Suffolk, New York is a vibrant county situated on Long Island in the state of New York. It is home to a diverse population and offers a range of attractions, amenities, and opportunities. This detailed description will focus on the list of creditors holding the 20 largest secured claims in Suffolk, New York. Please note that the information provided below is applicable post-2005 and excludes Chapter 7 or 13 cases. In Suffolk, New York, the list of creditors holding the 20 largest secured claims represents individuals or entities who have outstanding debts that are secured by collateral. Secured claims are debts that have specific assets (collateral) attached to them, which can be used to repay the debt in case of default. These claims provide creditors with a higher level of protection compared to unsecured claims. The 20 largest secured claims in Suffolk, New York can encompass various types, including but not limited to: 1. Mortgage Lenders: These are financial institutions or private lenders who hold mortgages on properties in Suffolk, New York. They have the right to foreclose on these properties in case of loan default. 2. Auto Lenders: Auto loans are common secured claims held by lenders in Suffolk, New York. These loans are secured by the vehicles themselves, and lenders can repossess the vehicles if borrowers fail to make payments. 3. Equipment Financing Companies: Businesses in Suffolk, New York often secure loans for purchasing equipment required for their operations. These lenders hold secured claims against the equipment, enabling them to repossess it in the event of non-payment. 4. Personal Property Lenders: Some lenders specialize in providing secured loans against personal property such as jewelry, artwork, or valuable assets. They hold secured claims by securing the loans with the respective items. 5. Construction Loans: Builders and contractors in Suffolk, New York may have secured loans from financial institutions or private lenders to fund construction projects. These lenders have claims secured by the underlying property. 6. Commercial Real Estate Loans: Large-scale commercial properties like office buildings or shopping centers often require substantial financing. These loans are secured by the properties themselves and are held by various lenders. 7. Agriculture Financing Institutions: Suffolk, New York is known for its agricultural industry. Farms and agricultural businesses may secure loans for land purchases, machinery, or livestock. These loans create secured claims against the specific assets involved. 8. Collateralized Business Loans: Businesses in Suffolk, New York may seek loans and secure them with specific assets as collateral. These claims can be held by banks or other lending institutions. 9. Boat and Yacht Lenders: Suffolk, New York's proximity to the Atlantic Ocean and Long Island Sound makes it a popular destination for boating enthusiasts. Lenders specializing in boat and yacht loans may hold secured claims on vessels. 10. Aviation Financing Companies: Suffolk, New York is also home to several airports and aviation-related activities. Lenders who provide financing for aircraft purchases may possess secured claims against these assets. It is essential to note that individuals and entities on the list of creditors holding the 20 largest secured claims in Suffolk, New York post-2005 can vary based on the specifics of each case and the prevailing economic conditions. These claims play a significant role in bankruptcy proceedings or debt restructuring efforts, ensuring that creditors maintain a certain level of security while attempting to recover their loans.

Suffolk New York List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005

Description

How to fill out Suffolk New York List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

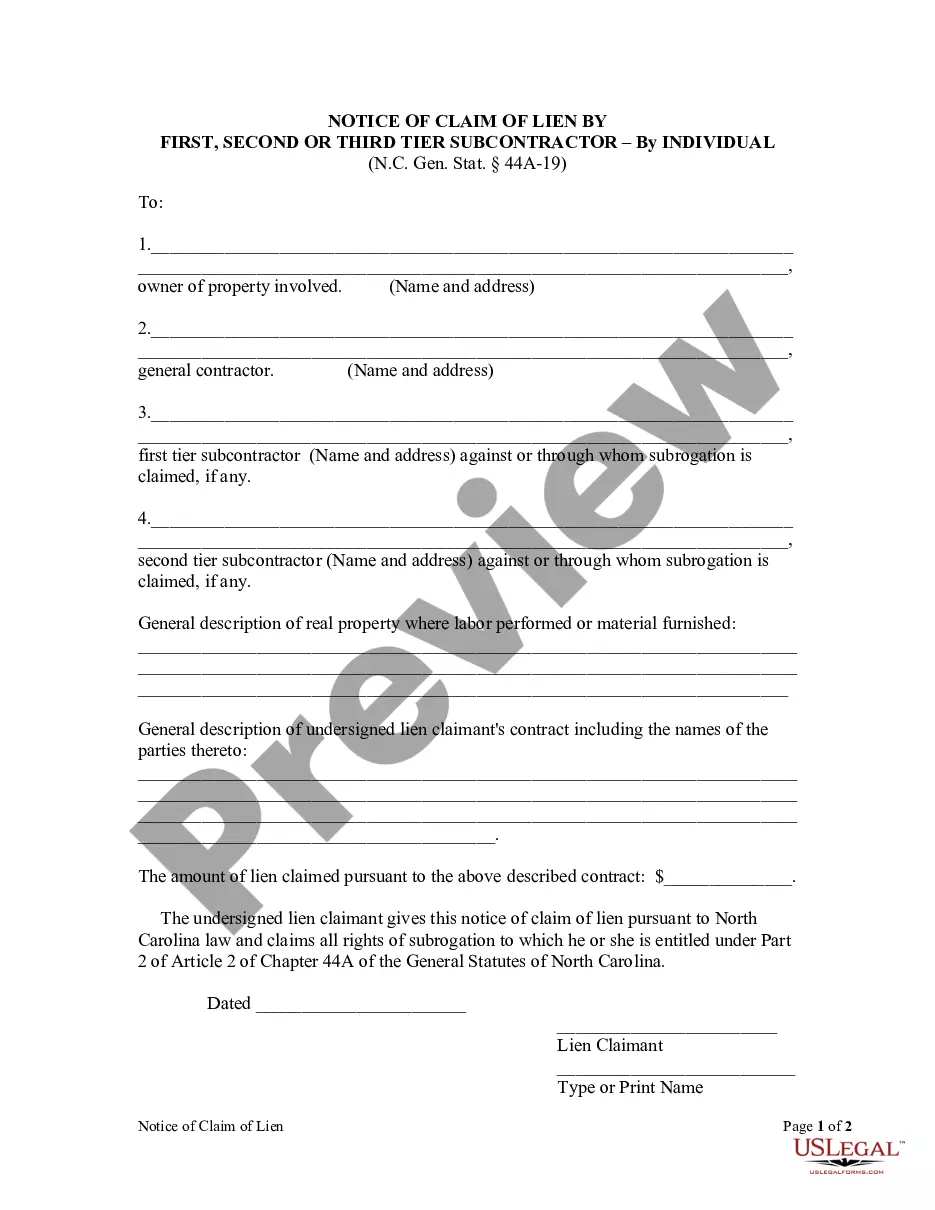

Do you need to quickly draft a legally-binding Suffolk List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 or probably any other form to handle your personal or business affairs? You can select one of the two options: contact a professional to write a valid paper for you or create it entirely on your own. Thankfully, there's another solution - US Legal Forms. It will help you receive neatly written legal documents without paying unreasonable fees for legal services.

US Legal Forms offers a huge collection of over 85,000 state-specific form templates, including Suffolk List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 and form packages. We offer templates for an array of use cases: from divorce papers to real estate documents. We've been out there for more than 25 years and got a rock-solid reputation among our customers. Here's how you can become one of them and get the necessary template without extra troubles.

- First and foremost, carefully verify if the Suffolk List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 is tailored to your state's or county's regulations.

- If the form comes with a desciption, make sure to verify what it's intended for.

- Start the searching process over if the form isn’t what you were hoping to find by utilizing the search box in the header.

- Select the plan that best fits your needs and move forward to the payment.

- Select the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Suffolk List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 template, and download it. To re-download the form, simply head to the My Forms tab.

It's effortless to buy and download legal forms if you use our services. Moreover, the documents we offer are updated by law professionals, which gives you greater peace of mind when dealing with legal affairs. Try US Legal Forms now and see for yourself!