Title: Understanding San Antonio, Texas Demand for Payment of Account by Business to Debtor Introduction: San Antonio, Texas, a vibrant city in the southern United States, is known for its rich history, cultural landmarks, and growing business scene. Among the various legal processes involving businesses, one crucial aspect is the "Demand for Payment of Account by Business to Debtor." In this article, we will delve into the details of this process, its significance, and potential variations of demand letters that businesses may use in San Antonio, Texas. 1. What is a Demand for Payment of Account? A Demand for Payment of Account is a formal communication sent by a business to a debtor seeking payment for goods or services rendered. It aims to express the creditor's intent to collect outstanding debts, often providing details of the account, the amount owed, payment terms, and a reasonable deadline for payment. 2. Understanding San Antonio, Texas Demand for Payment: San Antonio, Texas, follows specific guidelines and legal requirements for a Demand for Payment of Account. These guidelines ensure that businesses adhere to the legal framework while pursuing the collection of outstanding debts. Comprehending the key elements of a demand letter is essential for businesses in San Antonio. 3. Types of San Antonio, Texas Demand for Payment of Account by Business to Debtor: a) Initial Demand Letter: This is the initial communication sent by a business to a debtor seeking payment for an outstanding account. It typically includes a detailed account overview, the total amount owed, payment due date, and consequences of non-payment. b) Follow-up Demand Letter: In scenarios where the debtor fails to respond to the initial demand, a follow-up demand letter is sent. It emphasizes the urgency of payment, the potential consequences of non-payment, and may provide additional payment options. c) Final Notice of Demand: If previous demand letters have failed to generate a response or payment, a final notice of demand is sent to the debtor. This letter often informs the debtor of potential legal action that the creditor may pursue in the event of non-payment. 4. Key Elements of a San Antonio, Texas Demand for Payment of Account: a) Creditor's Information: The demand letter should clearly state the business's name, contact information, and a point of contact. b) Debtor's Information: Details about the debtor, including their name, contact information, account number, and any relevant account details, must be provided. c) Amount Due: The demand letter should explicitly state the total amount due, along with any incurred interest or applicable fees. d) Payment Options and Terms: Discussing various payment options (such as online payments, checks, or credit card payments) and specifying acceptable payment terms (e.g., 30 days from the date of the letter) is crucial. e) Consequences: The demand letter should outline the consequences of non-payment, which may include legal action, credit damage, or referral to a collection agency. Conclusion: San Antonio, Texas Demand for Payment of Account by Business to Debtor plays a significant role in ensuring timely payments and resolving outstanding debts within the local legal framework. By familiarizing themselves with the different types of demand letters and the key elements they should contain, businesses in San Antonio can protect their financial interests while maintaining professional relationships with debtors.

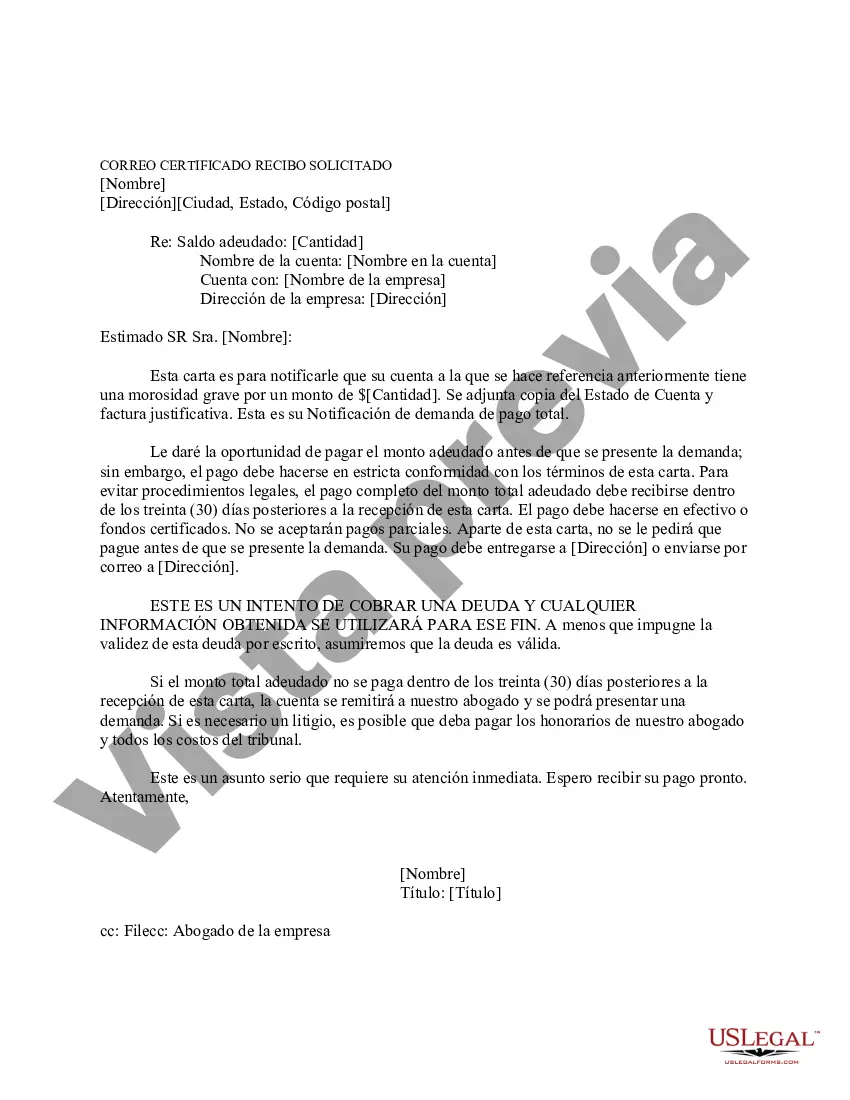

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Demanda de Pago de Cuenta por Empresa a Deudor - Demand for Payment of Account by Business to Debtor

Description

How to fill out San Antonio Texas Demanda De Pago De Cuenta Por Empresa A Deudor?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business objective utilized in your county, including the San Antonio Demand for Payment of Account by Business to Debtor.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the San Antonio Demand for Payment of Account by Business to Debtor will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to obtain the San Antonio Demand for Payment of Account by Business to Debtor:

- Make sure you have opened the proper page with your localised form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the suitable subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the San Antonio Demand for Payment of Account by Business to Debtor on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!