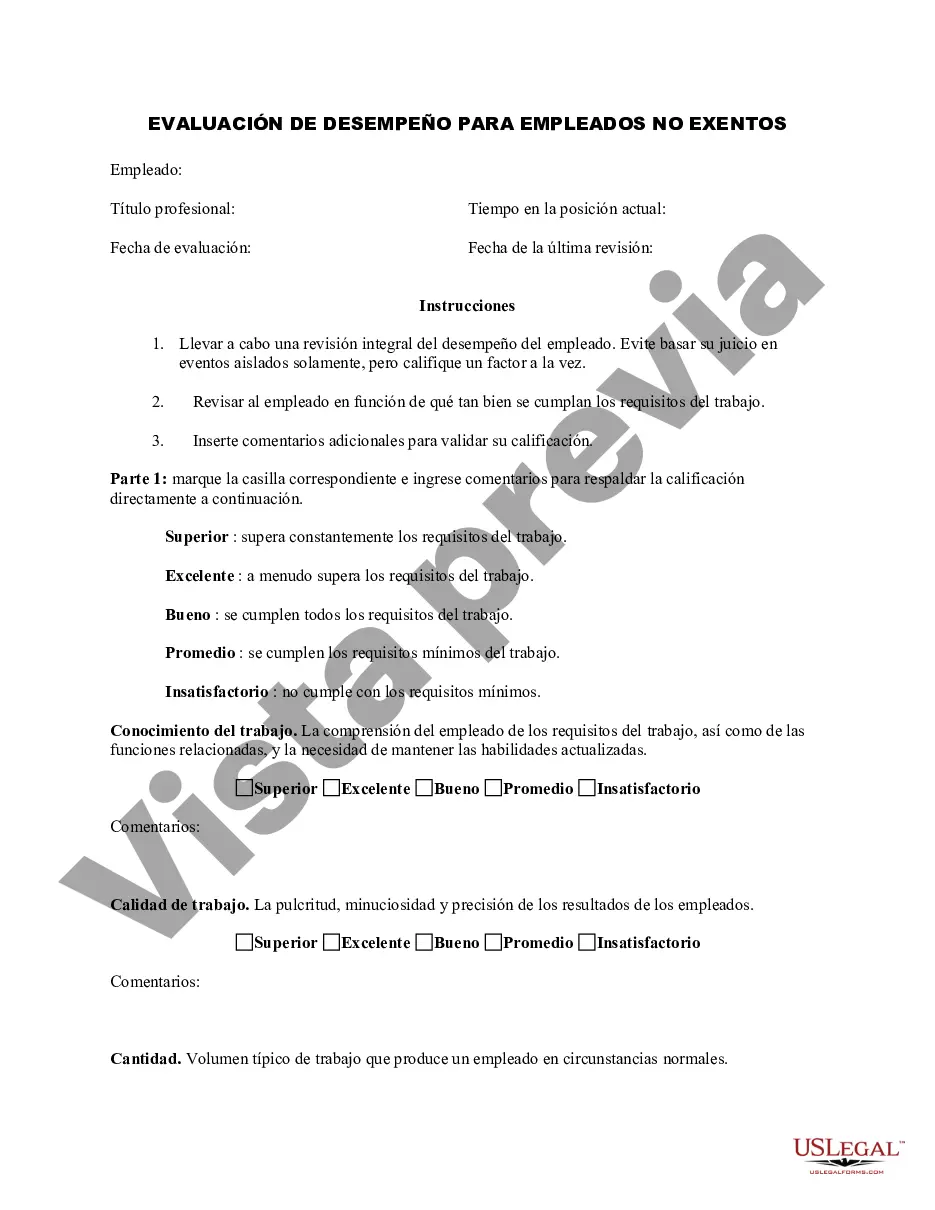

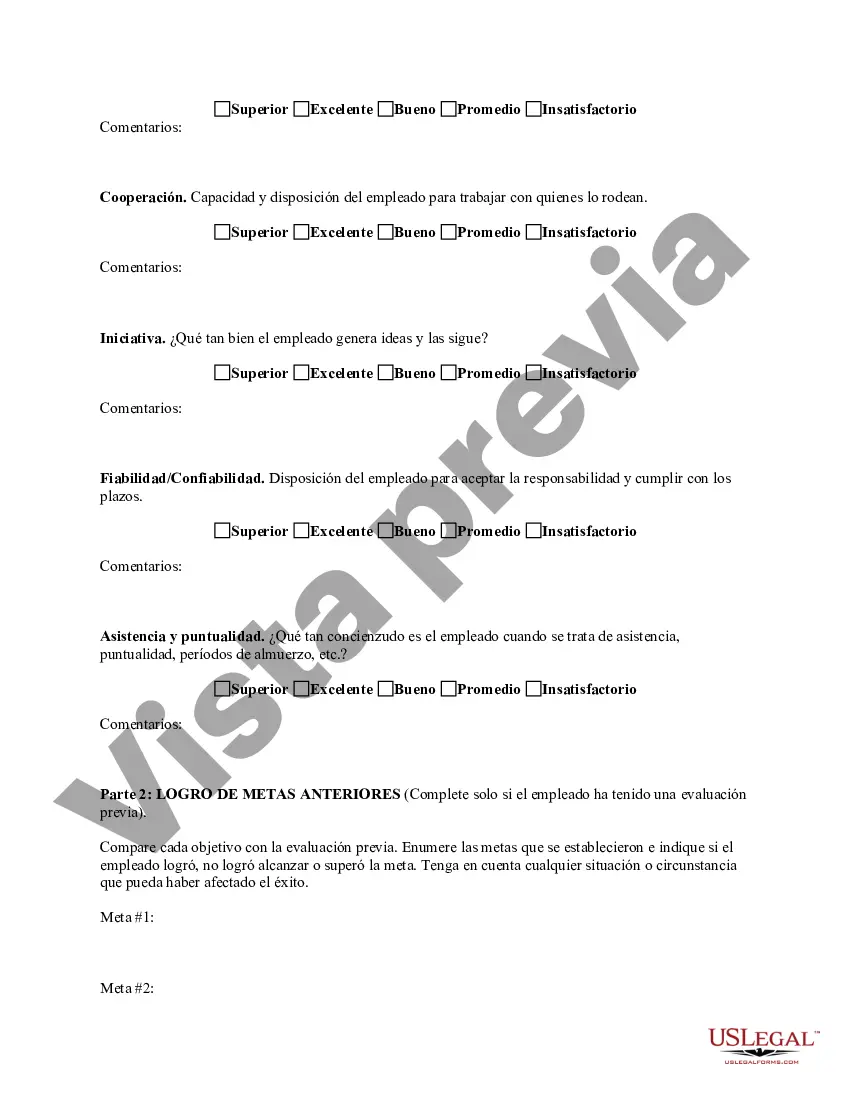

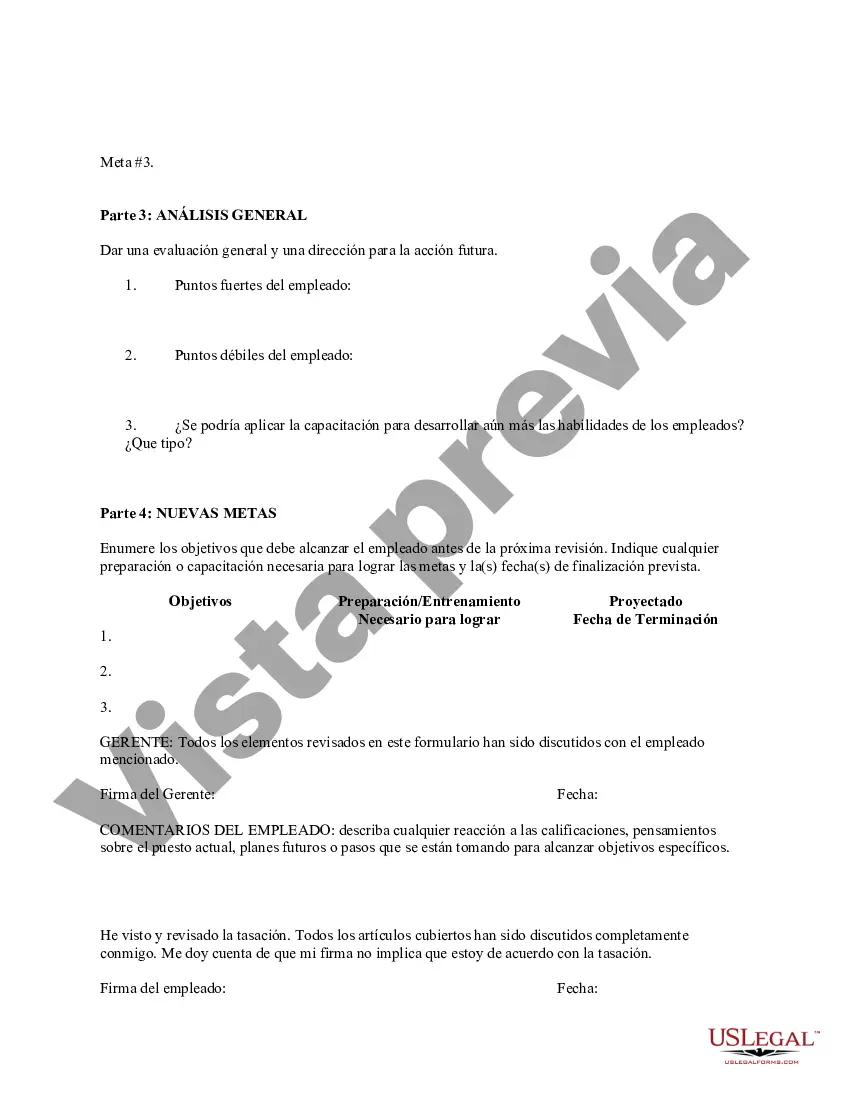

The Harris Texas Employee Evaluation Form for Accountant is a comprehensive tool designed to assess the performance and skills of accountants working in Harris County, Texas. This form captures essential information about the employee's job responsibilities, competence, and overall performance, providing a structured framework for evaluation and feedback. The evaluation form encompasses various sections that cover different aspects of an accountant's duties and performance. These sections include: 1. Job Knowledge and Expertise: This section evaluates the employee's understanding of accounting principles, their ability to interpret financial statements, perform reconciliations, and apply relevant tax laws and regulations. 2. Attention to Detail: This category focuses on the accountant's accuracy and precision in handling financial transactions, maintaining records, and preparing reports. It assesses their ability to identify errors and inconsistencies while ensuring data integrity. 3. Time Management: This section assesses how effectively the accountant manages their workload, meets deadlines, and prioritizes tasks. It may also evaluate their ability to handle multiple projects simultaneously and efficiently utilize available resources. 4. Communication Skills: This category evaluates the clarity, effectiveness, and professionalism of the accountant's written and verbal communication with colleagues, clients, and superiors. It also assesses their ability to actively listen, collaborate, and provide clear explanations when addressing financial matters. 5. Problem-Solving and Analytical Skills: This section examines the employee's problem-solving capabilities, critical thinking abilities, and their aptitude to identify and resolve financial discrepancies or operational inefficiencies. 6. Teamwork and Collaboration: This category assesses the employee's ability to work harmoniously with team members, contribute ideas, and actively participate in achieving collective goals. It evaluates their willingness to share knowledge and support colleagues when necessary. 7. Professionalism and Ethical Conduct: This section focuses on the employee's adherence to professional standards, ethical practices, and compliance with relevant regulations, such as maintaining client confidentiality and avoiding conflicts of interest. 8. Adaptability and Initiative: This category evaluates the employee's willingness to embrace change, adapt to new technologies or software, and take the initiative to improve processes or suggest innovative ideas for enhancing efficiency. Different types of Harris Texas Employee Evaluation Forms for Accountant may exist based on the specific accounting roles within the organization or different job levels. These variations could include forms for staff accountants, senior accountants, or specialized accountants in areas such as tax, auditing, or financial analysis. These forms may have similar evaluation criteria but can be tailored to the unique responsibilities and skill sets required for each role.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Formulario de evaluación de empleados para contador - Employee Evaluation Form for Accountant

Description

How to fill out Harris Texas Formulario De Evaluación De Empleados Para Contador?

Draftwing paperwork, like Harris Employee Evaluation Form for Accountant, to take care of your legal affairs is a tough and time-consumming process. Many situations require an attorney’s participation, which also makes this task expensive. However, you can consider your legal affairs into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents created for a variety of cases and life situations. We make sure each document is compliant with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Harris Employee Evaluation Form for Accountant form. Go ahead and log in to your account, download the template, and personalize it to your needs. Have you lost your document? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before getting Harris Employee Evaluation Form for Accountant:

- Ensure that your form is compliant with your state/county since the regulations for writing legal documents may differ from one state another.

- Find out more about the form by previewing it or reading a brief description. If the Harris Employee Evaluation Form for Accountant isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to start utilizing our service and download the document.

- Everything looks great on your side? Click the Buy now button and select the subscription option.

- Pick the payment gateway and type in your payment details.

- Your form is all set. You can try and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!