The Suffolk New York Agreement and Plan of Merger, involving Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank, refers to a strategic arrangement aimed at merging these financial entities. This merger endeavor encompasses multiple agreements and plans, each carrying its significance within the overall consolidation process. 1. Suffolk New York Agreement: This pact lays out the terms and conditions agreed upon by the parties involved. It outlines the legal framework within which the merger will take place, defining the rights, responsibilities, and obligations of all participating entities. 2. Plan of Merger: The Plan of Merger serves as a blueprint for the consolidation process. It entails a step-by-step strategy for combining the operations, assets, and liabilities of the individual institutions involved — Cascade Financial, CascadBantamAfirstsst Ban corporation, and American First National Bank. 3. Financial Consolidation Agreement: This agreement focuses on the financial aspects of the merger, outlining the procedures for integrating the financial systems and structures of the merging entities. It addresses matters such as capitalization, asset valuation, and financial reporting standards to ensure a seamless integration process. 4. Cascade Financial and Cascade Bank Merger Agreement: This specific agreement pertains to the merger between Cascade Financial and Cascade Bank. It outlines how the two entities will integrate their operations, governance structures, and customer service strategies, emphasizing a harmonized approach to operations moving forward. 5. Am first Ban corporation and American First National Bank Merger Agreement: This agreement specifically addresses the merger between Am first Ban corporation and American First National Bank. It outlines the necessary steps for integrating their systems, procedures, and business models while ensuring a smooth transition for employees and customers. The Suffolk New York Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Am first Ban corporation, and American First National Bank represent a comprehensive effort to combine the strengths and resources of these financial institutions, solidifying their position in the market through strategic collaboration. This merger aims to create a stronger, more competitive entity capable of delivering enhanced services and value to its customers.

Suffolk New York Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank

Description

How to fill out Suffolk New York Agreement And Plan Of Merger By Cascade Financial, Cascade Bank, Amfirst Bancorporation, And American First National Bank?

Whether you intend to start your business, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Suffolk Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank is quick and simple.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of additional steps to get the Suffolk Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank. Follow the guidelines below:

- Make certain the sample fulfills your personal needs and state law regulations.

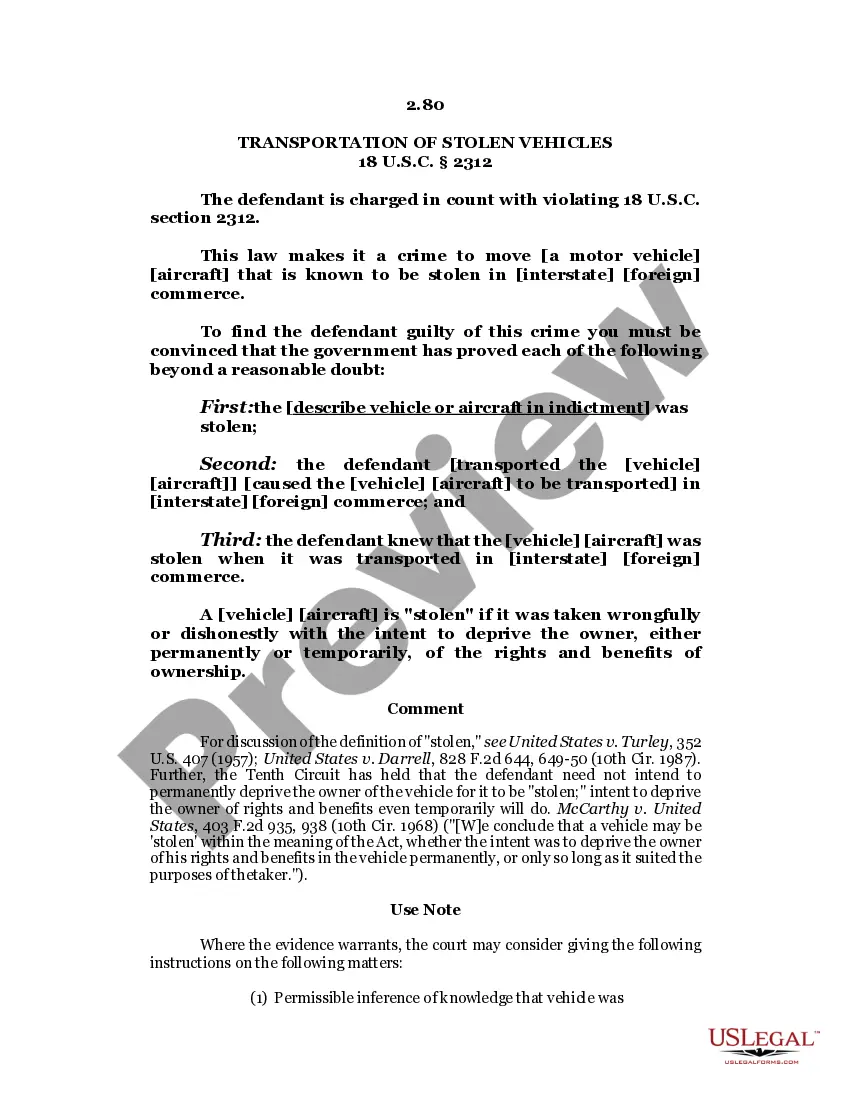

- Look through the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to find another template.

- Click Buy Now to obtain the sample when you find the proper one.

- Choose the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Suffolk Agreement and Plan of Merger by Cascade Financial, Cascade Bank, Amfirst Bancorporation, and American First National Bank in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any time in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!