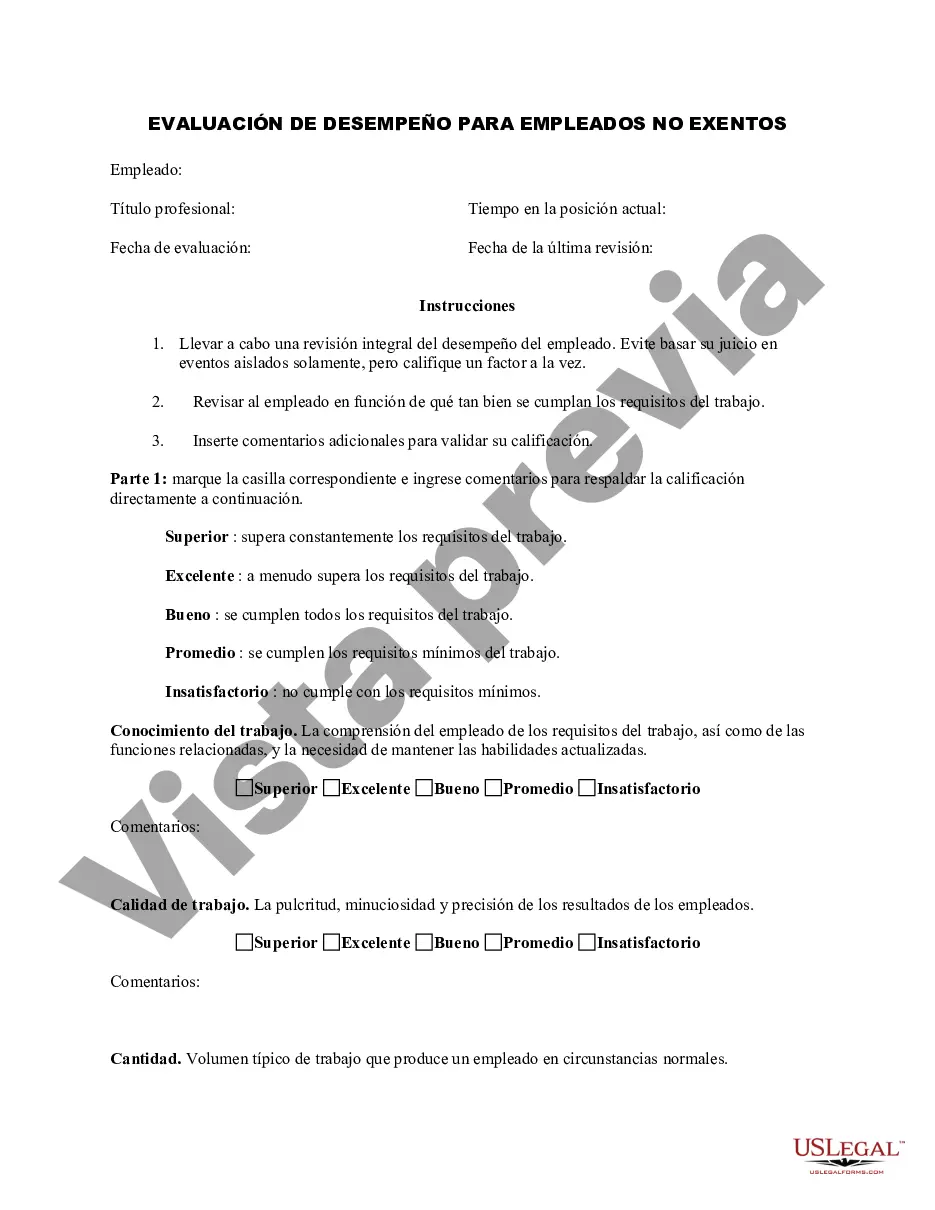

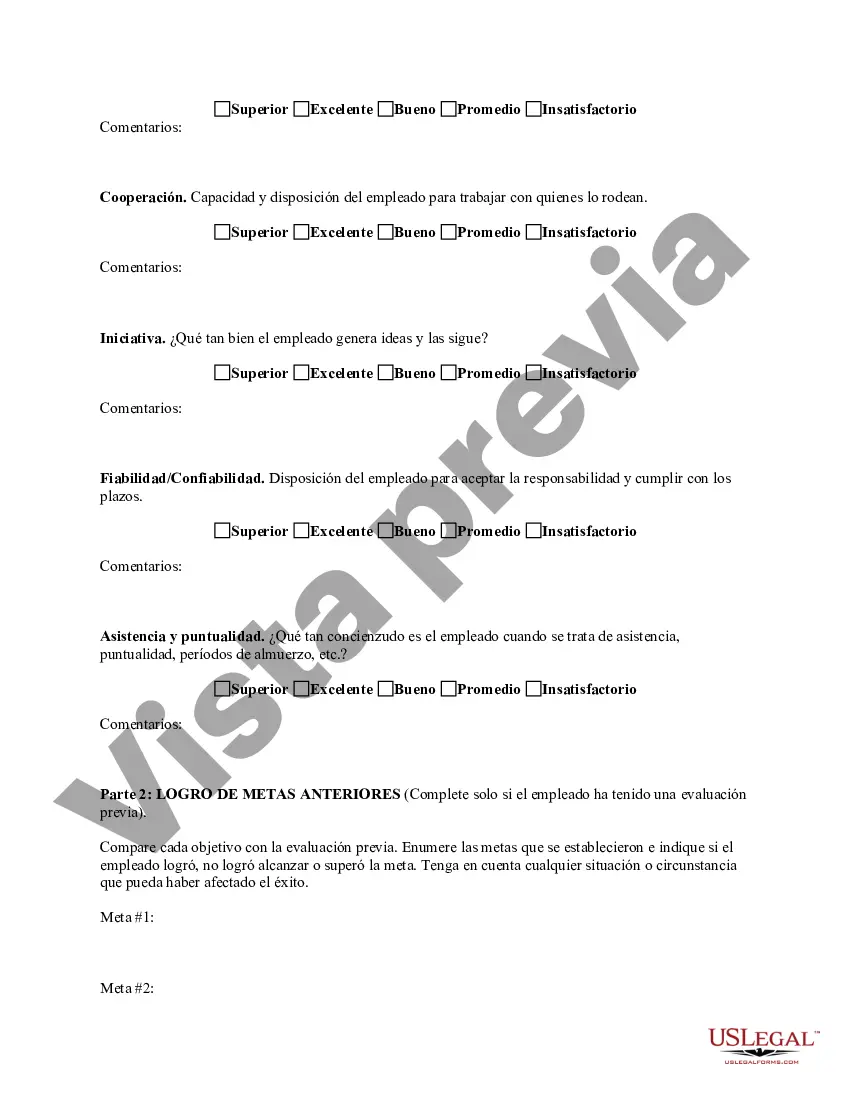

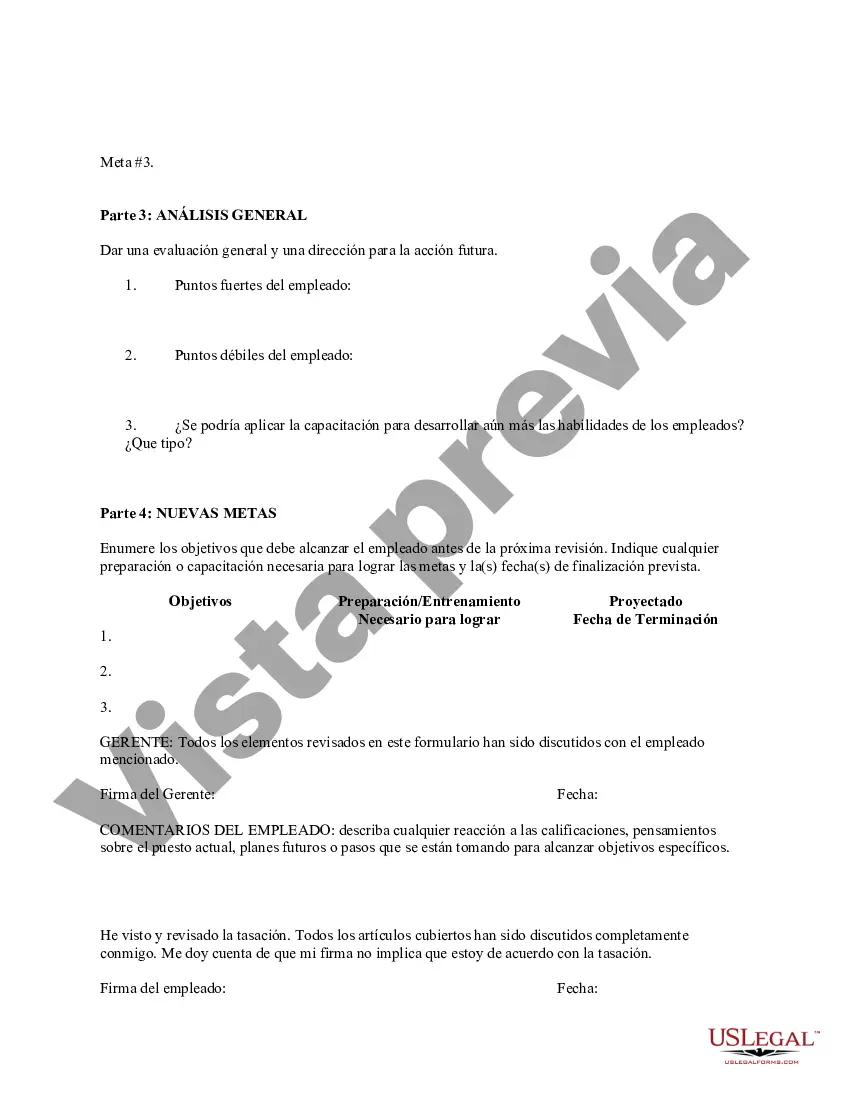

Collin Texas Employee Evaluation Form for Accountant is a comprehensive tool designed to assess the performance, skills, and job-related competencies of accountants working in various organizations. This evaluation form plays a crucial role in evaluating accountants' performance, identifying areas of improvement, and providing feedback for professional growth. The Collin Texas Employee Evaluation Form for Accountant consists of several sections that cover different aspects of an accountant's job responsibilities and performance criteria. These sections may include: 1. Job Performance: This section evaluates an accountant's overall job performance, including their accuracy, attention to detail, quality of work, ability to meet deadlines, and adherence to company policies and procedures. 2. Technical Skills: This section assesses the accountant's technical knowledge and skills pertaining to areas such as financial reporting, taxation, auditing, budgeting, and financial analysis. It evaluates their proficiency in using accounting software, spreadsheets, and other tools relevant to their role. 3. Communication and Collaboration: This section focuses on the accountant's communication skills, both written and verbal, as well as their ability to collaborate effectively with team members, clients, and other stakeholders. It may assess their ability to present financial information, explain complex concepts, and resolve conflicts. 4. Problem-Solving and Decision Making: This section evaluates the accountant's problem-solving skills, critical thinking abilities, and decision-making capabilities. It assesses their ability to analyze financial data, propose viable solutions, make informed decisions, and adapt to changing circumstances. 5. Professionalism and Ethics: This section assesses the accountant's professionalism, integrity, and adherence to ethical standards. It evaluates their ability to maintain confidentiality, handle sensitive information, and comply with relevant laws and regulations. 6. Goal Setting and Self-Development: This section focuses on the accountant's ability to set meaningful goals, prioritize tasks, and actively pursue personal and professional development. It may evaluate their willingness to seek feedback, participate in training programs, and stay updated with industry trends. Different types of Collin Texas Employee Evaluation Forms for Accountants may include variations in the performance criteria, rating scales, or additional sections tailored to meet specific organizational needs. These variations allow organizations to customize the evaluation form according to their industry, size, and unique requirements. Overall, the Collin Texas Employee Evaluation Form for Accountant serves as a valuable tool for assessing and documenting the performance and growth of accountants within organizations in Collin, Texas. It promotes accountability, facilitates constructive feedback, and supports professional development for accounting professionals in the region.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Formulario de evaluación de empleados para contador - Employee Evaluation Form for Accountant

Description

How to fill out Collin Texas Formulario De Evaluación De Empleados Para Contador?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Collin Employee Evaluation Form for Accountant, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Consequently, if you need the recent version of the Collin Employee Evaluation Form for Accountant, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample using the Download button. If you haven't subscribed yet, here's how you can get the Collin Employee Evaluation Form for Accountant:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the right one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Opt for the document format for your Collin Employee Evaluation Form for Accountant and save it.

Once done, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Try it out now!