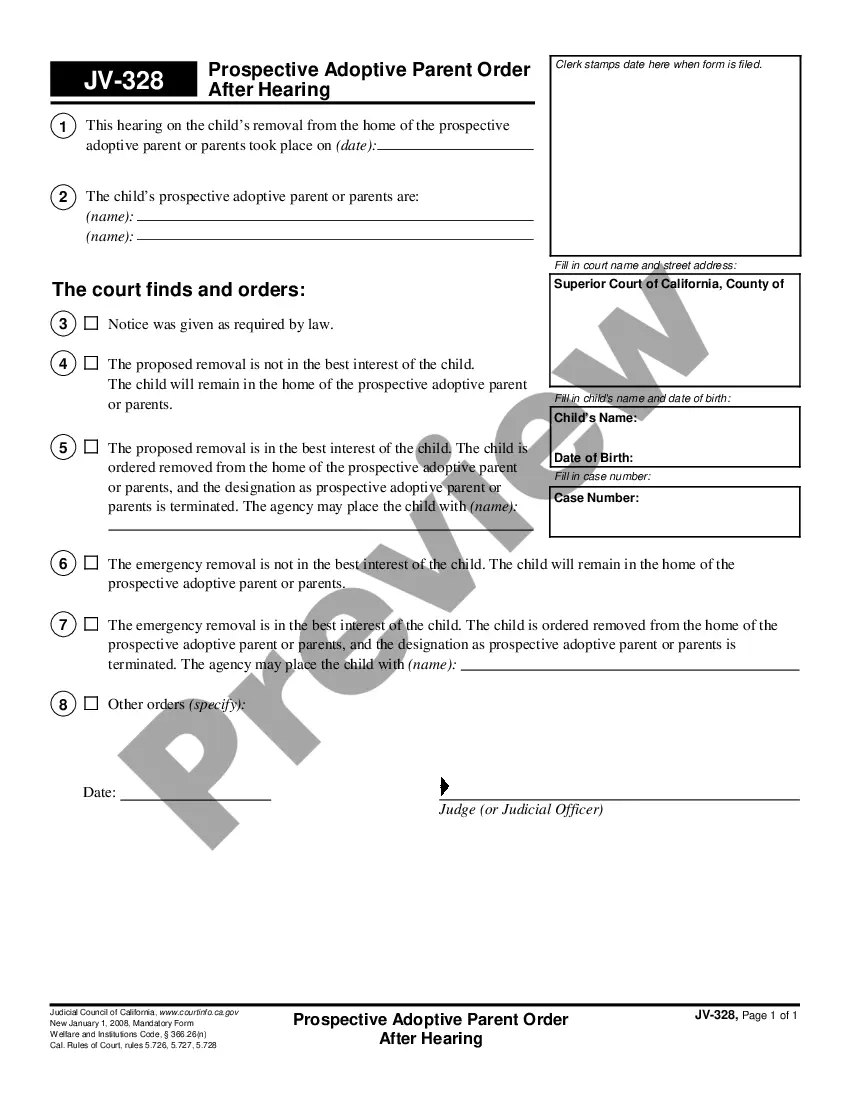

The Kings New York Stock Exchange Agreement is a significant agreement formed between SJW Corp, Roscoe Moss Company, and RMC Shareholders, facilitating a merger or acquisition within the stock market. This agreement allows companies to collaborate and share stock ownership, resources, and market presence. There are various types of Kings New York Stock Exchange Agreements that can be established, depending on the specific terms and conditions agreed upon by the involved parties. These may include: 1. Merger Agreement: In this type of agreement, SJW Corp and Roscoe Moss Company merge their operations and assets, forming a single entity to enhance market share and profitability. RMC Shareholders may receive shares in the newly formed company or other consideration as compensation for their acquired stakes. 2. Acquisition Agreement: This agreement outlines the terms and conditions under which SJW Corp or Roscoe Moss Company acquires a controlling interest in the other company. RMC Shareholders may receive cash, shares, or a combination of both as consideration for their shares in the acquired company. 3. Joint Venture Agreement: In certain cases, SJW Corp and Roscoe Moss Company may decide to form a joint venture rather than a complete merger or acquisition. This agreement allows both companies to contribute resources, expertise, and capital to achieve specific business objectives while maintaining separate legal entities. RMC Shareholders may have the opportunity to participate in the joint venture arrangement. 4. Share Purchase Agreement: This type of agreement is made when RMC Shareholders agree to sell their shares to SJW Corp or Roscoe Moss Company. The terms and conditions of the agreement, such as the purchase price and any additional considerations, are negotiated and specified in detail. Regardless of the specific type of agreement, the Kings New York Stock Exchange Agreement by SJW Corp, Roscoe Moss Company, and RMC Shareholders aims to create synergies, enhance market share and competitiveness, and drive overall growth and profitability. It is a crucial strategic move that enables the involved companies to maximize their strengths, resources, and market opportunities in the dynamic stock market landscape.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Acuerdo bursátil de SJW Corp, Roscoe Moss Company y accionistas de RMC: solo texto - Stock Exchange Agreement by SJW Corp, Roscoe Moss Company, and RMC Shareholders - Text Only

Description

How to fill out Kings New York Acuerdo Bursátil De SJW Corp, Roscoe Moss Company Y Accionistas De RMC: Solo Texto?

Laws and regulations in every sphere differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Kings Stock Exchange Agreement by SJW Corp, Roscoe Moss Company, and RMC Shareholders - Text Only, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals searching for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can simply log in and re-download the Kings Stock Exchange Agreement by SJW Corp, Roscoe Moss Company, and RMC Shareholders - Text Only from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Kings Stock Exchange Agreement by SJW Corp, Roscoe Moss Company, and RMC Shareholders - Text Only:

- Examine the page content to ensure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the template once you find the correct one.

- Choose one of the subscription plans and log in or create an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Complete and sign the template in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your paperwork in order with the US Legal Forms!