Title: Maricopa, Arizona Share Exchange Agreement: A Comprehensive Overview [+ Key Exhibits] Introduction: In this article, we will delve into the Maricopa, Arizona Share Exchange Agreement, providing a detailed description and highlighting key exhibits. The Share Exchange Agreement facilitates the exchange of shares between parties involved, ensuring transparency and legality in the process. There may be different types of Share Exchange Agreements with exhibits, some of which are mentioned below. Types of Maricopa, Arizona Share Exchange Agreements: 1. Public-to-Public Share Exchange Agreement: This type of agreement occurs when publicly listed companies within the Maricopa area mutually agree to exchange shares. The agreement outlines the terms, conditions, and rights associated with the exchange transaction. It provides a legal framework for the transfer of shares and facilitates regulatory compliance. 2. Private-to-Public Share Exchange Agreement: A private company seeking to go public in Maricopa, Arizona, may enter into a Share Exchange Agreement with a publicly listed company. This agreement allows the private company to exchange its shares for the publicly listed company's shares, thereby enabling it to gain access to the public market quickly. The agreement specifies the terms, such as valuation, regulatory requirements, and post-exchange operational considerations. 3. Merger and Acquisition Share Exchange Agreement: In cases involving mergers or acquisitions, companies may opt for a Share Exchange Agreement to facilitate the exchange of shares between the acquiring and target companies. This detailed agreement contains provisions regarding the exchange ratio, transaction structure, and any additional terms, ensuring a smooth transition of ownership. Key Exhibits in a Maricopa, Arizona Share Exchange Agreement: 1. Share Exchange Agreement Template: The exhibit includes a standard template that outlines the structure and essential clauses typically found in a Maricopa Share Exchange Agreement. This provides a framework for preparing a legally binding agreement and helps parties understand the necessary sections to address different aspects of the transaction. 2. Share Exchange Schedule: This exhibit presents a detailed schedule depicting the shares being exchanged, including the number of shares, ownership percentages, and any restrictions or conditions associated with the specific agreement. It ensures clarity and allows parties to keep track of the share exchange process accurately. 3. Valuation Report: A valuation report exhibit provides an in-depth analysis conducted by a qualified expert to assess the value of the shares involved in the exchange. It includes factors such as financial statements, market conditions, industry analysis, and projections, ultimately determining the fair value of the shares to be exchanged. 4. Regulatory Compliance Documents: Share exchange transactions often need to comply with local, state, and federal regulatory requirements. Exhibits may include relevant permits, licenses, or certifications required for approval by regulatory bodies. These exhibit documents ensure that the share exchange process adheres to the prevailing legal framework. Conclusion: The Maricopa, Arizona Share Exchange Agreement is a crucial legal document governing the exchange of shares between parties in various scenarios. Whether it involves public-to-public, private-to-public, or merger and acquisition exchanges, the agreement outlines the terms, conditions, and rights pertaining to the transaction. Exhibits like the Share Exchange Agreement Template, Share Exchange Schedule, Valuation Report, and Regulatory Compliance Documents provide additional support, ensuring transparency, compliance, and a smooth exchange process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acuerdo de intercambio de acciones con anexos - Share Exchange Agreement with exhibits

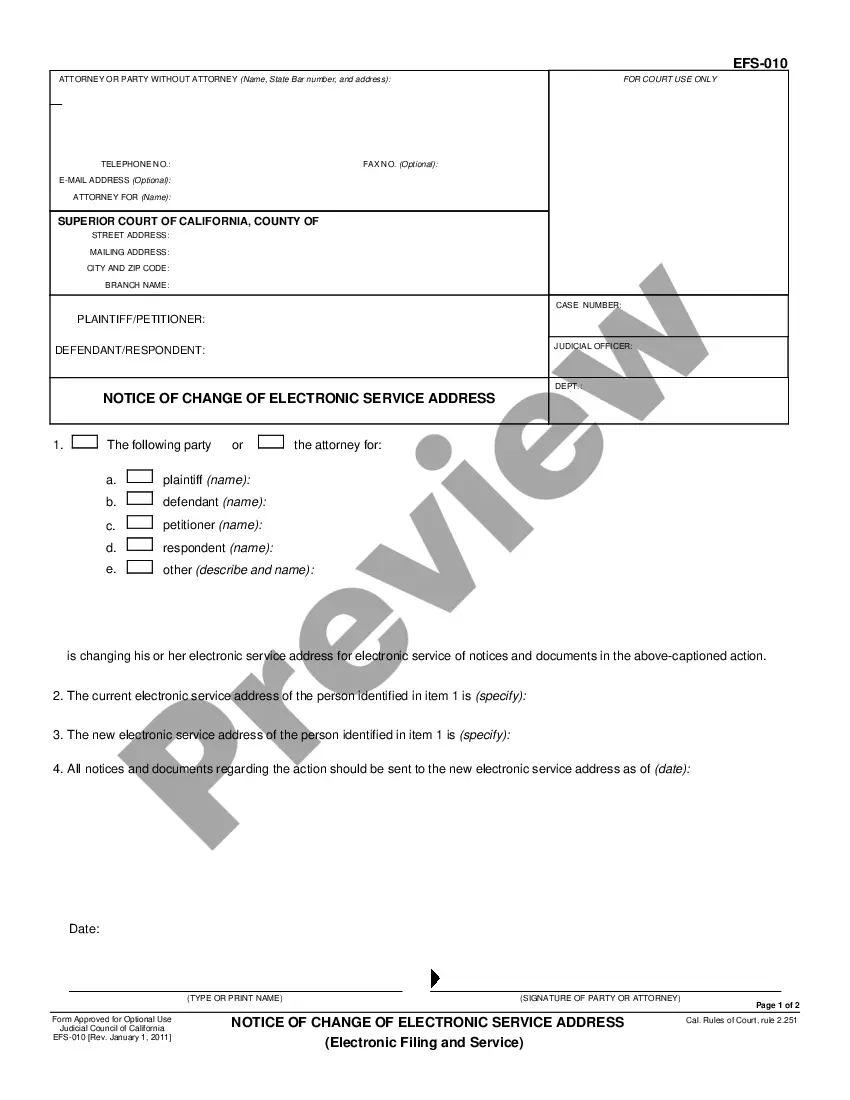

Description

How to fill out Maricopa Arizona Acuerdo De Intercambio De Acciones Con Anexos?

Do you need to quickly create a legally-binding Maricopa Share Exchange Agreement with exhibits or maybe any other document to manage your own or corporate matters? You can select one of the two options: contact a professional to draft a valid paper for you or draft it completely on your own. Luckily, there's a third option - US Legal Forms. It will help you receive professionally written legal paperwork without paying unreasonable prices for legal services.

US Legal Forms provides a huge catalog of more than 85,000 state-specific document templates, including Maricopa Share Exchange Agreement with exhibits and form packages. We provide templates for an array of life circumstances: from divorce papers to real estate documents. We've been on the market for over 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the needed document without extra hassles.

- To start with, carefully verify if the Maricopa Share Exchange Agreement with exhibits is adapted to your state's or county's laws.

- If the form has a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the template isn’t what you were looking for by utilizing the search bar in the header.

- Select the subscription that best fits your needs and proceed to the payment.

- Choose the format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Maricopa Share Exchange Agreement with exhibits template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. In addition, the paperwork we offer are reviewed by industry experts, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!