Title: Understanding the Collin Texas Withdrawal of Assumed Name for Corporation Introduction: Collin County, located in the state of Texas, has certain legal requirements for corporations that operate under assumed names within its jurisdiction. When a corporation no longer wishes to conduct business under an assumed name, it must complete the Collin Texas Withdrawal of Assumed Name for Corporation process. This article aims to provide a comprehensive overview of this procedure, highlighting its importance, relevant keywords, and potential types of withdrawal. Key terms: Collin Texas, withdrawal of assumed name, corporation, legal requirements, assumed name, business, jurisdiction, process, importance. 1. Definition and Purpose of Collin Texas Withdrawal of Assumed Name for Corporation: — Explanation of what an assumed name is for a corporation. — Importance of filing a withdrawal to legally stop conducting business under the assumed name. — Consequences of not completing the withdrawal process. 2. Legal Requirements: — The necessity of adhering to Collin County law when operating under an assumed name. — Specific documentation or information required for withdrawal. — Timeframes and deadlines for filing the withdrawal. 3. Procedure for Withdrawal: — Step-by-step explanation of the withdrawal process. — Filling out the withdrawal form accurately and completely. — Payment of any required fees associated with the process. 4. Types of Collin Texas Withdrawal of Assumed Name for Corporation: 4.1 Voluntary Withdrawal: — Description and relevance of voluntary withdrawal. — Reasons for a corporation opting for voluntary withdrawal. — Possible benefits or implications for voluntarily withdrawing an assumed name. 4.2 Dissolution-Related Withdrawal: — Explanation of dissolution-related withdrawal. — Discussing scenarios where a corporation may withdraw its assumed name due to dissolution. — How dissolution affects the withdrawal process and the corporation's ongoing obligations. 5. Common Mistakes to Avoid: — Highlighting common errors made during the withdrawal process. — Suggestions to prevent delays or rejections in the withdrawal application. — Importance of seeking legal advice or guidance to ensure a smooth withdrawal. 6. Consequences of Failing to Withdraw: — Negative implications of not completing the withdrawal process appropriately. — Legal ramifications or penalties for non-compliance. — Potential impact on the corporation's reputation and liability. Conclusion: Completing the Collin Texas Withdrawal of Assumed Name for Corporation is vital for businesses intending to cease operations under an assumed name within Collin County. By following the outlined procedure and meeting the necessary legal requirements, a corporation can avoid potential complications and ensure a seamless transition. Seek professional assistance or refer to authoritative sources to ensure accurate and up-to-date information regarding this withdrawal process.

Collin Texas Withdrawal of Assumed Name for Corporation

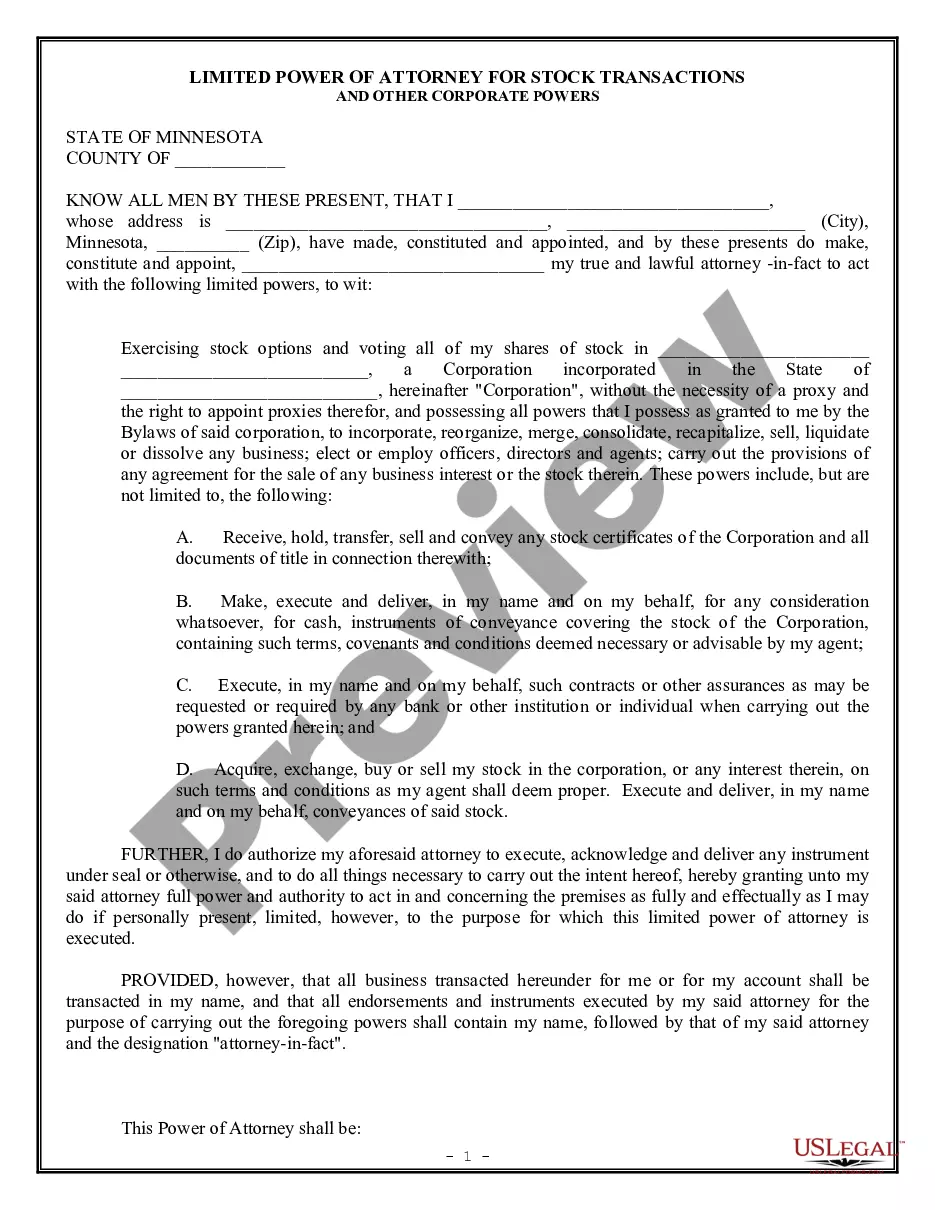

Description

How to fill out Collin Texas Withdrawal Of Assumed Name For Corporation?

How much time does it usually take you to create a legal document? Since every state has its laws and regulations for every life situation, locating a Collin Withdrawal of Assumed Name for Corporation meeting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online collection of templates, grouped by states and areas of use. Apart from the Collin Withdrawal of Assumed Name for Corporation, here you can get any specific form to run your business or individual affairs, complying with your county requirements. Experts check all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can retain the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Collin Withdrawal of Assumed Name for Corporation:

- Check the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Choose the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Collin Withdrawal of Assumed Name for Corporation.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!