Middlesex Massachusetts Approval of Amendment to Articles of Incorporation to Permit Certain Uses of Distributions from Capital Surplus Middlesex County in Massachusetts is a vibrant and thriving region known for its rich history, diverse communities, and economic prosperity. It is home to numerous businesses, organizations, and institutions that contribute to its growth and development. One important aspect of conducting business in Middlesex County is the approval of amendments to articles of incorporation. These amendments allow companies to make changes to their existing articles, including provisions related to the use of distributions from capital surplus. The approval process for such amendments ensures that businesses adhere to legal and regulatory requirements while maintaining transparency and accountability. By granting permission for certain uses of distributions from capital surplus, companies can further their growth, invest in new products or services, expand their infrastructure, or support charitable initiatives within the community. Examples of possible uses of distributions from capital surplus include: 1. Research and Development: Companies can allocate a portion of their surplus to fund research and development activities, enabling them to innovate and remain competitive in their industry. By investing in new technologies or conducting scientific studies, businesses can enhance their products or services, ultimately benefiting consumers and the local economy. 2. Expansion and Growth: Middlesex County serves as a hub for businesses looking to expand their operations. By permitting the use of distributions from capital surplus, companies can finance the acquisition of additional properties, offices, or manufacturing facilities. This expansion leads to job creation, increased tax revenue, and further economic development in the region. 3. Employee Benefits and Incentives: Businesses that prioritize their employees' well-being may allocate a portion of their surplus towards employee benefits and incentives. This can include health and wellness programs, training and professional development, retirement plans, or performance-based bonuses. These initiatives not only attract and retain talent but also foster a positive work environment and employee loyalty. 4. Corporate Social Responsibility: Many companies in Middlesex County are committed to giving back to the community and supporting worthy causes. The approval to use distributions from capital surplus allows businesses to contribute to charitable organizations, sponsor community events, or initiate social impact programs. By investing in the betterment of the community, companies build strong relationships and goodwill among consumers, employees, and stakeholders. In conclusion, Middlesex Massachusetts Approval of Amendment to Articles of Incorporation to Permit Certain Uses of Distributions from Capital Surplus enables businesses to adapt to changing needs, pursue growth opportunities, and contribute to the broader community. By supporting research, expanding operations, investing in employees, and pursuing corporate social responsibility initiatives, companies in Middlesex County can shape a prosperous and sustainable future.

Middlesex Massachusetts Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus

Description

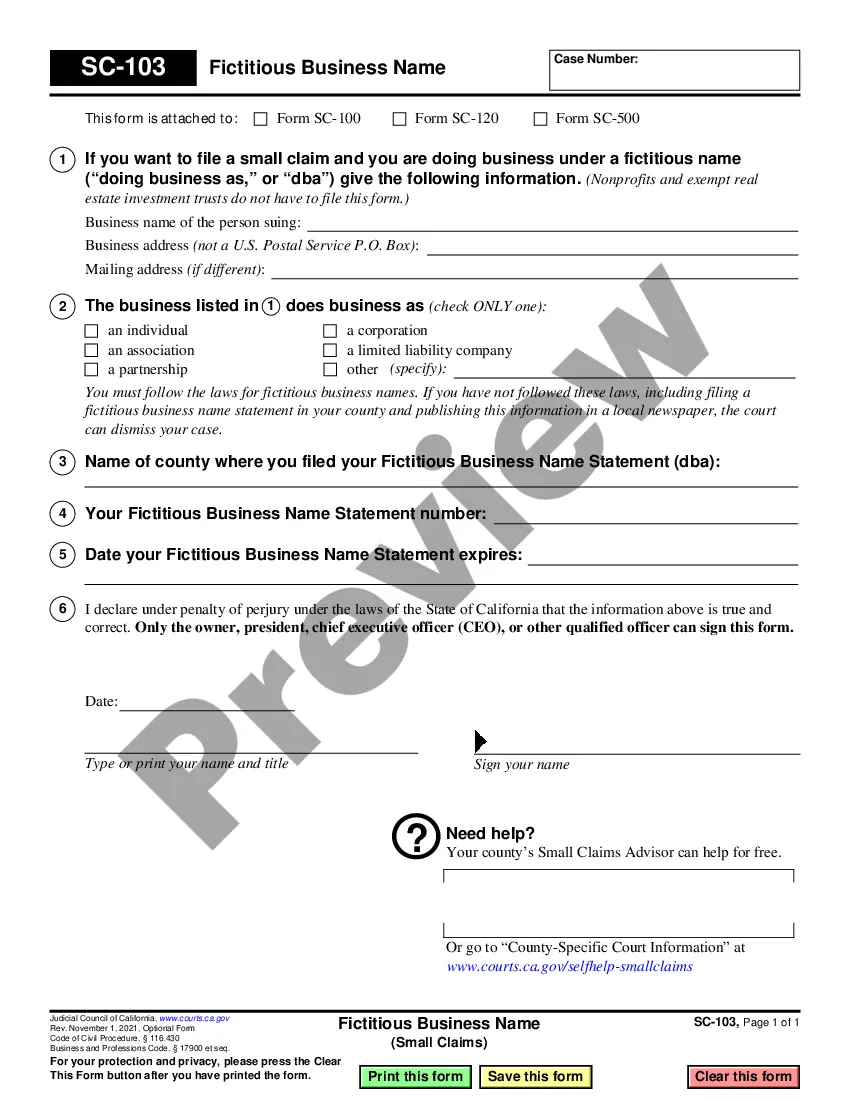

How to fill out Middlesex Massachusetts Approval Of Amendment To Articles Of Incorporation To Permit Certain Uses Of Distributions From Capital Surplus?

Creating legal forms is a necessity in today's world. Nevertheless, you don't always need to seek qualified assistance to draft some of them from scratch, including Middlesex Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching experience less challenging. You can also find detailed materials and guides on the website to make any tasks related to paperwork completion straightforward.

Here's how you can find and download Middlesex Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus.

- Go over the document's preview and description (if provided) to get a basic information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the legality of some documents.

- Check the similar document templates or start the search over to locate the correct file.

- Click Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a needed payment method, and purchase Middlesex Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus.

- Select to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the appropriate Middlesex Approval of amendment to articles of incorporation to permit certain uses of distributions from capital surplus, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you need to deal with an extremely difficult situation, we advise using the services of an attorney to check your document before signing and filing it.

With over 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Become one of them today and get your state-compliant paperwork effortlessly!