A debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt.

Examples include:

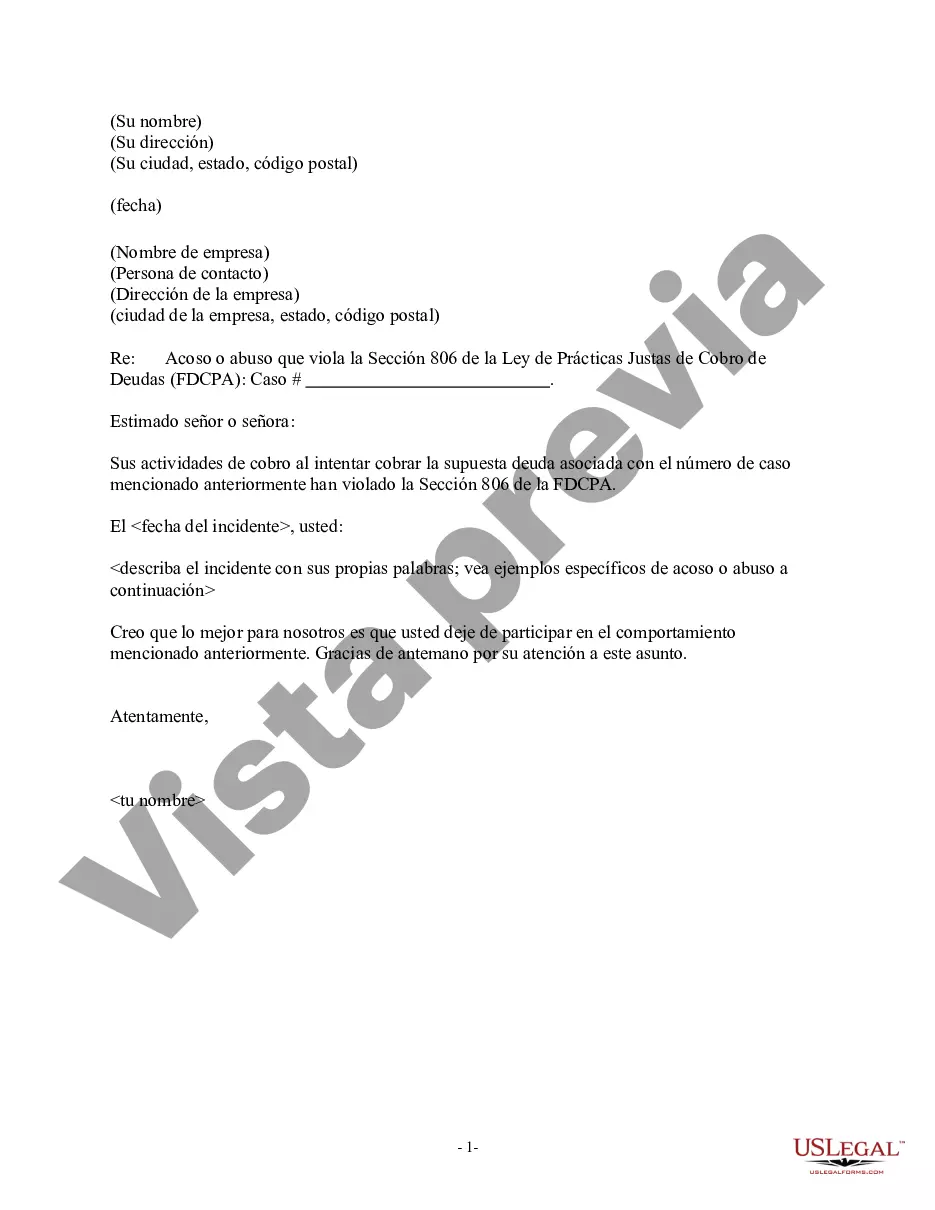

Use this form to get a debt collector to stop harassing, opressing, or abusing you.

This form also also includes follow-up letters containing a warning that the debt collector may face going to court if they continue engaging in behavior that violates the FDCPA. Contra Costa County is a prominent county located in the state of California. Situated in the northern region of the state, it is known for its diverse landscape, bustling cities, and vibrant communities. Home to numerous industries, breathtaking natural surroundings, and a thriving cultural scene, Contra Costa County offers an exceptional quality of life to its residents. In accordance with the Fair Debt Collection Practices Act (FD CPA), debt collectors are bound by certain regulations to ensure fair and ethical treatment of consumers. Section 806 of the FD CPA specifically prohibits harassment or abusive behavior by debt collectors. If you believe that a debt collector has violated Section 806 and engaged in harassment, it is important to take action and protect your rights. To address such violations, individuals may choose to send a Contra Costa California Notice letter to the debt collector. This letter serves as formal communication outlining the violation and seeking resolution. There might be different types of Contra Costa California Notice letters specifically tailored to address Section 806 violations — harassment. Some potential variations could include: 1. Standard Contra Costa California Notice Letter: This type of notice letter would include a detailed description of the alleged violation and how it has caused distress or harm. It would also explicitly reference Section 806 of the FD CPA, emphasizing the debt collector's obligation to adhere to fair practices. 2. Cease and Desist Contra Costa California Notice Letter: This type of notice letter would not only address the Section 806 violation but also request that the debt collector cease all forms of communication immediately. It would clearly state that any further contact would be considered a violation of the FD CPA and may result in legal action. 3. Demand for Validation Contra Costa California Notice Letter: In situations where the debt being collected is disputed or the consumer seeks validation of the debt, this type of notice letter would not only outline the Section 806 violation but also request the debt collector to provide documented proof of the validity of the debt. It would remind the debt collector of their obligations under the FD CPA to provide such validation upon request. It is important to consult with legal professionals or credit counseling agencies for guidance on drafting and sending a Contra Costa California Notice letter tailored to your specific situation. Remember to keep copies of all correspondence, maintain records of any related harassment incidents, and consider seeking legal advice if necessary.

Contra Costa County is a prominent county located in the state of California. Situated in the northern region of the state, it is known for its diverse landscape, bustling cities, and vibrant communities. Home to numerous industries, breathtaking natural surroundings, and a thriving cultural scene, Contra Costa County offers an exceptional quality of life to its residents. In accordance with the Fair Debt Collection Practices Act (FD CPA), debt collectors are bound by certain regulations to ensure fair and ethical treatment of consumers. Section 806 of the FD CPA specifically prohibits harassment or abusive behavior by debt collectors. If you believe that a debt collector has violated Section 806 and engaged in harassment, it is important to take action and protect your rights. To address such violations, individuals may choose to send a Contra Costa California Notice letter to the debt collector. This letter serves as formal communication outlining the violation and seeking resolution. There might be different types of Contra Costa California Notice letters specifically tailored to address Section 806 violations — harassment. Some potential variations could include: 1. Standard Contra Costa California Notice Letter: This type of notice letter would include a detailed description of the alleged violation and how it has caused distress or harm. It would also explicitly reference Section 806 of the FD CPA, emphasizing the debt collector's obligation to adhere to fair practices. 2. Cease and Desist Contra Costa California Notice Letter: This type of notice letter would not only address the Section 806 violation but also request that the debt collector cease all forms of communication immediately. It would clearly state that any further contact would be considered a violation of the FD CPA and may result in legal action. 3. Demand for Validation Contra Costa California Notice Letter: In situations where the debt being collected is disputed or the consumer seeks validation of the debt, this type of notice letter would not only outline the Section 806 violation but also request the debt collector to provide documented proof of the validity of the debt. It would remind the debt collector of their obligations under the FD CPA to provide such validation upon request. It is important to consult with legal professionals or credit counseling agencies for guidance on drafting and sending a Contra Costa California Notice letter tailored to your specific situation. Remember to keep copies of all correspondence, maintain records of any related harassment incidents, and consider seeking legal advice if necessary.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.