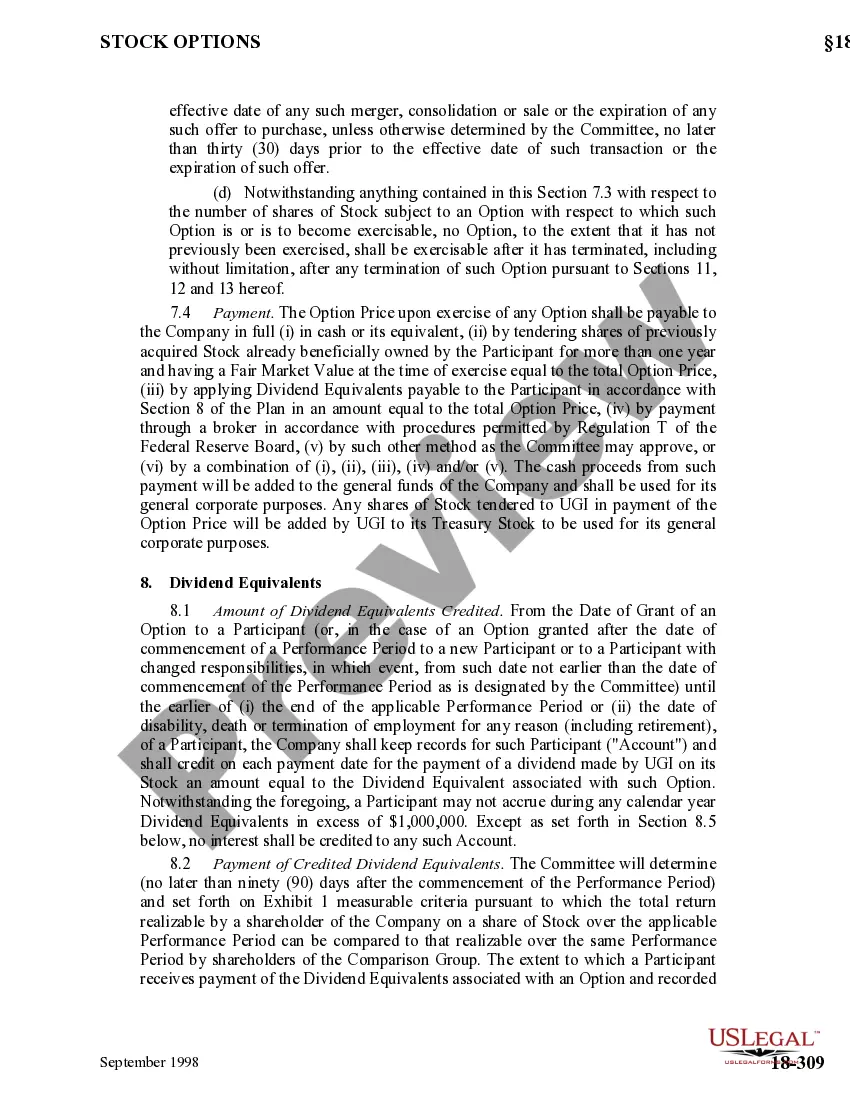

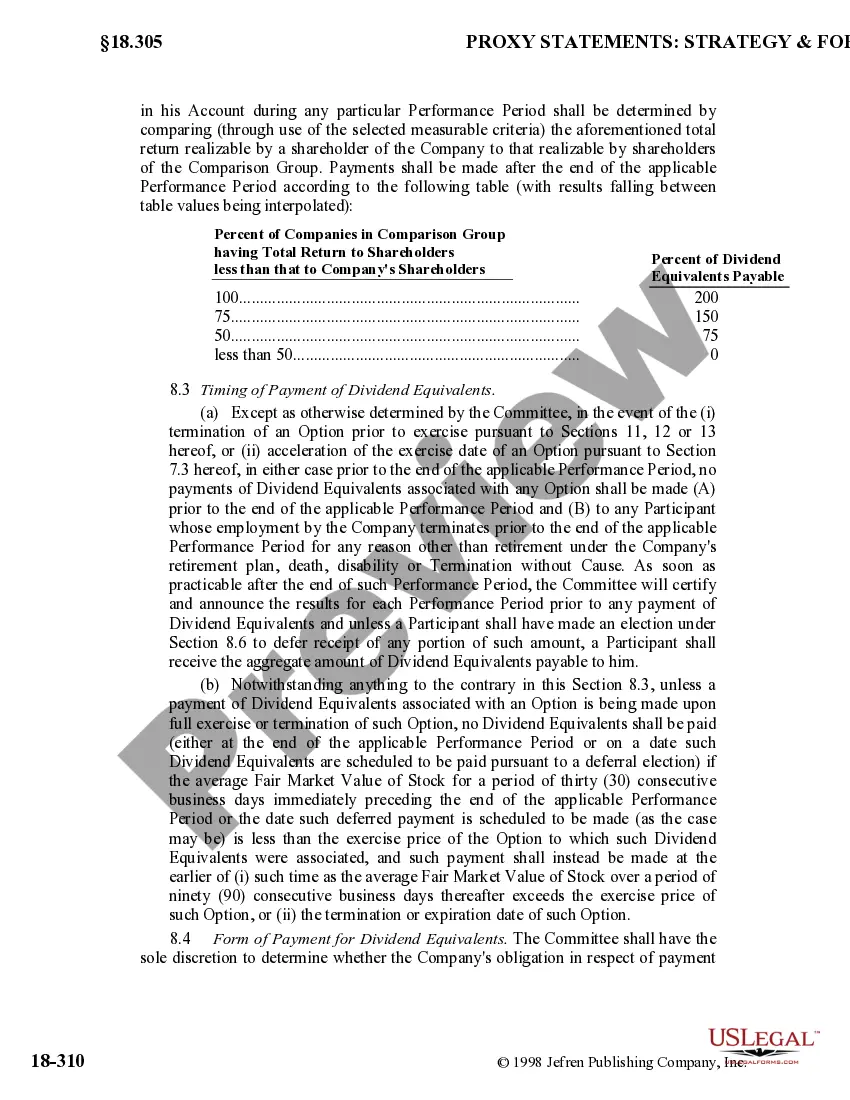

Riverside California Stock Option and Dividend Equivalent Plan is a compensation program offered by UGI Corp., a leading global energy distribution and services company headquartered in Pennsylvania. This plan aims to incentivize and retain key employees by granting them stock options and dividend equivalent rights. Let's delve deeper into the various aspects and types of this plan, highlighting key exhibits pertaining to UGI Corp. Introduction: Riverside California Stock Option and Dividend Equivalent Plan is a comprehensive employee benefit program designed to reward and motivate employees of UGI Corp. With this plan, eligible employees receive stock options and dividend equivalent rights, which give them the opportunity to share in the company's growth and success. Stock Options: Under the Riverside California Stock Option and Dividend Equivalent Plan, qualifying employees are granted stock options. These stock options allow employees to purchase UGI Corp.'s common stock at a predetermined exercise price within a specified period of time. By granting stock options, UGI Corp. offers its employees the chance to own a share of the company's equity and benefit from its future performance. Dividend Equivalent Rights: In addition to stock options, the plan also provides employees with dividend equivalent rights. These rights simulate the cash dividend payments that would have been received if the employees actually owned the underlying shares represented by the options. This means that employees can benefit from the dividends that would be paid out if they owned the company's stock, even if they have not yet exercised their stock options. Types of Riverside California Stock Option Plans: 1. Non-Qualified Stock Options (NO): UGI Corp. may offer non-qualified stock options under the Riverside California Stock Option and Dividend Equivalent Plan. These stock options are not eligible for special tax treatment, and they are typically subject to income tax when exercised. However, they provide flexibility in terms of granting options to a broader group of employees. 2. Incentive Stock Options (ISO): The plan may also include incentive stock options for eligible employees. Incentive stock options offer potential tax advantages, as they may qualify for favorable tax treatment upon exercise and sale, subject to certain conditions specified by the Internal Revenue Service (IRS). This type of stock option is designed to promote long-term employee retention and commitment. Exhibits: 1. Exhibit A: Riverside California Stock Option and Dividend Equivalent Plan Document: This exhibit includes the detailed terms and conditions governing the UGI Corp. Stock Option and Dividend Equivalent Plan, including eligibility criteria, grant process, exercise periods, and vesting schedules. 2. Exhibit B: Sample Stock Option Agreement: This exhibit provides a sample stock option agreement that outlines the specific terms, exercise price, number of shares, and expiration dates for the stock options granted to employees. 3. Exhibit C: Dividend Equivalent Rights Calculation Methodology: This exhibit presents the formula and methodology used to calculate the dividend equivalents employees are entitled to receive under the plan. 4. Exhibit D: Tax Implications and Reporting Guidelines: This exhibit offers an overview of the tax implications associated with stock options and dividend equivalent rights, including reporting requirements for both employees and UGI Corp. In conclusion, the Riverside California Stock Option and Dividend Equivalent Plan by UGI Corp. is a robust employee compensation program that offers stock options and dividend equivalent rights aimed at promoting employee retention and incentivizing performance. Through exhibits like the sample stock option agreement and tax implications documentation, UGI Corp. provides a comprehensive framework for employees to participate in the plan effectively.

Riverside California Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp.

Description

How to fill out Riverside California Stock Option And Dividend Equivalent Plan With Exhibits Of UGI Corp.?

Draftwing forms, like Riverside Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp., to manage your legal affairs is a tough and time-consumming process. Many cases require an attorney’s participation, which also makes this task expensive. However, you can take your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal forms intended for a variety of cases and life circumstances. We ensure each document is in adherence with the laws of each state, so you don’t have to worry about potential legal problems compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Riverside Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp. form. Simply log in to your account, download the form, and personalize it to your requirements. Have you lost your document? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is fairly simple! Here’s what you need to do before downloading Riverside Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp.:

- Ensure that your form is specific to your state/county since the rules for creating legal paperwork may differ from one state another.

- Find out more about the form by previewing it or going through a quick intro. If the Riverside Stock Option and Dividend Equivalent Plan with exhibits of UGI Corp. isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin using our service and download the document.

- Everything looks great on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment details.

- Your form is all set. You can try and download it.

It’s easy to find and buy the appropriate document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!