Maricopa Arizona Form I-9

Description

How to fill out Form I-9?

Laws and statutes in every domain vary from region to region.

If you are not an attorney, it can be straightforward to become confused by different standards when it comes to creating legal paperwork.

To prevent costly legal fees when completing the Maricopa Form I-9, you require an authorized template suitable for your locality.

Complete and sign the document on paper after printing it or do all electronically. This is the simplest and most cost-efficient way to obtain current templates for any legal situations. Find them all with just a few clicks and maintain your documentation in order with US Legal Forms!

- Evaluate the page content to ensure you have located the correct sample.

- Utilize the Preview function or read the form summary if available.

- Search for another document if there are discrepancies with your requirements.

- Employ the Buy Now button to acquire the document once you identify the right one.

- Select one of the subscription options and Log In or create an account.

- Decide how you want to pay for your subscription (using a credit card or PayPal).

- Choose the format you wish to save the file in and click Download.

Form popularity

FAQ

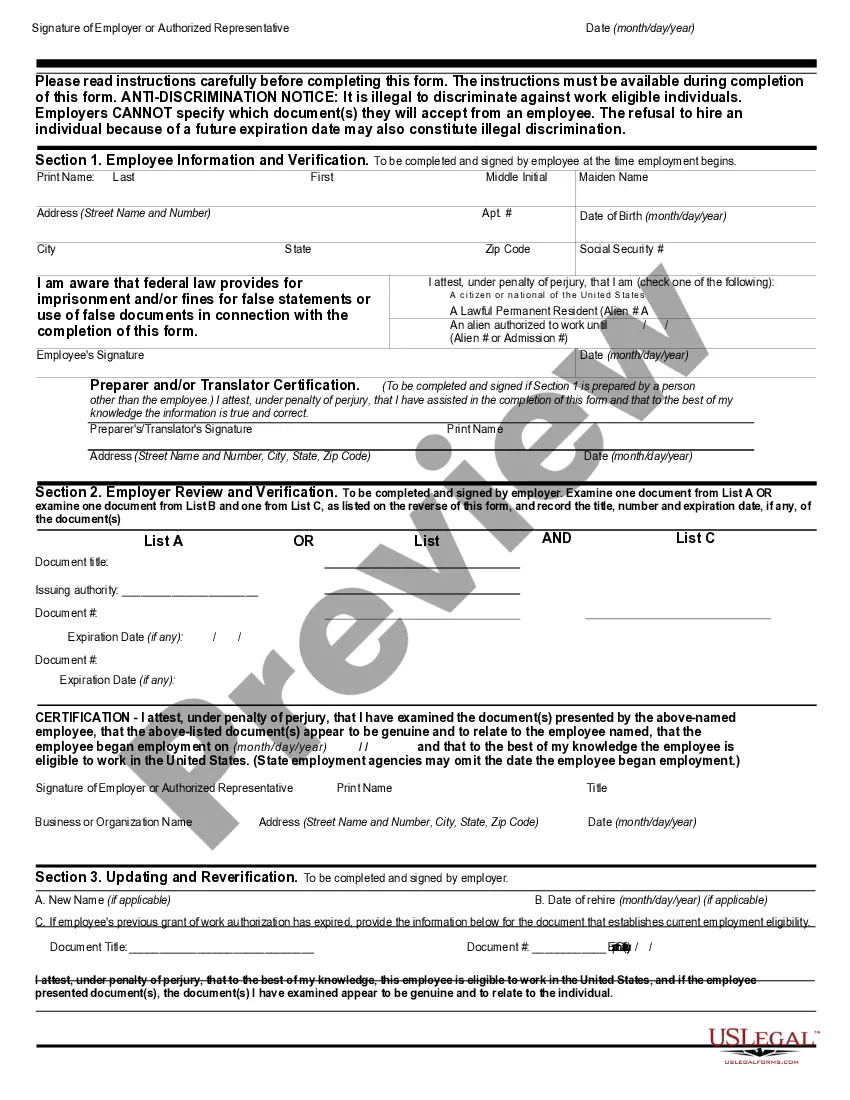

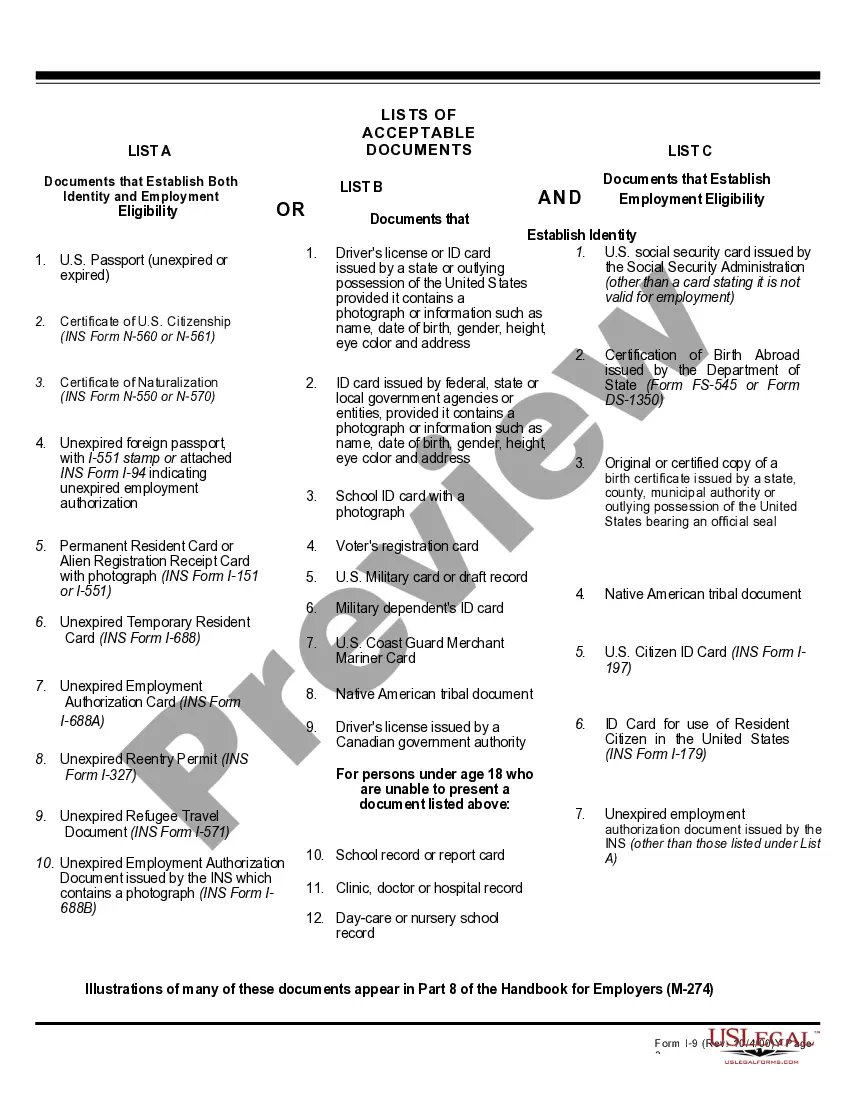

To fill out the Maricopa Arizona Form I-9 correctly, start by providing accurate personal information in Section 1. Next, gather the required identification documents for Section 2, ensuring they meet the necessary criteria. Review your entries for any mistakes, as inaccuracies can lead to complications during employment verification.

To order USCIS forms, you can download them from our website at or call our toll-free number at 1-800-870-3676. You can obtain information about Form I-9 from our website at or by calling 1-888-464-4218.

The most common types of employment forms to complete are: W-4 form (or W-9 for contractors) I-9 Employment Eligibility Verification form. State Tax Withholding form. Direct Deposit form. E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

On Jan. 31, 2020, USCIS published the Form I-9 Federal Register notice announcing a new version of Form I-9, Employment Eligibility Verification, that the Office of Management and Budget approved on Oct.

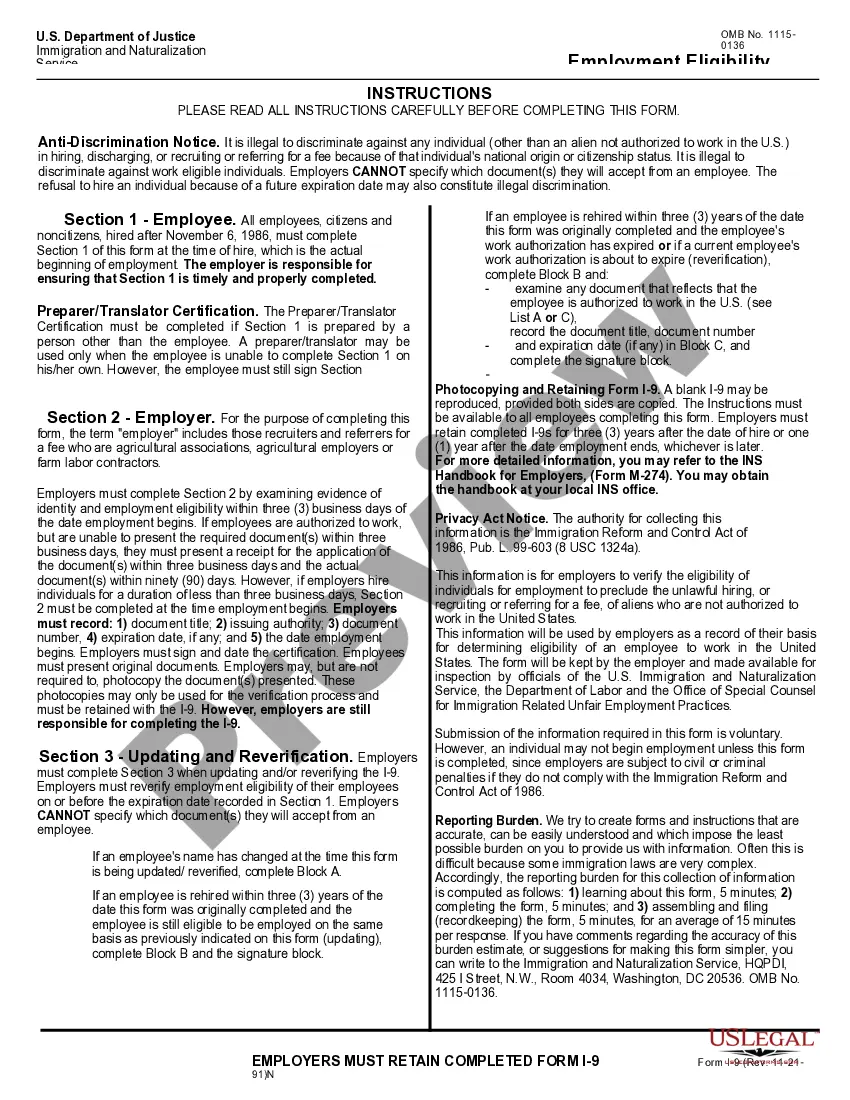

These instructions will assist you in properly completing Form I-9. The employer must ensure that all pages of the instructions and Lists of Acceptable Documents are available, either in print or electronically, to all employees completing this form.

6 Forms Employers Need to Collect for Each New Hire in Arizona Form I-9. All new employees are required to complete section one of the I-9 Form by the end of their first day of work.New Hire Reporting.Form W-4.Form A-4.Notice of Coverage Options.E-Verify.

Here are 8 steps a business will need to take when hiring their first employee in Arizona. Step 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.

Form I-9 must be completed for each newly hired employee, including U.S. citizens, permanent residents, and aliens authorized to work in the United States, to demonstrate the employer's compliance with the law and the employee's work authorization.

Federal law requires that every employer who recruits, refers for a fee, or hires an individual for employment in the U.S. must complete Form I-9, Employment Eligibility Verification. Form I-9 will help you verify your employee's identity and employment authorization.

You are required to complete and retain a Form I-9 for every employee you hire for employment in the United States, except for: Individuals hired on or before Nov. 6, 1986, who are continuing in their employment and have a reasonable expectation of employment at all times. (Some limitations to this exception apply.)