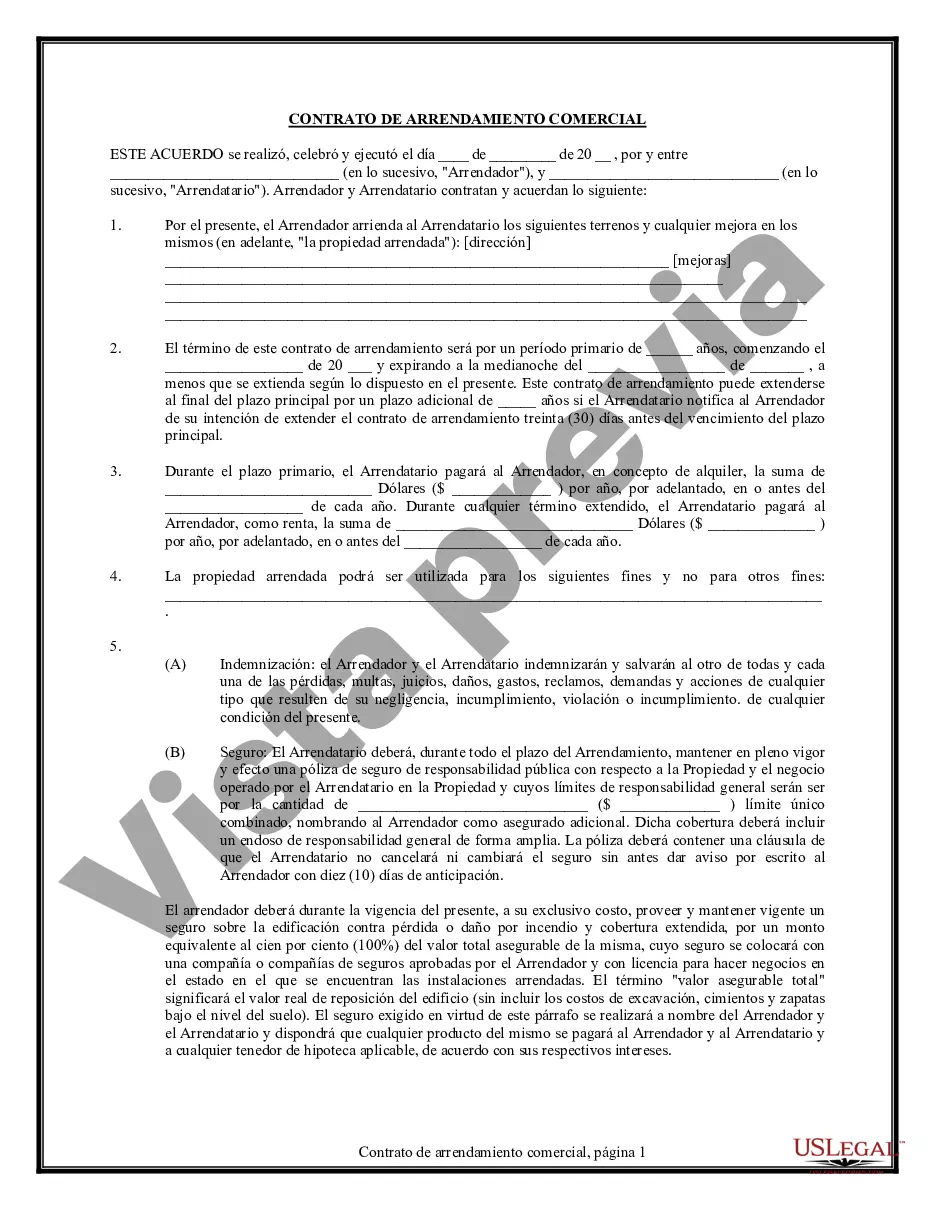

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Montgomery Maryland Contrato de Arrendamiento Comercial para Inquilino - Commercial Lease Agreement for Tenant

Description

How to fill out Montgomery Maryland Contrato De Arrendamiento Comercial Para Inquilino?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life sphere, locating a Montgomery Commercial Lease Agreement for Tenant meeting all regional requirements can be exhausting, and ordering it from a professional attorney is often costly. Numerous web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. In addition to the Montgomery Commercial Lease Agreement for Tenant, here you can find any specific form to run your business or individual affairs, complying with your county requirements. Professionals check all samples for their validity, so you can be sure to prepare your paperwork properly.

Using the service is pretty simple. If you already have an account on the platform and your subscription is valid, you only need to log in, choose the required form, and download it. You can retain the file in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be a few more steps to complete before you obtain your Montgomery Commercial Lease Agreement for Tenant:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Search for another form utilizing the corresponding option in the header.

- Click Buy Now when you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Montgomery Commercial Lease Agreement for Tenant.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!

Form popularity

FAQ

Pasos para hacer un contrato de alquiler correctamente Recopila informacion. En plena era de la transformacion digital estar informado es mas facil que nunca.Analiza el mercado.Establece la duracion del contrato de alquiler.Los firmantes.Condiciones pactadas previamente.Revisa el contrato antes de firmar.

Caracteristicas y elementos: La identificacion con nombre completo y cedula del arrendador (propietario) La identificacion del arrendatario. La identificacion plena del bien objeto de arrendamiento. Determinacion del valor del canon o valor mensual del arrendamiento.

Primera. Don 20262026202620262026202620262026202620262026.., cede en arrendamiento a Don 2026202620262026202620262026.. el uso del local descrito, por el plazo de 20262026. anos, a contar desde el dia de la fecha del presente contrato, en que dicho local se pone a disposicion del arrendatario, quien lo recibe, asi como las llaves.

Caracteristicas y elementos: La identificacion con nombre completo y cedula del arrendador (propietario) La identificacion del arrendatario. La identificacion plena del bien objeto de arrendamiento. Determinacion del valor del canon o valor mensual del arrendamiento.

¿Como se llena un contrato de arrendamiento sin fiador? Lugar y fecha. Se debe definir cuando y donde se revisara el documento para su firma. Datos personales. Informacion de la propiedad. Duracion. Valor y revision de la renta. Valor de la fianza. Firma del arrendador y arrendatario.

¿Como rentar un local en una plaza comercial? Explora la zona de tu interes. Define el giro del negocio. Haz una comparacion de todas las opciones. Revisa el contrato de arrendamiento. Notifica a las autoridades la apertura de tu negocio.

Elementos del Contrato de Arrendamiento de Local Comercial Nombre y datos generales del propietario. Nombre y datos generales de la(s) persona(s) (arrendatario) Ubicacion y descripcion del inmueble que se van a rentar. El objeto o proposito del contrato (dar en arrendamiento el inmueble).

Como redactar un contrato de arrendamiento DNI o algun documento equivalente de identidad, en el caso de que sean extranjeros. Nombres, apellidos, y estado civil de las partes. Fecha y lugar en la que se realiza el contrato. Datos del inmueble en alquiler, generalmente con la direccion es suficiente.

A continuacion te presentamos los 4 elementos basicos que conforman un contrato de arrendamiento: Informacion basica. El primer elemento que un contrato de arrendamiento debe llevar es la informacion basica, es decir, toda la informacion que aclare la intencion del contrato.Declaraciones.Clausulas.Firmas y anexos.

¿Cuales son las clausulas de un contrato de arrendamiento casa habitacion? Fecha de la firma del contrato. Nombre de las partes involucradas (arrendador y arrendatario) Direccion de la propiedad. Descripcion detallada con caracteristicas fisicas y funcionales de la propiedad incluyendo servicios.