The Harris Texas Plan of Reorganization is a legal framework utilized by businesses and organizations in Harris County, Texas, to restructure and reorganize their operations to overcome financial difficulties and achieve long-term sustainability. This plan provides a roadmap for businesses to negotiate with creditors, settle debts, and modify any existing contracts to effectively manage their financial obligations. Here are some key aspects and relevant keywords associated with the Harris Texas Plan of Reorganization: 1. Chapter 11 Bankruptcy: The Harris Texas Plan of Reorganization often refers to the Chapter 11 bankruptcy process, which allows businesses to continue operating while restructuring their debts and assets. 2. Debtors: The plan outlines the specific debtor(s) seeking reorganization, which can be a single business entity or a group of affiliated companies. 3. Automatic Stay: Upon filing for Chapter 11 bankruptcy, an automatic stay goes into effect, providing temporary relief from creditor actions such as foreclosures, lawsuits, or debt collection efforts. 4. Creditors: The plan categorizes creditors based on their priority and claim types, including secured creditors, unsecured creditors, priority creditors (such as taxes), and administrative creditors (such as legal and accounting fees). 5. Disclosure Statement: Debtors must prepare a comprehensive and detailed disclosure statement alongside the reorganization plan, providing pertinent financial information and outlining the proposed terms for debt repayment. 6. Claims Resolution: The Harris Texas Plan of Reorganization defines a mechanism to address creditor claims and establish a fair and equitable distribution of the debtor's assets and payments. 7. Negotiation and Voting: The plan grants the debtor the exclusive right to propose a reorganization plan and allows negotiation with creditors to secure their approval. Creditors vote on the proposed plan, and if accepted by the majority, it moves forward to court confirmation. 8. Confirmation Hearing: A confirmation hearing is held before a bankruptcy court judge to evaluate the feasibility and fairness of the proposed plan. The court assesses whether the plan complies with the requirements of the Bankruptcy Code and considers objections raised by creditors. It is important to note that the Harris Texas Plan of Reorganization may refer to various types of reorganization plans, depending on the nature, size, and complexity of the business seeking relief. Some common variations include individual reorganization plans, small business reorganization plans (SARA), and plans tailored to specific industries or sectors. In summary, the Harris Texas Plan of Reorganization provides a structured approach for organizations in Harris County, Texas, to reorganize their operations and navigate financial difficulties. This comprehensive plan encompasses aspects such as creditor negotiations, debtor obligations, claims resolution, and court confirmation, all aimed at helping businesses regain financial stability.

Harris Texas Plan of Reorganization

Description

How to fill out Harris Texas Plan Of Reorganization?

How much time does it normally take you to draft a legal document? Since every state has its laws and regulations for every life scenario, locating a Harris Plan of Reorganization suiting all regional requirements can be tiring, and ordering it from a professional lawyer is often costly. Numerous online services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive online collection of templates, gathered by states and areas of use. In addition to the Harris Plan of Reorganization, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Professionals verify all samples for their validity, so you can be sure to prepare your documentation properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required form, and download it. You can get the document in your profile at any time in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Harris Plan of Reorganization:

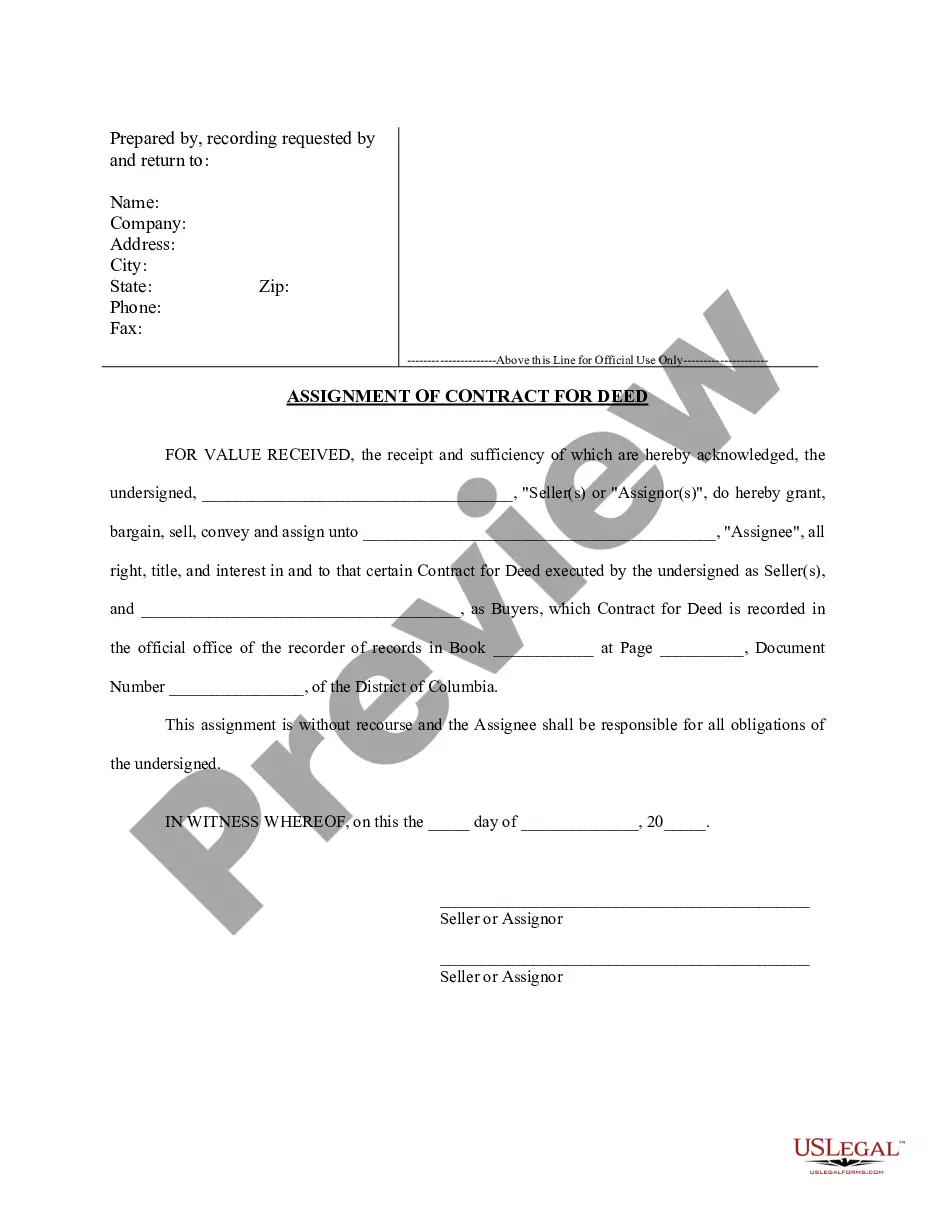

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now once you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Harris Plan of Reorganization.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Give it a try!